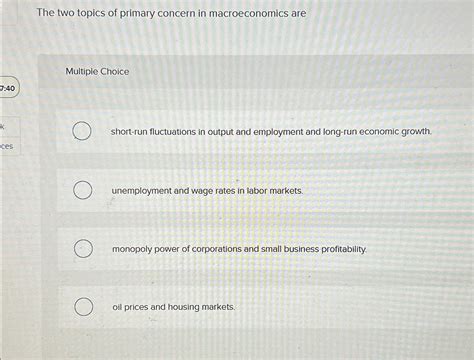

The Two Topics Of Primary Concern In Macroeconomics Are

Holbox

Mar 17, 2025 · 7 min read

Table of Contents

The Two Primary Concerns in Macroeconomics: Unemployment and Inflation

Macroeconomics, the study of the economy as a whole, grapples with numerous complex issues. However, two overarching concerns consistently dominate the field: unemployment and inflation. Understanding these twin challenges, their interconnectedness, and the policy responses designed to address them is crucial to comprehending the health and stability of any national economy. This article will delve deeply into both unemployment and inflation, exploring their causes, consequences, and the delicate balancing act policymakers face in managing them.

Unemployment: The Human Cost of Economic Downturn

Unemployment, simply defined as the state of being without a job while actively seeking employment, represents a significant societal and economic burden. Its impact extends far beyond the individual level, affecting families, communities, and the national economy as a whole. The severity of unemployment is often measured by the unemployment rate, which represents the percentage of the labor force that is unemployed.

Types of Unemployment

Understanding the different types of unemployment is crucial to understanding its root causes and potential solutions. Economists typically categorize unemployment into several types:

-

Frictional Unemployment: This type of unemployment is considered natural and unavoidable. It arises from the time it takes for workers to transition between jobs. Individuals may be searching for a better position, changing careers, or entering the workforce for the first time. While frictional unemployment is inherent in a dynamic economy, its duration should ideally be short.

-

Structural Unemployment: This form of unemployment stems from a mismatch between the skills possessed by workers and the skills demanded by employers. Technological advancements, shifts in industry, or geographical imbalances can all contribute to structural unemployment. Retraining and upskilling programs are often considered essential remedies for this type of unemployment.

-

Cyclical Unemployment: This is the most volatile form of unemployment and is directly tied to the business cycle. During economic recessions or downturns, businesses reduce production and lay off workers, leading to a rise in cyclical unemployment. This type of unemployment is often considered the most problematic, as it reflects a fundamental weakness in aggregate demand.

-

Seasonal Unemployment: This form of unemployment is predictable and occurs due to seasonal variations in demand for labor in certain industries, such as tourism, agriculture, and construction. It’s generally less concerning than other forms as it’s temporary and often anticipated.

The Consequences of High Unemployment

High unemployment rates have profound and far-reaching consequences:

-

Loss of Potential Output: Unemployed individuals represent a loss of potential contribution to the economy. Their skills and labor remain untapped, hindering overall productivity and economic growth. This lost output translates to a lower standard of living for the entire society.

-

Increased Poverty and Inequality: Unemployment disproportionately affects low-income individuals and families, exacerbating existing inequalities. The loss of income can lead to poverty, homelessness, and social unrest.

-

Reduced Consumer Spending: Unemployed individuals have less disposable income, leading to a decline in consumer spending. This reduced demand can further depress economic activity and prolong a recession.

-

Increased Crime Rates: Studies have shown a correlation between high unemployment rates and increased crime rates. Economic hardship can drive individuals to engage in criminal activities to support themselves and their families.

Policies to Reduce Unemployment

Governments employ various policies to combat unemployment:

-

Fiscal Policy: Governments can use fiscal policy tools, such as increased government spending or tax cuts, to stimulate aggregate demand and create jobs. This approach aims to boost economic activity and pull the economy out of a recession.

-

Monetary Policy: Central banks utilize monetary policy tools, such as lowering interest rates, to encourage borrowing and investment. Lower interest rates make it cheaper for businesses to borrow money, potentially leading to increased investment and job creation.

-

Active Labor Market Policies: These policies aim to directly address the challenges of unemployment by providing training programs, job search assistance, and placement services to help unemployed individuals find new jobs.

-

Infrastructure Investments: Investing in infrastructure projects, such as roads, bridges, and public transportation, can create numerous jobs in the short term and improve the long-term economic productivity of a country.

Inflation: The Erosion of Purchasing Power

Inflation, defined as a sustained increase in the general price level of goods and services in an economy over a period of time, is another major macroeconomic concern. When the price level rises, the purchasing power of money falls, meaning that each unit of currency buys fewer goods and services.

Types of Inflation

Economists categorize inflation into several types:

-

Demand-Pull Inflation: This type of inflation occurs when aggregate demand exceeds aggregate supply. Increased consumer spending, government spending, or investment can push prices upward as businesses struggle to keep up with demand.

-

Cost-Push Inflation: This type of inflation results from increases in the cost of production, such as rising wages, raw material prices, or energy costs. These increased costs are passed on to consumers in the form of higher prices.

-

Built-in Inflation: Also known as wage-price spiral, this type of inflation occurs when rising prices lead to demands for higher wages, which in turn lead to further price increases, creating a self-perpetuating cycle.

-

Hyperinflation: This is an extreme form of inflation characterized by a rapid and uncontrolled increase in the price level. Hyperinflation can severely destabilize an economy and erode public confidence in the currency.

The Consequences of High Inflation

High inflation rates have several negative consequences:

-

Erosion of Purchasing Power: As prices rise, the purchasing power of money declines. This means consumers can buy fewer goods and services with the same amount of money.

-

Uncertainty and Reduced Investment: High inflation creates uncertainty in the economy, making it difficult for businesses to plan for the future and discouraging investment.

-

Income Redistribution: Inflation can redistribute income from savers to borrowers. If the inflation rate exceeds the interest rate on savings, the real return on savings is negative.

-

Menu Costs: Businesses incur costs associated with changing prices, known as menu costs. High inflation necessitates frequent price adjustments, leading to increased administrative burdens.

-

Shoe-Leather Costs: High inflation can lead to increased shoe-leather costs as individuals spend more time and effort searching for the best prices.

Policies to Control Inflation

Governments and central banks employ various policies to control inflation:

-

Monetary Policy: Central banks are the primary actors in managing inflation through monetary policy. Raising interest rates makes borrowing more expensive, reducing aggregate demand and cooling down inflationary pressures.

-

Fiscal Policy: Governments can use fiscal policy to control inflation by reducing government spending or increasing taxes. This approach aims to reduce aggregate demand and lower inflationary pressures.

-

Supply-Side Policies: These policies aim to increase the productive capacity of the economy, thereby reducing inflationary pressures. They can include measures to improve infrastructure, reduce regulations, and invest in education and training.

The Interplay of Unemployment and Inflation: The Phillips Curve

The relationship between unemployment and inflation is complex and not always straightforward. The Phillips Curve, a graphical representation of the inverse relationship between unemployment and inflation, suggests that a trade-off exists between the two. Lower unemployment is often associated with higher inflation, and vice versa.

However, the simple Phillips Curve relationship has been challenged over time. The stagflation of the 1970s, a period characterized by high unemployment and high inflation simultaneously, demonstrated the limitations of the simple model. This phenomenon highlighted the importance of supply-side shocks and other factors influencing inflation, independent of the unemployment rate. The modern understanding of the Phillips Curve incorporates expectations of inflation and other macroeconomic variables to provide a more nuanced and accurate depiction of the relationship between unemployment and inflation. Understanding this nuanced relationship requires recognizing the impact of various macroeconomic factors and the time lags involved in policy responses.

Conclusion

Unemployment and inflation remain the two primary concerns in macroeconomics. Addressing these challenges requires a sophisticated understanding of their underlying causes, consequences, and the intricate interplay between them. Effective macroeconomic policy necessitates a careful balancing act, aiming for sustainable economic growth, low unemployment, and stable prices. The pursuit of this delicate equilibrium is a continuous endeavor, requiring constant monitoring, analysis, and adaptive policy adjustments in response to the ever-evolving economic landscape. Continued research and refinement of economic models are critical in navigating the complexities of these intertwined macroeconomic challenges and achieving a more prosperous and stable future for all.

Latest Posts

Latest Posts

-

What Do Pumice And Scoria Have In Common

Mar 17, 2025

-

Classify Each Substance Based On The Intermolecular Forces

Mar 17, 2025

-

A Person In Charge Should Be Able To Identify Signs

Mar 17, 2025

-

Per Company Policy Tools With A Purchase Price

Mar 17, 2025

-

Things Of Value Owned By A Firm Are Called Its

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about The Two Topics Of Primary Concern In Macroeconomics Are . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.