The Two Most Common Compensation Methods For Teams Are

Holbox

Mar 28, 2025 · 6 min read

Table of Contents

- The Two Most Common Compensation Methods For Teams Are

- Table of Contents

- The Two Most Common Compensation Methods for Teams: Equity vs. Salary

- Equity-Based Compensation: Owning a Piece of the Pie

- Advantages of Equity Compensation:

- Disadvantages of Equity Compensation:

- Types of Equity Compensation:

- Salary-Based Compensation: A Predictable Income Stream

- Advantages of Salary Compensation:

- Disadvantages of Salary Compensation:

- Structuring Salary Compensation Effectively:

- Choosing the Right Compensation Method: A Balanced Approach

- Latest Posts

- Latest Posts

- Related Post

The Two Most Common Compensation Methods for Teams: Equity vs. Salary

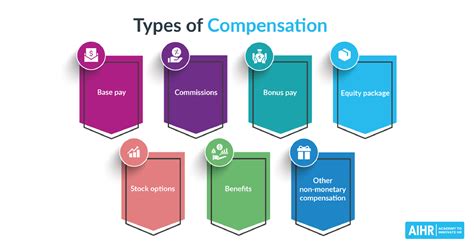

Compensation is a critical aspect of building and maintaining a high-performing team. Choosing the right compensation method significantly impacts team morale, productivity, and overall company success. While numerous compensation strategies exist, two stand out as the most prevalent: equity-based compensation and salary-based compensation. Understanding the nuances of each, their advantages, and disadvantages is crucial for making informed decisions about how to reward your team's contributions.

Equity-Based Compensation: Owning a Piece of the Pie

Equity-based compensation grants team members ownership in the company, usually in the form of stock options or restricted stock units (RSUs). This approach incentivizes employees to work towards the company's long-term success, as their personal financial gain is directly tied to the company's performance.

Advantages of Equity Compensation:

-

Stronger Alignment of Interests: Employees with equity become stakeholders, inherently motivated to contribute to the company's growth and profitability. Their success is directly linked to the company's success, fostering a shared sense of ownership and responsibility.

-

Attracting Top Talent: Equity can be a powerful tool for attracting and retaining highly skilled individuals, especially in competitive industries or during early-stage company growth. The potential for substantial returns makes it a highly attractive compensation component.

-

Cost-Effective (Initially): In the early stages of a company, equity is often a more cost-effective way to compensate employees compared to high salaries. As the company grows and becomes more profitable, the value of the equity increases, but the initial financial outlay is considerably lower.

-

Retention Incentive: Equity compensation can significantly improve employee retention. Employees are less likely to leave a company if they have a vested interest in its future success and stand to gain financially from its growth.

Disadvantages of Equity Compensation:

-

Illiquidity: Equity is not easily converted to cash. Employees must wait until the company is acquired, goes public (IPO), or is otherwise liquidated to realize the value of their equity. This illiquidity can be a significant drawback for employees who need immediate financial resources.

-

Valuation Uncertainty: The actual value of equity is uncertain until the company is sold or goes public. The value may be significantly less than anticipated, or even worthless if the company fails.

-

Tax Implications: Equity compensation can come with complex tax implications, especially upon vesting and sale. Consulting with a tax professional is crucial to understanding and managing these implications.

-

Dilution: As the company grows, it may need to issue more equity to raise capital or compensate new employees. This dilutes the existing shareholders' ownership, reducing the value of their shares.

-

Not Suitable for All Roles: Equity compensation is most effective for employees whose contributions directly impact the company's long-term value. It might not be the best approach for roles where the impact is less directly linked to overall company performance.

Types of Equity Compensation:

-

Stock Options: These grant employees the right, but not the obligation, to buy company stock at a predetermined price (the exercise price) within a specified timeframe.

-

Restricted Stock Units (RSUs): These award employees shares of company stock, but the shares are subject to certain vesting conditions (e.g., remaining employed for a specific period). Upon vesting, the employee owns the shares outright.

-

Performance-Based Equity: This links the value or vesting of equity to the achievement of specific company milestones or performance targets. This approach further aligns employee incentives with overall company success.

Salary-Based Compensation: A Predictable Income Stream

Salary-based compensation provides employees with a fixed or regular payment in exchange for their work. This approach is straightforward, predictable, and easy to understand.

Advantages of Salary Compensation:

-

Predictable Income: Employees receive a consistent and reliable income, allowing them to better manage their personal finances and plan for the future.

-

Immediate Gratification: Unlike equity, salary provides immediate financial compensation for the work performed. This can be highly attractive to employees who need immediate financial security.

-

Simplicity and Transparency: Salary-based compensation is simple to understand and administer, making it a relatively straightforward component of the overall compensation package.

-

Suitable for Various Roles: A salary structure can be easily adapted to various roles and levels of experience within a company.

-

Easy Budgeting: For the employer, salaries are predictable and easy to budget for, facilitating financial planning and forecasting.

Disadvantages of Salary Compensation:

-

Limited Upside Potential: Salary-based compensation does not offer the potential for significant financial gain beyond the predetermined amount. This can be demotivating for high-performing employees who might be looking for greater rewards based on their contributions.

-

Less Alignment of Interests: Employees solely compensated with salary may not be as strongly motivated to work towards the long-term success of the company compared to those with equity.

-

Higher Costs in the Long Run: While initially less expensive than equity, salary-based compensation can become more costly over time, especially with rising salaries and inflation.

-

Increased Risk of Employee Turnover: Without the additional incentive of equity, employees may be more likely to leave for higher-paying opportunities elsewhere.

Structuring Salary Compensation Effectively:

-

Competitive Salary Benchmarking: Conduct thorough research to establish a competitive salary range for each role, taking into account factors such as location, experience, and industry standards.

-

Performance-Based Bonuses: Consider incorporating performance-based bonuses to incentivize high performance and reward employees for exceeding expectations.

-

Benefits Package: A comprehensive benefits package, including health insurance, retirement plans, and paid time off, can enhance the overall compensation package and attract top talent.

-

Regular Salary Reviews: Conduct regular salary reviews to ensure that compensation remains competitive and reflects employee performance and contributions.

Choosing the Right Compensation Method: A Balanced Approach

The best compensation method often involves a combination of equity and salary. This hybrid approach leverages the advantages of both while mitigating their respective drawbacks. For example, a company might offer a competitive salary plus stock options or RSUs, particularly for key employees whose contributions directly influence the company's success.

The optimal blend depends on several factors, including:

-

Company Stage: Startups often rely heavily on equity, while established companies may use a greater proportion of salary.

-

Industry: High-growth industries may prioritize equity to attract talent, while more stable industries might focus more on salary.

-

Employee Role: Key employees with significant impact on the company's success may receive a greater portion of equity.

-

Company Culture: A culture that emphasizes ownership and long-term vision may lean more heavily on equity.

-

Financial Resources: The company's financial capacity will play a significant role in determining the proportion of equity and salary offered.

By carefully considering these factors and understanding the intricacies of both equity and salary compensation, businesses can create a compensation strategy that attracts, motivates, and retains top talent, ultimately leading to greater success. Remember, the ideal approach is not a one-size-fits-all solution, and careful planning and consideration are key to making the most appropriate choice for your specific team and circumstances. Seeking advice from compensation professionals or legal counsel can further enhance the effectiveness of your chosen strategy.

Latest Posts

Latest Posts

-

Ige Antibodies Are Best Described As

Mar 31, 2025

-

What Is Shown In This Picture

Mar 31, 2025

-

Correctly Label The Following Anatomical Features Of The Elbow Joint

Mar 31, 2025

-

If Services Are Rendered On Account Then

Mar 31, 2025

-

Consumers Seek To Maximize Satisfaction Based On

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about The Two Most Common Compensation Methods For Teams Are . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.