Unlike The Classical Economists Keynes Asserted That

Holbox

Mar 29, 2025 · 7 min read

Table of Contents

- Unlike The Classical Economists Keynes Asserted That

- Table of Contents

- Unlike the Classical Economists, Keynes Asserted That… A Revolution in Economic Thought

- The Classical Foundation: A Self-Regulating Economy

- Say's Law: Supply Creates Its Own Demand

- Flexible Wages and Prices: The Self-Correcting Mechanism

- Limited Role for Government Intervention: Laissez-Faire

- Keynes's Challenge: A Paradigm Shift

- Rejection of Say's Law: Effective Demand as the Driver

- Rigid Wages and Prices: The Importance of Market Imperfections

- The Role of Aggregate Demand: Active Government Intervention

- Multiplier Effect and Liquidity Preference

- Key Differences Summarized: A Comparative Table

- The Lasting Legacy of Keynesian Economics

- Keynesian Economics Today: A Refined Approach

- Latest Posts

- Latest Posts

- Related Post

Unlike the Classical Economists, Keynes Asserted That… A Revolution in Economic Thought

The field of economics, while seemingly focused on objective analysis of markets, is profoundly shaped by underlying philosophies and assumptions. The clash between Classical economics and the Keynesian revolution offers a compelling case study in this regard. While Classical economists championed self-regulating markets and the inherent tendency towards full employment, Keynes challenged these core tenets, proposing a radically different understanding of economic fluctuations and government intervention. This article will delve into the key differences between Classical and Keynesian economic thought, highlighting Keynes's assertions that overturned many established beliefs.

The Classical Foundation: A Self-Regulating Economy

Classical economics, dominant from the late 18th century through the early 20th century, rested on several fundamental principles. These principles, largely stemming from the works of Adam Smith, David Ricardo, and others, painted a picture of a remarkably stable and efficient economic system.

Say's Law: Supply Creates Its Own Demand

A cornerstone of Classical thought was Say's Law, which asserted that production (supply) automatically generates sufficient demand for all goods and services produced. The logic was straightforward: individuals produce goods not merely for the sake of production, but to exchange them for other goods and services they desire. Therefore, the very act of supplying goods creates the income necessary to demand those goods. This implicitly implied that general gluts (overproduction) were impossible in the long run.

Flexible Wages and Prices: The Self-Correcting Mechanism

Classical economists believed that markets were inherently self-correcting. Flexible wages and prices acted as shock absorbers, adjusting to maintain equilibrium. For instance, during periods of unemployment, wages would fall, making labor cheaper and encouraging employers to hire more workers. Similarly, falling prices would stimulate demand, ultimately clearing the market. This mechanism ensured that the economy would naturally gravitate towards full employment in the long run.

Limited Role for Government Intervention: Laissez-Faire

The inherent self-regulating nature of the economy led Classical economists to advocate for a minimal role for government intervention. They believed that government intervention, such as attempts to manage the economy through fiscal or monetary policy, would be ineffective and potentially harmful, disrupting the natural market forces. The "invisible hand" of the market, as described by Adam Smith, was deemed sufficient to guide the economy towards optimal outcomes. Laissez-faire, or non-intervention, was the preferred approach.

Keynes's Challenge: A Paradigm Shift

John Maynard Keynes, writing in the midst of the Great Depression, fundamentally challenged the Classical view. The severity and persistence of the Depression, which defied the Classical prediction of self-correction, provided fertile ground for Keynes's revolutionary ideas, presented in his seminal work, The General Theory of Employment, Interest and Money.

Rejection of Say's Law: Effective Demand as the Driver

Keynes directly challenged Say's Law, arguing that effective demand, the aggregate demand for goods and services in the economy, was not always sufficient to ensure full employment. He argued that production decisions were based on anticipated demand, which could fall short of actual production, leading to unplanned inventories and reduced output. This implied that an economy could remain stuck in a state of underemployment equilibrium for extended periods, without any automatic mechanism to restore full employment.

Rigid Wages and Prices: The Importance of Market Imperfections

Keynes also emphasized the rigidity of wages and prices, especially downwards. Unlike the Classical assumption of perfectly flexible wages, Keynes argued that wages and prices often remained sticky, preventing the market from quickly clearing during periods of recession. This rigidity stemmed from various factors, such as collective bargaining, long-term contracts, and psychological factors influencing both consumer and producer behavior. This meant that the self-correcting mechanism envisioned by Classical economists often failed to materialize.

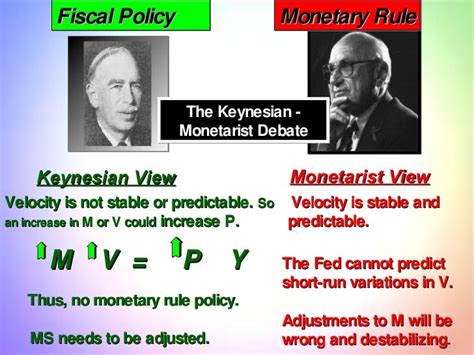

The Role of Aggregate Demand: Active Government Intervention

Keynes highlighted the crucial role of aggregate demand in driving economic activity. He posited that insufficient aggregate demand was the primary cause of economic downturns. This led him to advocate for active government intervention to stimulate demand through fiscal policy (government spending and taxation) and monetary policy (managing interest rates and the money supply). This represented a stark departure from the Classical emphasis on laissez-faire.

Multiplier Effect and Liquidity Preference

Keynes's theory incorporated the multiplier effect, which emphasizes that an initial injection of government spending can have a magnified effect on aggregate demand. This is because the initial spending increases income, which in turn leads to further spending, creating a ripple effect throughout the economy. He also introduced the concept of liquidity preference, arguing that individuals hold a portion of their wealth in liquid form (cash) due to uncertainty about the future, affecting the demand for money and interest rates. This added another layer of complexity to the understanding of monetary policy's influence.

Key Differences Summarized: A Comparative Table

| Feature | Classical Economics | Keynesian Economics |

|---|---|---|

| Say's Law | Supply creates its own demand | Effective demand determines output and employment |

| Wages & Prices | Perfectly flexible | Sticky, especially downwards |

| Unemployment | Temporary, self-correcting | Can persist for long periods due to insufficient demand |

| Government Role | Minimal intervention, laissez-faire | Active intervention through fiscal and monetary policy |

| Market Focus | Long-run equilibrium, self-regulating markets | Short-run fluctuations, market imperfections matter |

| Policy Emphasis | Limited government involvement | Demand management, stimulating aggregate demand |

The Lasting Legacy of Keynesian Economics

Keynes's ideas profoundly impacted economic policy and thinking. The Great Depression demonstrated the limitations of Classical economics, paving the way for the widespread acceptance of Keynesian principles. Government intervention, once considered anathema, became a widely accepted tool for managing the economy, particularly during recessions. Fiscal stimulus packages, designed to boost aggregate demand, became a standard response to economic downturns.

However, the triumph of Keynesian economics was not without its critiques. In the latter half of the 20th century, critics pointed to potential negative consequences of government intervention, such as inflation and government debt. The stagflation of the 1970s, a period of high inflation and unemployment, challenged the efficacy of traditional Keynesian policies. This led to the rise of new classical economics and other schools of thought that emphasized the importance of supply-side factors and the potential for government intervention to be counterproductive.

Keynesian Economics Today: A Refined Approach

Despite these critiques, Keynesian ideas remain influential in modern economics. Many economists now advocate for a more nuanced approach that combines elements of both Classical and Keynesian thought. This approach recognizes the importance of both supply-side and demand-side factors in driving economic growth and acknowledges the potential benefits and drawbacks of government intervention. Modern Keynesian economics places greater emphasis on the microeconomic foundations of aggregate demand, incorporating insights from behavioral economics and other fields.

The debate between Keynesian and Classical perspectives continues to shape economic policy discussions. The optimal balance between government intervention and market forces remains a subject of ongoing debate and research. Understanding the core differences between these two schools of thought is crucial for navigating the complexities of macroeconomic policy and for appreciating the ongoing evolution of economic theory. The legacy of Keynes continues to resonate, reminding us that even in the face of seemingly self-evident market mechanisms, careful consideration of aggregate demand and the potential for government intervention remains vital for maintaining economic stability and fostering prosperity. The implications of Keynes's assertions are far-reaching and continue to shape our understanding and management of global economies today. His work serves as a powerful reminder that economic models are not static, and that adaptive approaches are necessary to address the ever-evolving challenges presented by the global economy.

Latest Posts

Latest Posts

-

A Decrease In The Interest Rate Will

Apr 01, 2025

-

Which Statements Reflect A Servant Leadership Mindset

Apr 01, 2025

-

Which Of The Following Describes The Plasma Membrane

Apr 01, 2025

-

Draw The Product Of The Hydration Of 2 Butene

Apr 01, 2025

-

Which Of The Following Best Describes A Component Of Consent

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Unlike The Classical Economists Keynes Asserted That . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.