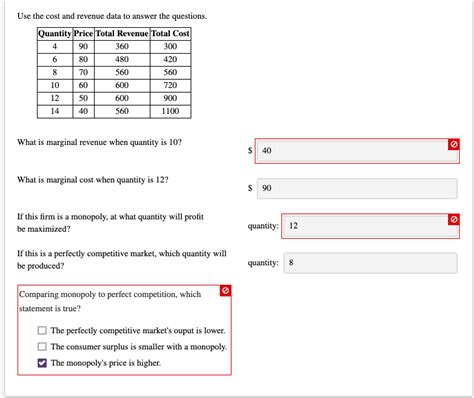

Use The Cost And Revenue Data To Answer The Questions

Holbox

Mar 17, 2025 · 7 min read

Table of Contents

Using Cost and Revenue Data to Answer Key Business Questions

Analyzing cost and revenue data is crucial for the health and success of any business, regardless of size or industry. This data provides invaluable insights into profitability, efficiency, and areas for improvement. Understanding how to interpret and utilize this information can significantly impact strategic decision-making, leading to increased profitability and sustainable growth. This comprehensive guide will explore how to leverage cost and revenue data to answer key business questions.

Understanding Your Cost Structure: A Deep Dive

Before analyzing the interplay between costs and revenue, it’s essential to have a clear understanding of your cost structure. This involves categorizing your expenses into different types:

1. Fixed Costs: The Unwavering Expenses

Fixed costs remain constant regardless of your production volume or sales. These include:

- Rent: Monthly lease payments for your office space or manufacturing facility.

- Salaries: Regular payments to employees (excluding commissions or bonuses).

- Insurance Premiums: Regular payments for business insurance coverage.

- Loan Payments: Consistent repayments on business loans.

- Depreciation: The gradual reduction in the value of assets over time.

Understanding your fixed costs is vital for determining your break-even point – the level of sales needed to cover all your expenses.

2. Variable Costs: The Fluctuating Expenses

Variable costs directly correlate with your production or sales volume. They increase as production increases and decrease as production decreases. Examples include:

- Raw Materials: The cost of materials used in producing your goods.

- Direct Labor: Wages paid to production workers based on output.

- Commissions: Payments to sales representatives based on sales performance.

- Packaging and Shipping: Costs associated with getting your product to the customer.

- Utilities (Variable Portion): The portion of your utility bills that fluctuates based on production (e.g., electricity used in manufacturing).

Careful monitoring of variable costs is crucial for optimizing your production process and maximizing profit margins.

3. Semi-Variable Costs: A Blend of Fixed and Variable

Semi-variable costs have both fixed and variable components. A portion of the cost remains constant, while another part fluctuates with production or sales. Examples include:

- Utilities (Fixed and Variable Portion): Your electricity bill might have a base charge (fixed) and a usage charge (variable).

- Telephone Expenses: A fixed monthly line rental fee plus variable charges based on usage.

- Maintenance and Repairs: Regular maintenance costs are fixed, but repairs are usually variable and depend on equipment usage.

Accurately categorizing your costs is essential for effective cost accounting and analysis.

Deciphering Your Revenue Streams: Understanding the Income

Revenue represents the total income generated from your business activities. Understanding your revenue streams is just as critical as understanding your costs. This involves identifying:

- Primary Revenue Streams: Your main sources of income. For example, a bakery's primary revenue stream might be the sale of baked goods.

- Secondary Revenue Streams: Additional income sources, such as catering services for the bakery.

- Revenue Channels: The methods through which you generate revenue, such as online sales, retail stores, or wholesale partnerships.

- Pricing Strategies: The methods used to determine the prices of your products or services. Understanding your pricing strategy is crucial for revenue optimization.

Analyzing your revenue streams allows you to identify your most profitable products or services and areas for revenue diversification.

Key Questions Answered Using Cost and Revenue Data

Now, let's explore how you can use your cost and revenue data to answer critical business questions:

1. What is my break-even point?

The break-even point is the point where your total revenue equals your total costs. It’s a crucial metric for determining the minimum sales volume needed to avoid losses. The calculation is:

Break-Even Point (Units) = Fixed Costs / (Selling Price per Unit - Variable Cost per Unit)

For example, if your fixed costs are $10,000, your selling price per unit is $50, and your variable cost per unit is $30, your break-even point is 500 units ($10,000 / ($50 - $30)).

This calculation helps you set realistic sales targets and understand the financial risks involved in your business operations.

2. What is my gross profit margin?

The gross profit margin shows the profitability of your sales after deducting the direct costs of producing your goods or services. It's calculated as:

Gross Profit Margin = (Revenue - Cost of Goods Sold) / Revenue * 100%

Cost of Goods Sold (COGS) includes direct materials, direct labor, and manufacturing overhead directly related to producing your product or service. A higher gross profit margin indicates greater efficiency and profitability.

Analyzing this metric helps you identify areas for cost reduction without sacrificing quality or impacting sales volume.

3. What is my net profit margin?

The net profit margin represents the overall profitability of your business after all expenses, including operating expenses, interest, and taxes, have been deducted. It’s calculated as:

Net Profit Margin = Net Profit / Revenue * 100%

Net Profit is your revenue less all your expenses. A higher net profit margin shows your business's overall efficiency and ability to generate profit. This is a key indicator of your business's long-term financial health.

Comparing your net profit margin to industry averages can highlight areas for improvement and competitiveness.

4. What is my return on investment (ROI)?

ROI measures the profitability of an investment relative to its cost. It's crucial for evaluating the effectiveness of various business initiatives. It's calculated as:

ROI = (Net Profit / Investment Cost) * 100%

Analyzing ROI for different projects, marketing campaigns, or product lines helps determine which initiatives are the most financially rewarding.

5. How can I improve profitability?

Analyzing cost and revenue data can reveal opportunities to improve profitability:

- Reducing Costs: Identify areas where costs can be reduced without compromising quality or customer satisfaction. This might involve negotiating better deals with suppliers, improving operational efficiency, or streamlining processes.

- Increasing Revenue: Explore strategies to boost revenue, such as launching new products or services, expanding into new markets, or implementing effective marketing campaigns.

- Improving Pricing Strategies: Review your pricing strategy to ensure it's optimal for maximizing profitability. This might involve adjusting prices, introducing tiered pricing, or offering discounts strategically.

- Improving Operational Efficiency: Analyze your operations to identify bottlenecks and inefficiencies. Improving workflow and utilizing technology can significantly impact cost reduction and productivity.

6. Which products or services are most profitable?

By analyzing the cost and revenue associated with each product or service, you can identify your most profitable offerings. This information can inform future product development, marketing strategies, and resource allocation. Prioritizing the development and marketing of high-profit products will naturally boost overall profitability.

7. What are my seasonal trends?

Analyzing cost and revenue data over time can reveal seasonal trends in sales and expenses. Understanding these trends helps you anticipate fluctuations in demand and plan accordingly, ensuring you have sufficient resources during peak seasons and effectively manage expenses during slower periods. This may involve adjusting staffing levels, inventory management, and marketing campaigns strategically throughout the year.

8. How do my costs compare to industry benchmarks?

Benchmarking your costs against industry averages can reveal areas where your business is underperforming or excelling. This helps you identify best practices and opportunities for improvement. This requires access to industry reports and data to make these comparisons.

9. What is the impact of price changes on revenue and profit?

Analyzing the impact of price changes on revenue and profit helps you make informed pricing decisions. Conducting sensitivity analysis to understand how changes in price will affect your profits is crucial for optimizing revenue and maximizing profitability. It allows for informed strategic price changes.

10. What are my future projections?

Using historical data and market trends, you can create forecasts for future revenue and costs. This allows you to make proactive decisions regarding resource allocation, investment strategies, and business planning. These projections are crucial for long-term planning and securing future growth.

Conclusion: Data-Driven Decision Making for Success

Effectively using cost and revenue data is paramount for achieving sustainable business success. By meticulously tracking and analyzing this information, you gain valuable insights into your business's financial health, enabling you to make informed decisions, improve efficiency, and ultimately, maximize profitability. Regular analysis and review of these metrics are essential for long-term success and growth. Remember that this data is a valuable tool; its effective use translates directly into improved business performance and strategic advantage in the market.

Latest Posts

Latest Posts

-

How To Cite Surveys In Mla

Mar 17, 2025

-

Wordpress Is Popular Free And Open Source

Mar 17, 2025

-

The Difference Between Aerobic And Anaerobic Glucose Breakdown Is

Mar 17, 2025

-

On December 29 2020 Patel Products

Mar 17, 2025

-

A Customer Tells His Current Sales Rep

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Use The Cost And Revenue Data To Answer The Questions . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.