The Real Interest Rate Tells You

Holbox

Mar 19, 2025 · 6 min read

Table of Contents

The Real Interest Rate: What It Tells You and Why It Matters

The real interest rate. It sounds intimidating, even arcane, but understanding this crucial economic indicator is key to navigating personal finances, investing wisely, and comprehending broader economic trends. This comprehensive guide will demystify the real interest rate, explaining what it is, how it's calculated, what it reveals about the economy, and how it impacts your decisions.

Understanding the Real Interest Rate: Beyond the Nominal

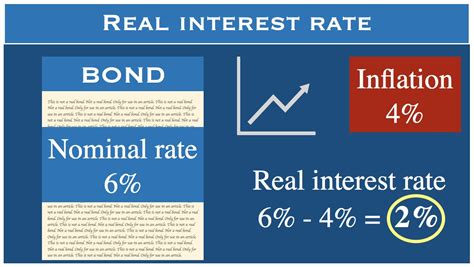

Before diving into the intricacies of the real interest rate, let's clarify its counterpart: the nominal interest rate. This is the interest rate you see advertised on savings accounts, loans, and bonds – the stated rate before adjusting for inflation. Think of it as the face value of interest.

The problem with relying solely on the nominal interest rate is that it doesn't account for inflation. Inflation erodes the purchasing power of money over time. If you earn 5% nominal interest but inflation is 3%, your real return is only 2%. This is where the real interest rate comes in.

The real interest rate represents the actual return on an investment after adjusting for inflation. It reflects the true increase in your purchasing power. A positive real interest rate means your investment is growing faster than inflation, while a negative real interest rate implies your purchasing power is declining despite earning interest.

Calculating the Real Interest Rate: A Simple Formula

Calculating the real interest rate is surprisingly straightforward. The most common method uses the Fisher equation, a simple approximation:

Real Interest Rate ≈ Nominal Interest Rate – Inflation Rate

For example, if the nominal interest rate on a savings account is 5% and the inflation rate is 3%, the real interest rate is approximately 2%.

It's important to note that this is an approximation. A more accurate calculation uses a slightly more complex formula that accounts for the compounding effect of interest and inflation:

Real Interest Rate = [(1 + Nominal Interest Rate) / (1 + Inflation Rate)] – 1

Using the same example, the more accurate calculation would be:

[(1 + 0.05) / (1 + 0.03)] – 1 ≈ 0.0194 or 1.94%

While the difference might seem minor in this instance, the more accurate formula becomes increasingly important with higher interest rates and inflation levels.

What the Real Interest Rate Tells Us About the Economy

The real interest rate is a powerful economic indicator, providing insights into several key aspects of the economy:

1. Investment Decisions: A Key Driver of Economic Growth

Businesses make investment decisions based on the real interest rate. A high real interest rate makes borrowing expensive, discouraging investment and potentially slowing economic growth. Conversely, a low real interest rate encourages borrowing and investment, stimulating economic activity. This is a crucial aspect of monetary policy, where central banks manipulate interest rates to influence economic growth.

2. Savings and Consumption: Balancing Act of Economic Stability

The real interest rate also influences consumer behavior. A high real interest rate incentivizes saving, as the return on savings exceeds the rate of inflation. This can lead to decreased consumer spending, potentially slowing economic growth. Conversely, a low real interest rate encourages spending as savings offer a lower return. Central banks must carefully balance these factors to maintain economic stability.

3. Inflationary Pressures: A Crucial Gauge for Price Stability

The real interest rate serves as a key indicator of inflationary pressures. A consistently low or negative real interest rate can fuel inflation as borrowing becomes cheap, leading to increased demand and potentially outpacing supply. Central banks monitor the real interest rate closely to anticipate and manage inflationary risks. Maintaining a positive real interest rate is often considered a key element in controlling inflation.

4. Bond Market Dynamics: Assessing Risk and Return

The real interest rate plays a crucial role in the bond market. Investors assess the attractiveness of bonds based on the real interest rate they offer compared to other investment options. A high real interest rate makes bonds more attractive, increasing demand and potentially lowering bond yields. The opposite is true for low real interest rates.

5. Currency Exchange Rates: Influence on International Trade

The real interest rate can influence currency exchange rates. A high real interest rate in a country can attract foreign investment, increasing demand for its currency and strengthening its exchange rate. This impacts international trade flows, making exports more expensive and imports cheaper.

The Real Interest Rate and Your Personal Finances

Understanding the real interest rate is vital for making informed financial decisions:

1. Choosing Savings Accounts: Maximizing Real Returns

When choosing a savings account, don't just look at the nominal interest rate. Consider the inflation rate to determine the real return. A high nominal rate might seem attractive, but if inflation erodes most of those gains, the real return could be disappointing.

2. Evaluating Loan Options: True Cost of Borrowing

Similarly, when evaluating loan options, consider the real interest rate. A seemingly low nominal interest rate might be less attractive if inflation substantially reduces your real cost of borrowing.

3. Investment Strategies: Real Growth Matters

For long-term investments like stocks and bonds, understanding the real interest rate helps determine the expected real return. This is crucial for setting realistic investment goals and managing risk. Remember, you want your investments to grow faster than inflation to maintain or increase purchasing power.

4. Retirement Planning: Ensuring Financial Security

In retirement planning, accurately forecasting the real interest rate is crucial for determining the necessary savings to maintain a desired standard of living. Underestimating inflation can significantly impact your retirement funds' purchasing power.

Limitations and Considerations of the Real Interest Rate

While the real interest rate provides valuable insights, it’s crucial to acknowledge its limitations:

-

Inflation Forecasting Challenges: Accurately predicting future inflation rates is difficult. The real interest rate is only as accurate as the inflation forecast used in its calculation.

-

Unexpected Inflation: Unexpected inflation can drastically alter the real return on investments. A sudden spike in inflation can wipe out the gains from a positive nominal interest rate, rendering the initial real interest rate estimate irrelevant.

-

Risk Premiums: The real interest rate doesn't inherently account for risk premiums associated with different investments. A higher-risk investment might offer a higher nominal interest rate but could also have a higher likelihood of losses, impacting the final real return.

-

Tax Implications: Tax implications on interest income are not directly factored into the real interest rate calculation. These tax implications can further reduce the actual real return on investment.

-

Liquidity and Accessibility: The real return of an investment is also impacted by the liquidity and accessibility of the asset.

Conclusion: A Powerful Tool for Informed Decisions

The real interest rate is a powerful economic indicator and a vital tool for making informed financial decisions. While it's not a perfect measure, understanding its calculation, implications, and limitations empowers individuals and businesses to navigate economic uncertainties more effectively. By considering both nominal interest rates and inflation, you can gain a clearer picture of the true cost of borrowing and the actual return on your investments. This knowledge is crucial for making sound financial decisions that support your long-term goals, no matter the economic climate. Remember to stay informed about economic trends and consult with financial professionals for personalized advice tailored to your specific circumstances.

Latest Posts

Latest Posts

-

An Inbound Sales Rep For A Digital

Mar 19, 2025

-

A Firms Supply Curve Is Upsloping Because

Mar 19, 2025

-

5 21 Cm Is The Same Distance As

Mar 19, 2025

-

Assigning Manufacturing Overhead To Product Is Complicated Because

Mar 19, 2025

-

Why Is Supporting In The Present Important Cpi

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about The Real Interest Rate Tells You . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.