There Are Various Budgets Within The Master Budget

Holbox

Mar 30, 2025 · 7 min read

Table of Contents

- There Are Various Budgets Within The Master Budget

- Table of Contents

- There Are Various Budgets Within the Master Budget: A Comprehensive Guide

- The Master Budget: An Overview

- Key Budgets Within the Master Budget

- 1. Sales Budget: The Foundation of All Budgets

- 2. Production Budget: Matching Supply with Demand

- 3. Direct Materials Budget: Securing Raw Materials

- 4. Direct Labor Budget: Planning Workforce Needs

- 5. Manufacturing Overhead Budget: Covering Indirect Costs

- 6. Selling and Administrative Expense Budget: Supporting Operations

- 7. Cash Budget: Maintaining Liquidity

- 8. Capital Expenditure Budget: Investing in Growth

- 9. Budgeted Income Statement: Projecting Profitability

- 10. Budgeted Balance Sheet: Projecting Financial Position

- 11. Budgeted Statement of Cash Flows: Forecasting Cash Movements

- Interrelationships Between Budgets

- Benefits of a Well-Developed Master Budget

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

There Are Various Budgets Within the Master Budget: A Comprehensive Guide

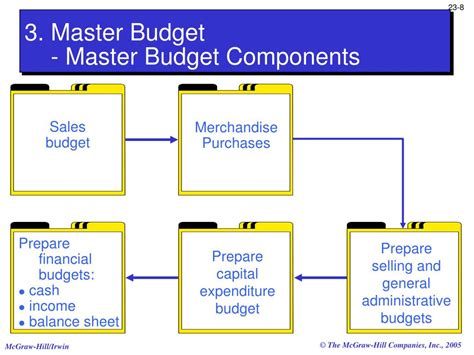

The master budget, the cornerstone of any organization's financial planning, isn't a single document. Instead, it's a comprehensive collection of individual budgets, each focusing on a specific area of the business. Understanding the different types of budgets within the master budget is crucial for effective financial management and strategic decision-making. This detailed guide explores the various components, their interrelationships, and their importance in achieving organizational goals.

The Master Budget: An Overview

Before diving into the individual budgets, let's establish a clear understanding of the master budget itself. The master budget is a comprehensive financial plan that outlines an organization's projected revenue, expenses, and financial position over a specific period, typically a year. It serves as a roadmap, guiding the company's operations and resource allocation. Its primary purpose is to coordinate various functional areas to achieve the overall strategic objectives of the organization. Think of it as the central nervous system of the financial planning process.

A well-constructed master budget provides a framework for:

- Performance Evaluation: Comparing actual results to budgeted figures allows for timely identification of variances and corrective actions.

- Resource Allocation: It guides the allocation of resources, ensuring they are utilized efficiently and effectively.

- Strategic Planning: The process of creating the budget itself encourages strategic thinking and helps align operational goals with the overall business strategy.

- Communication: The budget serves as a communication tool, conveying financial expectations to different departments and stakeholders.

- Securing Funding: For organizations seeking external financing, the master budget is a critical document showcasing the financial viability of their plans.

Key Budgets Within the Master Budget

The specific budgets included in a master budget can vary depending on the nature and size of the organization. However, some key budgets are almost universally present:

1. Sales Budget: The Foundation of All Budgets

The sales budget is the cornerstone of the entire master budget. It's the first budget prepared and sets the stage for all other budgets. It projects the anticipated sales revenue for the budget period, considering factors like:

- Market Research: Analysis of market trends, customer demand, and competitor activity.

- Sales History: Review of past sales data to identify trends and seasonality.

- Sales Forecasts: Predictions of future sales based on various forecasting methods.

- Pricing Strategies: The planned pricing structure for products or services.

Accuracy in the sales budget is critical, as it directly influences the projections for other budgets, like production, purchasing, and operating expenses.

2. Production Budget: Matching Supply with Demand

The production budget translates the sales budget into production plans. It determines the number of units that need to be produced to meet the anticipated sales demand, taking into account:

- Beginning and Ending Inventory: The desired level of inventory at the beginning and end of the budget period.

- Sales Forecast: The sales projections from the sales budget.

- Production Capacity: The company's ability to produce goods or services within the given time frame.

This budget is crucial for managing production capacity, ensuring efficient resource utilization, and preventing stockouts or overstocking.

3. Direct Materials Budget: Securing Raw Materials

The direct materials budget details the quantity and cost of raw materials required for production. This budget considers:

- Production Budget: The number of units to be produced, as determined by the production budget.

- Bill of Materials: A list of all raw materials needed to produce one unit of the product.

- Materials Costs: The estimated cost of each raw material, including purchasing costs and potential price fluctuations.

- Beginning and Ending Inventory: The desired level of raw materials inventory at the beginning and end of the budget period.

Effective management of direct materials is critical for cost control and maintaining a smooth production process.

4. Direct Labor Budget: Planning Workforce Needs

The direct labor budget estimates the labor costs associated with production. It considers:

- Production Budget: The number of units to be produced, directly influencing labor hours required.

- Labor Rates: The hourly wages or salaries of production workers.

- Labor Efficiency: The anticipated productivity of the workforce.

- Labor Costs: The total cost of direct labor, including wages, benefits, and payroll taxes.

Accurate forecasting of direct labor costs is essential for managing payroll expenses and ensuring sufficient staffing levels.

5. Manufacturing Overhead Budget: Covering Indirect Costs

The manufacturing overhead budget accounts for all indirect manufacturing costs, including:

- Indirect Labor: Salaries of supervisors, maintenance personnel, and other support staff.

- Factory Rent and Utilities: Costs associated with the factory building and its operation.

- Depreciation: The allocation of the cost of factory equipment over its useful life.

- Factory Supplies: Costs of materials consumed during production but not directly traceable to individual units.

Accurate budgeting for manufacturing overhead is crucial for cost control and ensuring the profitability of the production process.

6. Selling and Administrative Expense Budget: Supporting Operations

The selling and administrative expense budget covers all non-manufacturing expenses, such as:

- Sales Salaries and Commissions: Compensation for sales personnel.

- Marketing and Advertising: Expenses related to promoting products or services.

- General and Administrative Expenses: Salaries of administrative staff, rent for office space, utilities, and other overhead costs.

- Research and Development: Costs associated with developing new products or services.

Effective management of selling and administrative expenses is crucial for maintaining profitability and ensuring efficient operation of the business.

7. Cash Budget: Maintaining Liquidity

The cash budget is a crucial component of the master budget, projecting the inflows and outflows of cash during the budget period. It considers:

- Cash Receipts: Projected cash inflows from sales, collections from accounts receivable, and other sources.

- Cash Disbursements: Projected cash outflows for payments to suppliers, payroll, operating expenses, and capital expenditures.

- Financing Activities: Potential borrowing or repayment of loans to manage cash flow.

The cash budget helps ensure the company maintains sufficient liquidity to meet its obligations and avoid cash shortages.

8. Capital Expenditure Budget: Investing in Growth

The capital expenditure budget plans for investments in long-term assets, such as:

- Property, Plant, and Equipment (PP&E): Purchases of new equipment, buildings, or land.

- Technology Upgrades: Investments in new software or technology to improve efficiency or productivity.

- Expansion Projects: Investments to expand production capacity or enter new markets.

This budget is vital for long-term growth and competitiveness.

9. Budgeted Income Statement: Projecting Profitability

The budgeted income statement summarizes the projected revenues and expenses for the budget period, resulting in a projected net income or loss. It uses information from other budgets to create a comprehensive picture of the company’s financial performance. This is crucial for assessing the overall financial health and viability of the company’s plans.

10. Budgeted Balance Sheet: Projecting Financial Position

The budgeted balance sheet presents a projected snapshot of the company's financial position at the end of the budget period. It shows the projected assets, liabilities, and equity, reflecting the cumulative impact of all budget components. This helps stakeholders understand the anticipated financial strength of the company.

11. Budgeted Statement of Cash Flows: Forecasting Cash Movements

The budgeted statement of cash flows projects the movement of cash during the budget period. This statement provides detailed information about cash flows from operating, investing, and financing activities, and it's essential for assessing the liquidity and financial stability of the business.

Interrelationships Between Budgets

It's crucial to understand that these budgets are interconnected. Changes in one budget will often necessitate adjustments in others. For example, an increase in the sales budget will require a corresponding increase in the production budget, direct materials budget, and direct labor budget. This interconnectedness highlights the importance of a coordinated and integrated budgeting process.

Benefits of a Well-Developed Master Budget

A well-developed master budget offers numerous benefits, including:

- Improved Financial Planning: Provides a framework for strategic financial planning, guiding resource allocation and decision-making.

- Enhanced Coordination: Coordinates the activities of different departments and ensures alignment with overall organizational goals.

- Effective Performance Management: Facilitates performance evaluation by comparing actual results to budgeted figures.

- Improved Resource Allocation: Optimizes resource utilization by allocating resources to high-priority areas.

- Increased Profitability: Helps improve profitability by monitoring costs and revenues effectively.

- Reduced Risk: Helps mitigate financial risks by anticipating potential problems and developing contingency plans.

- Improved Decision-Making: Provides valuable information for informed decision-making.

Conclusion

The master budget is not a static document but a dynamic tool that requires continuous monitoring and adjustment. Regular review and analysis of the budget throughout the year are essential to ensure it remains relevant and effective. By understanding the various components of the master budget and their interrelationships, organizations can create a powerful financial planning tool that drives strategic success. The detailed and integrated nature of a comprehensive master budget provides a robust foundation for making informed financial decisions, improving operational efficiency, and achieving long-term organizational objectives. The process of building and using a master budget fosters a culture of financial accountability and proactive management within the organization.

Latest Posts

Latest Posts

-

High And Persistent Inflation Is Caused By

Apr 02, 2025

-

Classify Whether Each Compound Contains An Ionic Bond

Apr 02, 2025

-

Obvious Elder Abuse Is More Likely To Occur

Apr 02, 2025

-

An Elderly Widower You Care For

Apr 02, 2025

-

Medical Language For Modern Health Care

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about There Are Various Budgets Within The Master Budget . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.