The Price Elasticity Of Demand Measures The:

Holbox

Mar 19, 2025 · 6 min read

Table of Contents

The Price Elasticity of Demand Measures the Responsiveness of Quantity Demanded to a Change in Price

The price elasticity of demand measures the responsiveness of the quantity demanded of a good or service to a change in its price. It's a crucial concept in economics, informing businesses about pricing strategies, governments about tax policies, and consumers about their purchasing power. Understanding price elasticity allows for more informed decision-making across various sectors. This article will delve deep into the intricacies of price elasticity of demand, exploring its calculation, interpretations, different types, and real-world applications.

Understanding the Concept of Price Elasticity of Demand

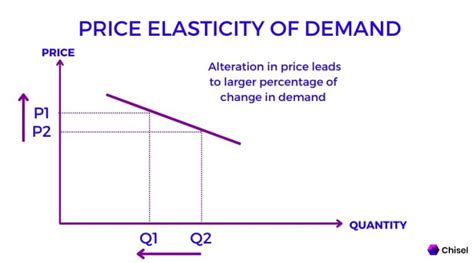

At its core, price elasticity of demand answers the question: How much will the quantity demanded change if the price changes? A highly elastic demand means a small price change leads to a large change in quantity demanded. Conversely, an inelastic demand means a significant price change results in a relatively small change in quantity demanded.

This responsiveness isn't simply a matter of percentage changes; it's a comparative measure. We're interested in the relative change in quantity demanded compared to the relative change in price. This makes price elasticity of demand a dimensionless number – it doesn't have units like dollars or kilograms.

Calculating Price Elasticity of Demand

The most common way to calculate price elasticity of demand is using the percentage change method:

Price Elasticity of Demand (PED) = (% Change in Quantity Demanded) / (% Change in Price)

Let's break down how to calculate the percentage changes:

- % Change in Quantity Demanded = [(New Quantity Demanded - Old Quantity Demanded) / Old Quantity Demanded] x 100

- % Change in Price = [(New Price - Old Price) / Old Price] x 100

Example:

Let's say the price of apples increases from $1 to $1.20 per pound. As a result, the quantity demanded falls from 1000 pounds to 800 pounds.

- % Change in Quantity Demanded = [(800 - 1000) / 1000] x 100 = -20%

- % Change in Price = [(1.20 - 1) / 1] x 100 = 20%

Therefore, the price elasticity of demand is:

PED = -20% / 20% = -1

The negative sign indicates the inverse relationship between price and quantity demanded – a fundamental law of demand. The absolute value is used for interpretation.

Interpreting the Magnitude of Price Elasticity

The absolute value of the PED coefficient offers insight into the nature of demand:

-

|PED| > 1: Elastic Demand: The percentage change in quantity demanded is greater than the percentage change in price. A small price increase leads to a significant drop in quantity demanded. Examples include luxury goods and goods with many substitutes.

-

|PED| = 1: Unitary Elastic Demand: The percentage change in quantity demanded is equal to the percentage change in price. A proportionate change in price leads to a proportionate change in quantity demanded. This is a relatively rare scenario.

-

|PED| < 1: Inelastic Demand: The percentage change in quantity demanded is less than the percentage change in price. Even a large price change results in a small change in quantity demanded. Examples include necessities like gasoline, electricity, and essential medicines.

-

|PED| = 0: Perfectly Inelastic Demand: The quantity demanded doesn't change regardless of price changes. This is a theoretical extreme and rarely observed in reality. Examples could be life-saving medications in the short term.

-

|PED| = ∞: Perfectly Elastic Demand: Any price increase above a certain level results in zero quantity demanded. Consumers are highly sensitive to price changes and will readily switch to alternatives. This is also a theoretical extreme.

Factors Affecting Price Elasticity of Demand

Several factors influence the price elasticity of demand for a good or service:

-

Availability of Substitutes: Goods with many close substitutes tend to have more elastic demand because consumers can easily switch if the price rises.

-

Necessity vs. Luxury: Necessities (e.g., food, shelter) typically have inelastic demand, while luxury goods (e.g., yachts, diamonds) have elastic demand.

-

Proportion of Income Spent on the Good: Goods that represent a small proportion of a consumer's income tend to have inelastic demand, while those representing a significant proportion tend to have elastic demand.

-

Time Horizon: Demand is generally more elastic in the long run than in the short run. Consumers have more time to adjust their consumption patterns and find substitutes.

-

Brand Loyalty: Strong brand loyalty can make demand more inelastic, as consumers are less responsive to price changes if they are committed to a specific brand.

-

Durability of the Good: Durable goods (e.g., cars, appliances) often have more elastic demand than non-durable goods (e.g., food, clothing) due to the possibility of delaying purchases.

Different Types of Price Elasticity

While the basic PED calculation provides a valuable overview, economists also consider other types of price elasticity, including:

-

Cross-Price Elasticity of Demand: This measures the responsiveness of the quantity demanded of one good to a change in the price of another good. Positive values indicate substitutes (an increase in the price of one good increases the demand for the other), while negative values indicate complements (an increase in the price of one good decreases the demand for the other).

-

Income Elasticity of Demand: This measures the responsiveness of the quantity demanded of a good to a change in consumer income. Normal goods have positive income elasticity (demand increases with income), while inferior goods have negative income elasticity (demand decreases with income).

Applications of Price Elasticity of Demand

Understanding price elasticity has significant implications for various stakeholders:

For Businesses:

-

Pricing Strategies: Businesses can use PED to determine the optimal price point to maximize revenue. For goods with inelastic demand, raising prices might increase revenue, while for goods with elastic demand, lowering prices might be more profitable.

-

Marketing and Advertising: Knowledge of PED can inform marketing campaigns, targeting specific consumer segments and highlighting product features that differentiate them from substitutes.

-

Product Development: Understanding elasticity can guide decisions on developing new products or improving existing ones to meet consumer preferences and price sensitivities.

For Governments:

-

Taxation: Governments use PED to assess the impact of taxes on consumer behavior. Taxes on inelastic goods (e.g., cigarettes) generate more revenue without significantly reducing consumption, while taxes on elastic goods might lead to a sharp drop in demand and less revenue.

-

Subsidies: Governments can use subsidies to increase the consumption of goods with elastic demand, benefiting both consumers and producers.

-

Regulation: Understanding elasticity is crucial for regulating industries, particularly those with significant impacts on consumer welfare.

For Consumers:

-

Budgeting: Consumers can use elasticity information to make better purchasing decisions, choosing cheaper substitutes when prices rise for goods with elastic demand.

-

Advocacy: Consumers can use knowledge of elasticity to advocate for fairer pricing policies, particularly for essential goods with inelastic demand.

Limitations of Price Elasticity of Demand

While a powerful tool, PED has some limitations:

-

Data Availability: Accurate data on price and quantity changes is crucial for reliable calculations. Obtaining this data can be challenging, especially for new products or in rapidly changing markets.

-

Assumption of Ceteris Paribus: PED calculations assume all other factors remain constant (ceteris paribus). In reality, multiple factors often influence demand simultaneously, making it difficult to isolate the effect of price changes.

-

Aggregation Issues: PED can vary significantly across different consumer segments, making aggregate figures potentially misleading.

Conclusion

The price elasticity of demand is a fundamental concept in economics with far-reaching implications for businesses, governments, and consumers. By understanding how responsive quantity demanded is to price changes, stakeholders can make better-informed decisions regarding pricing, taxation, subsidies, marketing, and more. While limitations exist, mastering price elasticity is crucial for navigating the complexities of markets and enhancing economic efficiency. Further research into specific industries and market conditions can refine the application of PED, leading to more precise predictions and effective strategies.

Latest Posts

Latest Posts

-

Cookie Monster Loves Cookies The Table Shows

Mar 19, 2025

-

For Next Month Which Metric Would You Focus On Improving

Mar 19, 2025

-

Match The Phase Of Swallowing With The Correct Events

Mar 19, 2025

-

What Are Appropriate Means For Leaving Evidence Of Presence

Mar 19, 2025

-

What Command Prompt Would You Use To Ensure

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about The Price Elasticity Of Demand Measures The: . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.