The Predetermined Overhead Rate Is Based On The Relationship Between

Holbox

Mar 29, 2025 · 6 min read

Table of Contents

- The Predetermined Overhead Rate Is Based On The Relationship Between

- Table of Contents

- The Predetermined Overhead Rate: A Deep Dive into its Calculation and Application

- Understanding the Components of the Predetermined Overhead Rate

- 1. Estimated Total Manufacturing Overhead Costs

- 2. Estimated Total Amount of the Allocation Base

- Calculating the Predetermined Overhead Rate

- Applying the Predetermined Overhead Rate

- Advantages of Using a Predetermined Overhead Rate

- Limitations and Potential Pitfalls

- Addressing Potential Issues: Refinement and Adjustments

- Conclusion: A Vital Tool for Effective Cost Management

- Latest Posts

- Latest Posts

- Related Post

The Predetermined Overhead Rate: A Deep Dive into its Calculation and Application

The predetermined overhead rate is a crucial element in managerial accounting, acting as a bridge between indirect costs (overhead) and the products or services a company produces. Understanding its calculation and application is vital for accurate cost estimations, pricing strategies, and performance evaluation. This comprehensive guide will delve into the intricacies of the predetermined overhead rate, exploring its underlying relationship with estimated overhead costs and the allocation base, examining its practical applications, and addressing potential pitfalls.

Understanding the Components of the Predetermined Overhead Rate

The predetermined overhead rate is, fundamentally, a ratio. It expresses the relationship between the estimated total manufacturing overhead costs for a specific period and the estimated total amount of the allocation base for that same period. Let's break down each component:

1. Estimated Total Manufacturing Overhead Costs

This encompasses all indirect costs associated with production. These costs are not directly traceable to individual products but are essential for the manufacturing process. Examples include:

- Indirect materials: Consumables like lubricants, cleaning supplies, and small tools.

- Indirect labor: Wages paid to factory supervisors, maintenance personnel, and quality control inspectors.

- Factory rent and utilities: Costs related to the factory building, including electricity, water, and heating.

- Depreciation on factory equipment: The allocation of the cost of factory equipment over its useful life.

- Factory insurance: Premiums paid for insurance covering the factory and its equipment.

- Property taxes on the factory: Taxes levied on the factory building and land.

Accurately estimating these costs requires careful planning and analysis, often involving historical data, projected changes in production volume, and anticipated price increases. The accuracy of the predetermined overhead rate directly depends on the accuracy of these estimations.

2. Estimated Total Amount of the Allocation Base

The allocation base, also known as the cost driver, is a measure of activity that drives overhead costs. The choice of allocation base is critical, as it dictates how overhead costs are distributed across products. Common allocation bases include:

- Direct labor hours: The total number of hours worked by direct labor employees. This is a traditional and widely used allocation base, but its relevance can diminish in automated production environments.

- Machine hours: The total number of hours that machines are in operation. This is a more suitable allocation base in automated or highly mechanized production settings where machine usage is a primary driver of overhead.

- Direct labor costs: The total wages paid to direct labor employees. This method simplifies the calculation but may not accurately reflect the relationship between overhead and production volume.

- Units produced: The total number of units manufactured during the period. This is appropriate when overhead costs are relatively constant regardless of direct labor or machine hours.

The selection of the most appropriate allocation base hinges on the specific nature of the manufacturing process and the types of overhead costs involved. A thorough understanding of the company's operations is crucial for making an informed decision. An inappropriate allocation base can lead to significant distortions in product costing.

Calculating the Predetermined Overhead Rate

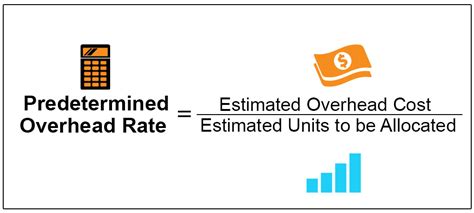

Once the estimated total manufacturing overhead costs and the estimated total amount of the allocation base are determined, calculating the predetermined overhead rate is straightforward:

Predetermined Overhead Rate = Estimated Total Manufacturing Overhead Costs / Estimated Total Amount of the Allocation Base

For example, if the estimated total manufacturing overhead costs are $500,000 and the estimated total direct labor hours are 100,000, the predetermined overhead rate would be:

$500,000 / 100,000 = $5 per direct labor hour

This means that for every direct labor hour worked, $5 of overhead costs are allocated to the product.

Applying the Predetermined Overhead Rate

The predetermined overhead rate is applied at the beginning of the accounting period, before actual overhead costs are known. This allows for timely cost estimations and pricing decisions. The application involves multiplying the actual amount of the allocation base used for a specific job or product by the predetermined overhead rate.

For instance, if a job requires 100 direct labor hours, and the predetermined overhead rate is $5 per direct labor hour, the overhead cost allocated to that job would be:

100 direct labor hours * $5/direct labor hour = $500

This allocated overhead cost is then added to the direct materials and direct labor costs to determine the total cost of the job or product.

Advantages of Using a Predetermined Overhead Rate

Employing a predetermined overhead rate offers several significant advantages:

- Timely cost estimations: It allows for timely cost estimations for bids, pricing decisions, and performance evaluations, as it doesn't require waiting until the end of the period to determine actual overhead costs.

- Improved cost control: By establishing a predetermined overhead rate, managers can monitor actual overhead costs against the budgeted amount and take corrective actions if necessary.

- Simplified costing: It simplifies the costing process by providing a consistent and readily available overhead allocation method.

- Accurate product costing (when properly applied): When the allocation base is accurately chosen and overhead costs are accurately estimated, it results in a more precise product cost, facilitating better pricing and profitability analysis.

Limitations and Potential Pitfalls

While the predetermined overhead rate is a valuable tool, it's crucial to be aware of its limitations:

- Estimation errors: Inaccuracies in estimating overhead costs or the allocation base can lead to significant distortions in product costs. Regular reviews and adjustments are essential to mitigate these errors.

- Oversimplification: The predetermined overhead rate can oversimplify the complex relationship between overhead costs and production volume. It may not accurately reflect the varying overhead consumption across different products or production processes.

- Arbitrary allocation: The allocation of overhead costs based on a predetermined rate can be arbitrary, particularly if the chosen allocation base does not accurately reflect the cost drivers.

- Changes in production volume: Significant variations in production volume from the estimated level can lead to under or over allocation of overhead costs.

Addressing Potential Issues: Refinement and Adjustments

Several strategies can help mitigate the limitations of the predetermined overhead rate:

- Multiple overhead rates: For companies with diverse production processes or products that consume overhead differently, using multiple overhead rates (one for each department or product line) can improve accuracy.

- Activity-based costing (ABC): ABC is a more sophisticated costing method that assigns overhead costs based on activities that consume resources. It is particularly useful for companies with diverse product lines or complex production processes.

- Variance analysis: Regular variance analysis comparing actual overhead costs to the predetermined overhead costs helps to identify areas for improvement and cost control.

- Regular review and adjustment: The predetermined overhead rate should be reviewed and adjusted periodically to reflect changes in production volume, technology, or cost structures.

Conclusion: A Vital Tool for Effective Cost Management

The predetermined overhead rate, despite its limitations, remains a vital tool for effective cost management. By carefully estimating overhead costs, selecting an appropriate allocation base, and implementing strategies to mitigate potential errors, companies can leverage this method to make informed decisions regarding pricing, production, and overall profitability. Remember that the key to success lies in understanding the underlying principles, critically evaluating the chosen approach, and continuously monitoring and adjusting the process to maintain accuracy and relevance. A well-managed predetermined overhead rate system forms a cornerstone of sound financial planning and effective resource allocation within any manufacturing organization.

Latest Posts

Latest Posts

-

Another Term For Return On Investment Is

Apr 02, 2025

-

Las Nuevas Normas Astm Para El Calzado Especifican Que Debe

Apr 02, 2025

-

Correctly Label The Pectoral And Brachial Muscles

Apr 02, 2025

-

Drag Each Label To The Type Of Gland It Describes

Apr 02, 2025

-

Name The Membranous Encasement Surrounding The Brain

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about The Predetermined Overhead Rate Is Based On The Relationship Between . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.