The Selected Inventory Costing Method Impacts:

Holbox

Mar 20, 2025 · 6 min read

Table of Contents

- The Selected Inventory Costing Method Impacts:

- Table of Contents

- The Selected Inventory Costing Method Impacts: A Comprehensive Guide

- Understanding Inventory Costing Methods

- 1. First-In, First-Out (FIFO):

- 2. Last-In, First-Out (LIFO):

- 3. Weighted-Average Cost:

- 4. Specific Identification:

- Choosing the Right Method: Key Considerations

- The Impact on Financial Statements

- The Impact on Tax Liabilities

- Long-Term Implications and Strategic Considerations

- Conclusion

- Latest Posts

- Related Post

The Selected Inventory Costing Method Impacts: A Comprehensive Guide

Choosing the right inventory costing method is a crucial decision for any business, significantly impacting financial statements, tax liabilities, and overall profitability. The method selected directly affects the valuation of inventory on hand and the cost of goods sold (COGS), influencing key financial metrics like gross profit margin and net income. This comprehensive guide delves into the intricacies of various inventory costing methods, their implications, and how to select the most appropriate one for your specific business needs.

Understanding Inventory Costing Methods

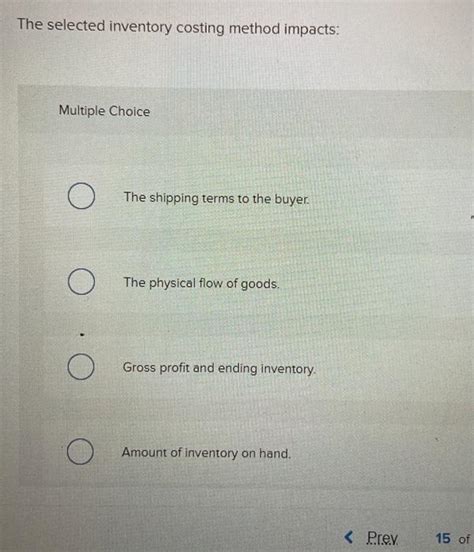

Inventory costing methods determine how the cost of goods sold (COGS) and the value of ending inventory are calculated. Different methods lead to different financial results, even if the physical inventory remains the same. The primary methods include:

1. First-In, First-Out (FIFO):

FIFO assumes that the oldest inventory items are sold first. This method reflects the actual flow of goods in many businesses and is often considered the most intuitive.

Impact: During periods of inflation, FIFO results in a lower COGS and a higher net income because the older, cheaper inventory is being sold. This also leads to a higher valuation of ending inventory. Conversely, during deflation, FIFO leads to a higher COGS and lower net income.

Advantages:

- Simple to understand and implement: The logic closely aligns with the physical flow of goods.

- Higher net income during inflation: This can be advantageous for attracting investors and securing loans.

- Realistic inventory valuation: Reflects the current market value of inventory more accurately during inflationary periods.

Disadvantages:

- Higher taxes during inflation: Higher net income translates to higher tax liabilities.

- Less accurate during deflation: Can lead to an overstated inventory value.

2. Last-In, First-Out (LIFO):

LIFO assumes that the newest inventory items are sold first. This method is only permitted under US GAAP and is not allowed under IFRS.

Impact: During periods of inflation, LIFO results in a higher COGS and a lower net income because the newer, more expensive inventory is being sold. This also leads to a lower valuation of ending inventory. During deflation, LIFO leads to a lower COGS and higher net income.

Advantages:

- Lower taxes during inflation: The higher COGS reduces taxable income.

- Matches current costs with current revenues: This provides a more accurate reflection of profitability in inflationary environments.

Disadvantages:

- Lower net income during inflation: This can be less appealing to investors.

- Can lead to understated inventory value: This may not accurately reflect the current market value.

- Not permitted under IFRS: This limits its applicability for companies operating internationally under IFRS.

- Potential for inventory manipulation: Companies could potentially manipulate their inventory levels to influence their reported income.

3. Weighted-Average Cost:

The weighted-average cost method calculates the average cost of all inventory items available for sale during a period. This average cost is then used to determine the cost of goods sold and the value of ending inventory.

Impact: This method smooths out fluctuations in cost that occur with FIFO and LIFO, resulting in a more stable cost of goods sold and inventory valuation. It's less sensitive to price changes.

Advantages:

- Simple to calculate: The average cost is relatively easy to compute.

- Smooths out price fluctuations: Provides a more stable cost of goods sold and inventory valuation.

- Reduces the impact of price volatility: This is beneficial in volatile markets.

Disadvantages:

- May not accurately reflect the actual cost of goods sold: The average cost may not represent the true cost of the items sold.

- Less accurate in times of significant price changes: The average cost may become less meaningful during periods of rapid inflation or deflation.

4. Specific Identification:

Specific identification method tracks the cost of each individual item in inventory. This is most commonly used for high-value, unique items like cars, jewelry, or specialized equipment.

Impact: This method provides the most accurate cost of goods sold and ending inventory valuation because it tracks each item individually.

Advantages:

- Most accurate cost of goods sold and inventory valuation: Provides the most precise reflection of costs.

- Suitable for high-value, unique items: Ideal for businesses dealing with goods that are easily identifiable.

Disadvantages:

- Time-consuming and costly: Requires meticulous tracking of each item.

- Not practical for large inventories: The administrative burden becomes excessive with numerous items.

- Potential for manipulation: There is a greater potential for manipulation if the tracking system is not robust.

Choosing the Right Method: Key Considerations

Selecting the appropriate inventory costing method depends on several factors:

- Type of Inventory: Businesses selling unique, high-value items may prefer specific identification. Businesses with large volumes of homogeneous goods might opt for FIFO, LIFO, or weighted-average.

- Industry Regulations: Compliance with GAAP or IFRS is crucial. LIFO is not permitted under IFRS.

- Tax Implications: LIFO often leads to lower taxes during inflation, while FIFO results in higher taxes.

- Management Reporting Needs: Some methods provide better insights into the actual flow of goods (FIFO) while others offer a smoother portrayal of profitability (weighted-average).

- Inflationary Environment: The impact of inflation on COGS and net income differs significantly across methods.

- Internal Controls: The chosen method should align with the company’s internal controls to ensure accuracy and prevent manipulation.

The Impact on Financial Statements

The chosen inventory costing method directly influences several key financial statements:

- Income Statement: The COGS is calculated differently under each method, directly affecting gross profit, operating income, and net income.

- Balance Sheet: The value of ending inventory is impacted, affecting the company's current assets and total assets.

- Cash Flow Statement: Indirect methods of calculating cash flow are impacted by changes in inventory levels and COGS.

The Impact on Tax Liabilities

Tax implications are a significant factor in the inventory costing method selection. LIFO, while not allowed under IFRS, often results in lower taxable income during periods of inflation due to the higher COGS. However, this lower income in the current period may lead to higher taxes in future periods when the lower-cost inventory is eventually sold. FIFO generally leads to higher tax liabilities during inflation.

Long-Term Implications and Strategic Considerations

The choice of an inventory costing method is not a trivial matter; it has long-term implications for financial reporting, tax planning, and overall business strategy. Consistency is crucial. Once a method is chosen, it should be consistently applied from period to period to ensure comparability of financial data. Changes in method should be disclosed and accounted for appropriately.

Furthermore, businesses should consider the impact of their choice on investor relations. Investors closely scrutinize financial statements, and the chosen inventory costing method can influence their perception of the company's performance and profitability.

Conclusion

Selecting an appropriate inventory costing method requires careful consideration of various factors including the type of inventory, industry regulations, tax implications, management reporting needs, and inflationary environment. Each method has its advantages and disadvantages, and the optimal choice depends on the specific circumstances of the business. Understanding these intricacies enables businesses to make informed decisions that accurately reflect their financial performance and optimize their tax strategies. Consulting with tax and accounting professionals is strongly recommended to ensure compliance and make the most appropriate choice for your business. Remember, the chosen method should not only be compliant but also enhance the transparency and reliability of the financial information provided to stakeholders. A well-informed decision will lead to better financial reporting, more accurate tax calculations, and a stronger overall financial position.

Latest Posts

Related Post

Thank you for visiting our website which covers about The Selected Inventory Costing Method Impacts: . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.