The Profitability Index And The Internal Rate Of Return

Holbox

Mar 27, 2025 · 7 min read

Table of Contents

- The Profitability Index And The Internal Rate Of Return

- Table of Contents

- Profitability Index vs. Internal Rate of Return: A Deep Dive into Capital Budgeting Decisions

- Understanding the Profitability Index (PI)

- Calculating the Profitability Index

- Interpreting the Profitability Index

- Advantages of Using the Profitability Index

- Disadvantages of Using the Profitability Index

- Understanding the Internal Rate of Return (IRR)

- Calculating the Internal Rate of Return

- Interpreting the Internal Rate of Return

- Advantages of Using the Internal Rate of Return

- Disadvantages of Using the Internal Rate of Return

- Profitability Index vs. Internal Rate of Return: A Comparative Analysis

- Choosing Between PI and IRR

- Conclusion: A Holistic Approach to Capital Budgeting

- Latest Posts

- Latest Posts

- Related Post

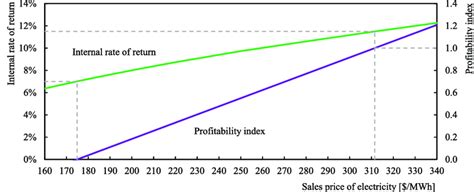

Profitability Index vs. Internal Rate of Return: A Deep Dive into Capital Budgeting Decisions

Choosing the right investment projects is crucial for any business aiming for sustainable growth. Two powerful tools frequently employed in capital budgeting are the Profitability Index (PI) and the Internal Rate of Return (IRR). While both help evaluate the attractiveness of potential investments, they offer different perspectives and have unique strengths and weaknesses. This comprehensive guide delves deep into both the PI and IRR, exploring their calculation methods, interpretations, limitations, and ultimately, how to choose between them for optimal decision-making.

Understanding the Profitability Index (PI)

The Profitability Index, also known as the Value Investment Ratio (VIR), is a capital budgeting tool that measures the relative profitability of a project. It essentially answers the question: "For every dollar invested, how much value is created?" A PI greater than 1 indicates a positive net present value (NPV), suggesting the project is worthwhile.

Calculating the Profitability Index

The calculation of the PI is straightforward:

PI = Present Value of Future Cash Flows / Initial Investment

Let's break down each component:

-

Present Value of Future Cash Flows: This is the sum of the present values of all expected cash inflows from the project, discounted at the company's required rate of return (discount rate). This requires forecasting future cash flows, which can be challenging and inherently uncertain. The accuracy of the PI depends heavily on the reliability of these forecasts.

-

Initial Investment: This represents the total upfront cost of the project. This is typically a known value, although unforeseen costs can sometimes arise.

Example:

Consider a project with an initial investment of $100,000 and expected cash inflows of $30,000 per year for five years. Assuming a discount rate of 10%, the present value of these cash flows is approximately $113,724. Therefore, the PI would be:

PI = $113,724 / $100,000 = 1.137

This PI of 1.137 indicates that for every dollar invested, the project is expected to generate $1.137 in present value terms. Since the PI is greater than 1, the project is considered profitable.

Interpreting the Profitability Index

- PI > 1: The project is considered acceptable because it adds value. The higher the PI, the more attractive the project.

- PI = 1: The project is indifferent; it neither adds nor subtracts value.

- PI < 1: The project is not acceptable; it destroys value.

Advantages of Using the Profitability Index

- Simplicity: The PI is relatively easy to understand and calculate, making it accessible to a wider range of users.

- Ranking Projects: The PI allows for easy ranking of multiple projects based on their relative profitability. Projects with higher PIs are preferred.

- Intuitive Interpretation: The ratio directly shows the return on investment, making it easy to grasp the project's financial impact.

Disadvantages of Using the Profitability Index

- Dependence on Discount Rate: The PI is sensitive to the chosen discount rate. A small change in the discount rate can significantly impact the PI, potentially altering the investment decision.

- Ignoring Project Scale: The PI doesn't inherently consider the size of the project. A small project with a high PI might be less valuable than a larger project with a slightly lower PI.

- Cash Flow Forecasting Challenges: Accurate cash flow forecasting is essential for a reliable PI calculation. Inaccurate forecasts can lead to misleading results.

Understanding the Internal Rate of Return (IRR)

The Internal Rate of Return is the discount rate that makes the Net Present Value (NPV) of a project equal to zero. In simpler terms, it's the rate of return the project is expected to generate.

Calculating the Internal Rate of Return

Calculating the IRR isn't as straightforward as the PI. There's no simple formula; it typically requires iterative calculations or the use of financial calculators or software. The process involves finding the discount rate that equates the present value of cash inflows to the present value of cash outflows.

Example:

Using the same example as above (initial investment of $100,000 and annual cash inflows of $30,000 for five years), the IRR would need to be calculated iteratively. Financial calculators or software readily provide the IRR, which in this case would be approximately 13.1%. This means the project is expected to yield a 13.1% return annually.

Interpreting the Internal Rate of Return

- IRR > Required Rate of Return: The project is acceptable because it generates a return exceeding the company's minimum acceptable rate of return.

- IRR = Required Rate of Return: The project is indifferent.

- IRR < Required Rate of Return: The project is not acceptable.

Advantages of Using the Internal Rate of Return

- Intuitive Measure: The IRR is an easily understood measure of profitability, expressed as a percentage return.

- Considers Time Value of Money: The IRR explicitly accounts for the time value of money by discounting future cash flows.

- Widely Used and Accepted: The IRR is a widely accepted and used metric in capital budgeting decisions.

Disadvantages of Using the Internal Rate of Return

- Multiple IRRs: In some cases, projects with unconventional cash flows (multiple sign changes) can have multiple IRRs, leading to ambiguity.

- Difficulty in Calculation: Calculating the IRR manually is complex and usually requires specialized tools.

- Not Suitable for Mutually Exclusive Projects: When comparing mutually exclusive projects (where only one can be chosen), the IRR might not always choose the project with the highest NPV.

- Sensitivity to Reinvestment Rate Assumption: The IRR calculation implicitly assumes that cash flows are reinvested at the IRR itself. This assumption may not always be realistic.

Profitability Index vs. Internal Rate of Return: A Comparative Analysis

| Feature | Profitability Index (PI) | Internal Rate of Return (IRR) |

|---|---|---|

| Definition | Ratio of present value of cash flows to initial investment | Discount rate that makes NPV = 0 |

| Calculation | Relatively simple | Iterative, requires financial calculator/software |

| Interpretation | PI > 1: Accept; PI < 1: Reject | IRR > Required Rate of Return: Accept; IRR < Required Rate of Return: Reject |

| Ranking Projects | Easy to rank projects | Can be difficult for mutually exclusive projects |

| Scale Considerations | Doesn't explicitly consider project size | Considers project size implicitly through cash flows |

| Multiple Solutions | No | Possible for unconventional cash flows |

| Reinvestment Rate Assumption | Does not have an explicit reinvestment assumption | Implicitly assumes reinvestment at the IRR |

Choosing Between PI and IRR

The choice between PI and IRR depends on the specific circumstances and the preferences of the decision-maker.

-

Use PI when: You need a simple, easily understandable metric for ranking projects, and you are comfortable with the limitations regarding project scale and sensitivity to the discount rate.

-

Use IRR when: You need a measure of profitability expressed as a percentage return, and the project cash flows are conventional (no multiple sign changes). However, be mindful of the limitations concerning mutually exclusive projects and the reinvestment rate assumption.

Conclusion: A Holistic Approach to Capital Budgeting

While both the PI and IRR provide valuable insights into project profitability, neither is perfect. Ideally, a comprehensive capital budgeting analysis should incorporate both metrics alongside other relevant factors, such as:

- Net Present Value (NPV): The absolute measure of a project's value. A positive NPV indicates profitability.

- Payback Period: The time it takes for the project to recoup its initial investment.

- Qualitative Factors: Factors like strategic fit, risk assessment, and management expertise, which are difficult to quantify but crucial for successful investment decisions.

By using a combination of these tools and incorporating qualitative assessments, businesses can significantly improve the accuracy and effectiveness of their capital budgeting decisions, leading to more informed investments and enhanced long-term profitability. Remember that financial models are tools to aid decision-making, not to dictate it. A holistic and well-rounded approach is key to ensuring sound investment choices.

Latest Posts

Latest Posts

-

Draw The Major Organic Product Of The Following Reaction

Mar 31, 2025

-

Which Of The Following Statements About Variation Is False

Mar 31, 2025

-

The Resistance Of A Wire Depends On

Mar 31, 2025

-

After Providing Initial Care Which Actions Must You Implement

Mar 31, 2025

-

Luna Mae Is 12 Years Old

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about The Profitability Index And The Internal Rate Of Return . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.