Wang Company Accumulates The Following Adjustment

Holbox

Mar 22, 2025 · 5 min read

Table of Contents

- Wang Company Accumulates The Following Adjustment

- Table of Contents

- Wang Company Accumulates the Following Adjustments: A Comprehensive Guide to Accounting Adjustments

- Understanding Accounting Adjustments

- Wang Company's Adjustments: A Case Study

- Analyzing and Recording Wang Company's Adjustments

- 1. Accrued Salaries Adjustment

- 2. Unearned Revenue Adjustment

- 3. Prepaid Insurance Adjustment

- 4. Depreciation Expense Adjustment

- 5. Bad Debt Expense Adjustment

- Impact on Financial Statements

- Importance of Accurate Adjustments

- Conclusion: Maintaining Financial Integrity through Accurate Adjustments

- Latest Posts

- Related Post

Wang Company Accumulates the Following Adjustments: A Comprehensive Guide to Accounting Adjustments

Understanding accounting adjustments is crucial for maintaining accurate and reliable financial records. This comprehensive guide delves into the intricacies of accounting adjustments, using the hypothetical case of Wang Company to illustrate key concepts and processes. We'll explore various types of adjustments, their impact on financial statements, and the importance of accurate record-keeping. By the end, you'll have a solid grasp of how to handle common accounting adjustments and ensure the financial health of your own business.

Understanding Accounting Adjustments

Accounting adjustments are entries made at the end of an accounting period to correct or update the general ledger accounts. These adjustments are necessary because many business transactions don't neatly align with the accounting period's end. They ensure that the financial statements – the balance sheet, income statement, and cash flow statement – accurately reflect the company's financial position and performance. Failure to make these adjustments can lead to inaccurate financial reporting, misleading stakeholders, and ultimately, poor decision-making.

Why are adjustments necessary?

Several factors necessitate accounting adjustments:

- Accruals: Expenses incurred but not yet paid (like accrued salaries) or revenue earned but not yet received (like accrued interest).

- Deferrals: Prepaid expenses (like insurance) that need to be allocated over time or unearned revenue (like advance payments) that needs to be recognized as earned.

- Depreciation: The systematic allocation of the cost of an asset over its useful life.

- Bad Debts: Estimating the portion of accounts receivable that are unlikely to be collected.

- Inventory: Adjusting inventory values to reflect the current market price or to account for shrinkage or obsolescence.

Wang Company's Adjustments: A Case Study

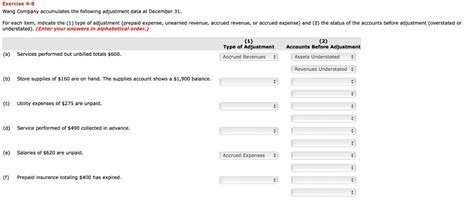

Let's assume Wang Company accumulates the following adjustments at the end of its fiscal year:

1. Accrued Salaries: Wang Company owes its employees $5,000 in salaries for the last week of the fiscal year. This expense has been incurred but not yet paid.

2. Unearned Revenue: Wang Company received $10,000 in advance payments for services to be rendered in the next fiscal year. This represents unearned revenue that needs to be deferred.

3. Prepaid Insurance: Wang Company paid $12,000 for a one-year insurance policy on July 1st. The fiscal year ends on December 31st. Therefore, only six months of insurance expense has been used.

4. Depreciation Expense: Wang Company's equipment depreciates at a rate of $2,000 per year.

5. Bad Debt Expense: Wang Company estimates that 2% of its accounts receivable of $50,000 are uncollectible.

Analyzing and Recording Wang Company's Adjustments

Let's analyze each adjustment and record the appropriate journal entries:

1. Accrued Salaries Adjustment

- Debit: Salaries Expense $5,000 (Increases expense)

- Credit: Salaries Payable $5,000 (Increases liability)

Explanation: This entry recognizes the salary expense incurred but not yet paid. The Salaries Payable account represents the liability to employees.

2. Unearned Revenue Adjustment

- Debit: Unearned Revenue $10,000 (Decreases liability)

- Credit: Service Revenue $10,000 (Increases revenue)

Explanation: Since the services haven’t been performed yet, the revenue is initially recognized as a liability. This entry recognizes the portion of the advance payment that remains unearned. For example, if the company only performed 25% of the service for which the advance payment was made, $2500 of this advance payment should be adjusted to revenue.

3. Prepaid Insurance Adjustment

- Debit: Insurance Expense $6,000 (Increases expense)

- Credit: Prepaid Insurance $6,000 (Decreases asset)

Explanation: The insurance expense for the six months used ($12,000/2 = $6,000) is recognized. The prepaid insurance account is reduced to reflect the portion of the policy that has expired.

4. Depreciation Expense Adjustment

- Debit: Depreciation Expense $2,000 (Increases expense)

- Credit: Accumulated Depreciation $2,000 (Increases contra-asset account)

Explanation: This entry recognizes the depreciation expense for the year. Accumulated depreciation is a contra-asset account that reduces the book value of the asset.

5. Bad Debt Expense Adjustment

- Debit: Bad Debt Expense $1,000 (Increases expense)

- Credit: Allowance for Doubtful Accounts $1,000 (Increases contra-asset account)

Explanation: This entry recognizes the estimated uncollectible accounts receivable ($50,000 * 0.02 = $1,000). The Allowance for Doubtful Accounts is a contra-asset account that reduces the net realizable value of accounts receivable.

Impact on Financial Statements

These adjustments significantly impact Wang Company's financial statements:

- Income Statement: The adjustments increase expenses (Salaries, Insurance, Depreciation, Bad Debt) and may increase or decrease revenue (Unearned Revenue), ultimately affecting the net income.

- Balance Sheet: The adjustments affect assets (Prepaid Insurance, Accounts Receivable), liabilities (Salaries Payable, Unearned Revenue), and equity (retained earnings through net income).

Importance of Accurate Adjustments

Making accurate adjustments is paramount for several reasons:

- Accurate Financial Reporting: Provides a true and fair view of the company's financial position and performance.

- Compliance: Adherence to accounting standards (e.g., Generally Accepted Accounting Principles - GAAP) and regulations.

- Decision-Making: Informed decision-making by management, investors, and creditors based on reliable financial information.

- Tax Purposes: Accurate financial statements are essential for accurate tax calculations.

- Stakeholder Confidence: Building trust and confidence with investors, lenders, and other stakeholders.

Conclusion: Maintaining Financial Integrity through Accurate Adjustments

The process of making accounting adjustments, as illustrated by the case of Wang Company, is a critical component of sound financial management. By consistently and accurately recording these adjustments, businesses ensure the integrity of their financial statements, providing a reliable foundation for informed decision-making and stakeholder confidence. Understanding the different types of adjustments, their impact on financial statements, and the importance of meticulous record-keeping are essential for any business aiming for long-term financial health and success. Regular reviews and internal controls can further help minimize errors and maintain the accuracy of the financial records. Remember, the accuracy of your financial information is crucial for the overall health and success of your business.

Latest Posts

Related Post

Thank you for visiting our website which covers about Wang Company Accumulates The Following Adjustment . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.