The Number Of Shares Of Issued Stock Equals

Holbox

Mar 28, 2025 · 6 min read

Table of Contents

- The Number Of Shares Of Issued Stock Equals

- Table of Contents

- The Number of Shares of Issued Stock Equals: A Deep Dive into Corporate Finance

- What are Issued Shares?

- The Difference Between Authorized, Issued, and Outstanding Shares

- Calculating the Number of Issued Shares

- The Significance of Issued Shares

- 1. Determining Earnings Per Share (EPS)

- 2. Assessing Shareholder Value

- 3. Understanding Capital Structure

- 4. Evaluating Stock Dilution

- 5. Mergers and Acquisitions

- Factors Influencing the Number of Issued Shares

- 1. Initial Public Offering (IPO):

- 2. Secondary Offerings:

- 3. Stock Splits:

- 4. Stock Dividends:

- 5. Share Repurchases (Treasury Stock):

- 6. Mergers and Acquisitions:

- Analyzing the Trend of Issued Shares

- The Importance of Transparency

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

The Number of Shares of Issued Stock Equals: A Deep Dive into Corporate Finance

Understanding the number of shares of issued stock is fundamental to comprehending a company's financial health and structure. This metric, while seemingly simple, holds significant implications for investors, shareholders, and corporate governance. This comprehensive guide delves into the intricacies of issued shares, exploring its calculation, significance, and the various factors that influence this crucial figure.

What are Issued Shares?

Issued shares represent the total number of company shares that have been formally allocated to investors and are actively trading in the market. These shares are a slice of the company's ownership, and their issuance is governed by strict legal and regulatory frameworks. Crucially, the number of issued shares doesn't include authorized shares (the maximum number of shares a company can issue according to its charter) or treasury shares (shares repurchased by the company). Understanding this distinction is paramount to accurate interpretation of a company's capital structure.

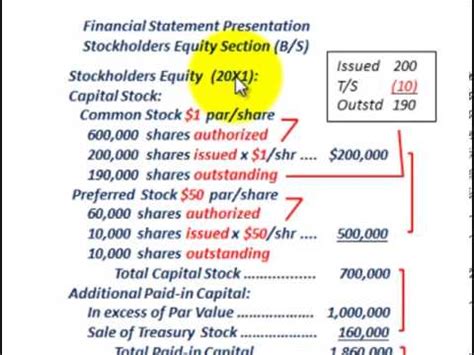

The Difference Between Authorized, Issued, and Outstanding Shares

To clarify, let's break down the key differences:

-

Authorized Shares: This is the maximum number of shares a corporation is legally permitted to issue, as specified in its corporate charter. This number can be increased or decreased through a shareholder vote.

-

Issued Shares: These are the authorized shares that have actually been sold to investors. This is the number we are focusing on in this article.

-

Outstanding Shares: These are the issued shares that are currently held by investors (excluding treasury stock). This represents the total number of shares actively trading in the market.

The relationship can be expressed as: Outstanding Shares = Issued Shares - Treasury Shares

Calculating the Number of Issued Shares

Determining the precise number of issued shares requires accessing a company's official financial statements. Specifically, you'll typically find this information in:

-

Balance Sheet: The balance sheet usually includes a line item for "Common Stock" or "Share Capital," which details the par value (a nominal value assigned to each share) multiplied by the number of issued shares. This provides a readily available means of determining the total number of shares issued.

-

Shareholder's Equity Section: Within the balance sheet, the shareholder's equity section often provides additional details about the capital structure, which can help confirm the number of issued shares.

-

Company Filings: For publicly traded companies, information about issued shares is readily available in their financial reports filed with regulatory bodies like the Securities and Exchange Commission (SEC) in the US or equivalent agencies in other countries. These filings provide a transparent and verifiable source of this information.

-

Company Website: Many companies post their annual reports and other financial documents on their investor relations section of their website.

The Significance of Issued Shares

The number of issued shares carries significant weight in several financial contexts:

1. Determining Earnings Per Share (EPS)

Earnings per share (EPS) is a crucial metric used to assess a company's profitability on a per-share basis. It is calculated by dividing the net income attributable to common shareholders by the number of outstanding (and therefore issued) shares. The number of issued shares is a vital component of this calculation. A lower number of issued shares, with the same net income, results in a higher EPS, potentially signaling stronger performance to investors.

2. Assessing Shareholder Value

The number of issued shares directly impacts shareholder value. All else being equal, a smaller number of issued shares typically translates to a higher ownership percentage for each existing shareholder. This can lead to increased influence in corporate decisions and potentially larger dividends per share.

3. Understanding Capital Structure

The number of issued shares is a key element of a company's capital structure. It reveals how a company has financed its operations, indicating the balance between equity financing (issuing shares) and debt financing (loans). Analyzing the changes in issued shares over time can shed light on a company's growth strategy and financial health. For example, frequent issuances of new shares might signal a company’s need for additional capital.

4. Evaluating Stock Dilution

Stock dilution occurs when a company issues additional shares, reducing the ownership percentage of existing shareholders. Monitoring the changes in the number of issued shares allows investors to assess the potential impact of stock dilution on their ownership stake and the overall value of their investment.

5. Mergers and Acquisitions

In mergers and acquisitions, the number of issued shares plays a crucial role. The exchange ratio—the number of shares of the acquiring company exchanged for each share of the target company—is determined in part by the number of issued shares of both companies. Understanding the issued shares of involved companies is crucial for proper valuation and due diligence.

Factors Influencing the Number of Issued Shares

Several factors can influence the number of issued shares a company has outstanding:

1. Initial Public Offering (IPO):

When a company goes public through an IPO, a significant number of shares are issued to the public for the first time. This substantially increases the number of issued shares.

2. Secondary Offerings:

After an IPO, companies may issue additional shares through secondary offerings to raise capital for expansion, acquisitions, or other strategic initiatives. This leads to an increase in the number of issued shares.

3. Stock Splits:

Stock splits increase the number of issued shares by dividing each existing share into multiple shares. For example, a 2-for-1 stock split doubles the number of issued shares while halving the share price. Although this increases the number of shares, it does not inherently change the overall value of the company.

4. Stock Dividends:

Similar to stock splits, stock dividends distribute additional shares to existing shareholders. This increases the number of issued shares, again without impacting the overall company value.

5. Share Repurchases (Treasury Stock):

Companies can repurchase their own shares, reducing the number of outstanding shares. This is commonly done when a company believes its shares are undervalued or to boost EPS. While shares are bought back, they are not destroyed but are held as treasury shares. This reduces outstanding shares but doesn't affect issued shares.

6. Mergers and Acquisitions:

Mergers and acquisitions can impact the number of issued shares, depending on the terms of the deal. The acquiring company might issue new shares to acquire the target company, leading to an increase in the total number of issued shares.

Analyzing the Trend of Issued Shares

Tracking the number of issued shares over time offers valuable insights into a company's financial strategy and performance. A consistent increase in the number of shares might indicate aggressive growth strategies or frequent capital raising needs. Conversely, a decrease could signal a focus on share buybacks or a period of reduced investment. It's important to analyze this trend in conjunction with other financial metrics to draw comprehensive conclusions.

The Importance of Transparency

Transparency surrounding the number of issued shares is critical for investor confidence and market stability. Accurate reporting and readily available information allow investors to make informed decisions, fostering a healthy and efficient capital market. Regulatory oversight plays a significant role in ensuring this transparency.

Conclusion

The number of issued shares is not merely a single data point; it's a crucial indicator of a company's financial health, capital structure, and growth strategies. Understanding its calculation, significance, and the factors that influence it empowers investors, analysts, and stakeholders to make well-informed decisions. By diligently studying this metric in conjunction with other financial indicators, a comprehensive understanding of a company's financial standing can be achieved, leading to better investment choices and more robust corporate governance. Remember to always access official company filings and financial statements for accurate and reliable data.

Latest Posts

Latest Posts

-

Hugo Decides To Buy His Christmas Gifts On Black Friday

Mar 31, 2025

-

Sleep Awareness Week Begins In The Spring With The Release

Mar 31, 2025

-

How To Reference A Letter Apa

Mar 31, 2025

-

A Leading Question Is One That

Mar 31, 2025

-

A Notary Who Is Not Also A Licensed Attorney May

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about The Number Of Shares Of Issued Stock Equals . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.