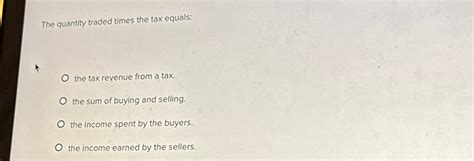

The Quantity Traded Times The Tax Equals

Holbox

Mar 16, 2025 · 6 min read

Table of Contents

The Quantity Traded Times the Tax Equals: A Deep Dive into Tax Revenue Calculation and its Economic Implications

The seemingly simple equation – Quantity Traded x Tax Rate = Tax Revenue – underpins a significant portion of government fiscal policy. While straightforward on the surface, understanding its nuances reveals complex economic relationships and far-reaching consequences for businesses, consumers, and the overall economy. This article will delve into this equation, exploring its components, the factors that influence it, and its impact on various economic aspects.

Deconstructing the Equation: Understanding its Components

The equation, in its purest form, represents the total tax revenue generated from a particular transaction or market. Let's break down each component:

1. Quantity Traded: The Foundation of Tax Revenue

The quantity traded refers to the total number of units of a good or service exchanged within a specific timeframe (e.g., daily, monthly, annually). This is not merely a static number; it's highly dynamic and influenced by several market forces, including:

- Price: Higher prices, all else being equal, typically lead to a lower quantity traded, as consumers are less willing or able to purchase the good or service.

- Consumer Demand: Strong consumer demand, driven by factors like income levels, consumer confidence, and the desirability of the product, will push up the quantity traded.

- Supply: The availability of the good or service, influenced by production capacity, input costs, and technological advancements, significantly impacts the quantity traded. A shortage will restrict quantity, while an abundance may increase it.

- Government Regulations: Government regulations, such as quotas, permits, or import restrictions, can directly influence the quantity traded.

- Seasonality: For some goods and services, the quantity traded fluctuates seasonally. Think of agricultural products or tourism-related services.

Understanding these drivers of the quantity traded is crucial for accurate tax revenue forecasting and policy design.

2. Tax Rate: The Multiplier Effect

The tax rate represents the percentage or fixed amount levied on each unit of the good or service traded. This is determined by the government and can vary significantly depending on the type of good or service, the economic goals of the government, and the prevailing political climate. Key aspects of the tax rate include:

- Type of Tax: The tax rate can be applied as a percentage (ad valorem tax, like sales tax) or as a fixed amount per unit (specific tax, like excise duty on cigarettes).

- Tax Base: The tax base defines what is being taxed. It could be the value of the transaction, the quantity of the product, or even the income derived from the transaction.

- Tax Incidence: The tax incidence refers to who actually bears the burden of the tax. This isn’t always the entity directly paying the tax. For example, a tax on producers might get passed on to consumers in the form of higher prices.

- Tax Elasticity: The sensitivity of the quantity traded to changes in the tax rate is known as tax elasticity. If the quantity traded falls significantly in response to a tax increase, the tax is considered elastic. If the change is minimal, it’s inelastic.

The tax rate is a powerful policy tool. Governments can use it to influence behavior, such as discouraging the consumption of harmful goods (e.g., tobacco) through high excise taxes, or to generate revenue to fund public services.

3. Tax Revenue: The Outcome

The tax revenue is the ultimate outcome of the equation – the total amount of money collected by the government from the tax. This revenue is crucial for financing public expenditures, including:

- Public Goods and Services: Education, healthcare, infrastructure, defense, and social welfare programs all rely heavily on tax revenue.

- Debt Reduction: Governments can use tax revenue to pay down existing debt and improve their fiscal position.

- Economic Stabilization: Tax policy can be used as a tool to stabilize the economy, for example, through tax cuts during recessions to stimulate demand.

Factors Influencing the Equation and its Implications

The seemingly simple equation is susceptible to a multitude of factors that can drastically alter the tax revenue generated. Ignoring these complexities can lead to inaccurate predictions and ineffective policies.

1. The Laffer Curve: A Balancing Act

The Laffer Curve illustrates the relationship between tax rates and tax revenue. It suggests that at both very high and very low tax rates, tax revenue is low. There is an optimal tax rate that maximizes revenue. Increasing the tax rate beyond this point may lead to a decrease in the quantity traded due to reduced demand or increased tax avoidance, ultimately lowering tax revenue.

2. Tax Avoidance and Evasion: Undermining Tax Revenue

Tax avoidance, the legal minimization of tax liability, and tax evasion, the illegal non-payment of taxes, significantly impact the quantity traded and, consequently, tax revenue. Sophisticated tax planning by businesses and individuals can reduce the effective tax rate and the overall revenue collected. Aggressive tax evasion further erodes the government's tax base.

3. Economic Growth and Tax Revenue

A robust economy typically translates to higher tax revenue. Increased economic activity leads to a larger quantity traded, boosting the tax base. Conversely, economic downturns can sharply decrease tax revenue, creating fiscal challenges for governments.

4. Inflation and Tax Revenue

Inflation, the general increase in prices, can affect tax revenue in two ways. Firstly, it can increase the nominal value of transactions, leading to higher tax revenue, especially with ad valorem taxes. However, if inflation is not managed effectively, it can lead to economic instability and reduce overall economic activity, ultimately lowering tax revenue.

5. Technological Advancements and Tax Revenue

Technological advancements can create both challenges and opportunities for tax revenue. E-commerce and the digital economy, for example, present challenges in tax collection due to the borderless nature of online transactions. However, they can also open up new avenues for taxation, such as digital services taxes.

6. International Trade and Tax Revenue

International trade plays a significant role in influencing tax revenue. Import and export taxes, as well as trade agreements, can affect the quantity traded and the overall tax revenue generated. Globalization and the rise of multinational corporations also pose challenges in international tax coordination and enforcement.

Policy Implications and Considerations

Understanding the complexities of the "Quantity Traded x Tax Rate = Tax Revenue" equation is crucial for effective policymaking. Governments must consider the following:

- Optimal Tax Rate Determination: Finding the optimal tax rate that maximizes revenue while minimizing economic distortion requires careful analysis of the relevant markets and economic conditions.

- Tax Base Broadening: Expanding the tax base by including more goods and services or income sources can help generate more revenue without overly increasing tax rates on existing items.

- Tax Administration and Enforcement: Effective tax administration and enforcement are critical to minimizing tax avoidance and evasion and maximizing revenue collection.

- Transparency and Accountability: Transparent and accountable tax systems build trust and ensure that taxes are used efficiently and effectively to benefit society.

- Social Equity: Tax policies should be designed to consider social equity, ensuring that the tax burden is distributed fairly across different segments of the population.

Conclusion

The equation "Quantity Traded x Tax Rate = Tax Revenue" is far more intricate than it initially appears. Its effectiveness in generating revenue and its impact on the economy are influenced by a complex interplay of market forces, government policies, and economic conditions. Understanding these intricacies is paramount for governments to design effective tax policies that promote economic growth, social equity, and sustainable public finance. Continuous monitoring and adjustments to tax policies are crucial in response to changing economic landscapes and technological advancements to ensure the ongoing success of this fundamental equation in supporting public welfare.

Latest Posts

Latest Posts

-

Consider The Following Two Mutually Exclusive Projects

Mar 16, 2025

-

Transfer Prices Check All That Apply

Mar 16, 2025

-

Job A3b Was Ordered By A Customer On September 25

Mar 16, 2025

-

Silver Ions React With Thiocyanate Ions As Follows

Mar 16, 2025

-

Supervisory Managers Spend Most Of Their Time On

Mar 16, 2025

Related Post

Thank you for visiting our website which covers about The Quantity Traded Times The Tax Equals . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.