The Invisible Hand Refers To The

Holbox

Mar 31, 2025 · 6 min read

Table of Contents

- The Invisible Hand Refers To The

- Table of Contents

- The Invisible Hand: Understanding Adam Smith's Enduring Concept

- What is the Invisible Hand?

- The Mechanics of the Invisible Hand

- 1. Competition:

- 2. Price Signals:

- 3. Specialization and Division of Labor:

- Limitations of the Invisible Hand

- 1. Perfect Competition:

- 2. Perfect Information:

- 3. Absence of Externalities:

- 4. Public Goods:

- The Invisible Hand in the Modern World

- Misinterpretations of the Invisible Hand

- 1. Unfettered Free Markets:

- 2. Self-Interest as Moral Equivalence:

- 3. Ignoring Inequality:

- Conclusion: A Balanced Perspective

- Latest Posts

- Latest Posts

- Related Post

The Invisible Hand: Understanding Adam Smith's Enduring Concept

The "invisible hand" is perhaps the most famous and misunderstood concept in all of economics. Coined by Adam Smith in his seminal work, The Wealth of Nations (1776), it's often invoked to justify laissez-faire capitalism and minimized government intervention. However, a deeper dive reveals a more nuanced understanding of Smith's argument, one that doesn't necessarily endorse unfettered free markets but highlights the often unintended positive consequences of individual self-interest within a competitive market framework. This article will explore the invisible hand, examining its meaning, its limitations, its relevance in the modern world, and its common misinterpretations.

What is the Invisible Hand?

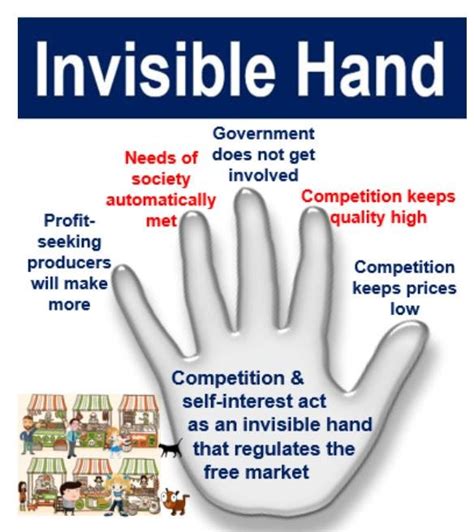

In simple terms, the invisible hand describes the unintended social benefits of individual actions. Smith argued that when individuals pursue their own self-interest within a free market, they are led by an "invisible hand" to promote the overall good of society, even if they don't intend to. This isn't about altruism; it's about the mechanics of a competitive market.

For example, a baker doesn't bake bread out of a desire to feed the community; he bakes bread to make a profit. However, in doing so, he satisfies the community's need for bread. The same principle applies to countless other economic actors: farmers, manufacturers, shopkeepers, and so on. Their individual pursuit of profit leads to the production of goods and services that satisfy societal needs and wants.

Smith’s original passage illustrates this:

"By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good."

This passage is crucial. Smith isn't saying that individuals shouldn't care about the public good; rather, he's suggesting that the pursuit of self-interest, within a well-functioning market, is a more effective mechanism for achieving societal benefit than deliberate attempts at social engineering.

The Mechanics of the Invisible Hand

The invisible hand operates through several key market mechanisms:

1. Competition:

Competition among producers drives down prices and improves the quality of goods and services. If one producer charges exorbitant prices or offers inferior goods, consumers will flock to competitors offering better value. This pressure forces producers to be efficient and responsive to consumer demand.

2. Price Signals:

Prices act as signals that convey information throughout the market. High prices indicate scarcity, encouraging producers to increase supply and consumers to reduce demand. Low prices indicate abundance, prompting producers to reduce supply and consumers to increase demand. This dynamic process continuously adjusts supply and demand, leading to market equilibrium.

3. Specialization and Division of Labor:

The invisible hand also promotes specialization and the division of labor. By focusing on specific tasks, individuals can become more efficient and productive, leading to greater overall output. This increased efficiency further reduces costs and benefits consumers.

Limitations of the Invisible Hand

While the invisible hand is a powerful concept, it's crucial to understand its limitations. It doesn't operate perfectly in all situations and relies on several key assumptions:

1. Perfect Competition:

The invisible hand's efficacy hinges on the existence of perfect competition – a situation where many buyers and sellers exist, none of whom have significant market power. In reality, monopolies, oligopolies, and other forms of market imperfections can distort price signals and hinder the efficient allocation of resources.

2. Perfect Information:

The invisible hand assumes that all market participants have access to perfect information. In reality, information asymmetry – where some participants have more information than others – can lead to market failures, such as adverse selection and moral hazard.

3. Absence of Externalities:

Externalities are costs or benefits that affect parties who are not directly involved in a transaction. Pollution, for example, is a negative externality; the producer doesn't bear the full cost of its pollution, leading to overproduction. The invisible hand doesn't account for these externalities, necessitating government intervention to correct market failures.

4. Public Goods:

Public goods, such as national defense or clean air, are non-excludable and non-rivalrous. This means that it's difficult to exclude people from consuming them, even if they don't pay, and one person's consumption doesn't diminish another person's consumption. The private sector is generally unable to provide public goods efficiently, necessitating government intervention.

The Invisible Hand in the Modern World

The invisible hand remains a relevant concept in the modern world, but its application requires careful consideration of its limitations. While free markets are generally efficient at allocating resources, they are not self-regulating and require appropriate oversight to address market failures.

Many contemporary economic debates center around the appropriate balance between free markets and government regulation. Advocates of laissez-faire capitalism argue that government intervention distorts markets and hinders economic growth. Conversely, proponents of interventionist policies argue that government intervention is necessary to correct market failures, protect consumers, and promote social equity.

Misinterpretations of the Invisible Hand

The invisible hand is frequently misinterpreted and misused to justify policies that run counter to Smith's original intentions. Some common misinterpretations include:

1. Unfettered Free Markets:

Many interpret the invisible hand as advocating for completely unregulated free markets. However, Smith himself acknowledged the need for government intervention in certain areas, such as enforcing contracts, providing public goods, and regulating monopolies. He saw the role of government as crucial in maintaining the framework within which the invisible hand could operate effectively.

2. Self-Interest as Moral Equivalence:

Some argue that the invisible hand justifies selfish behavior. While Smith acknowledged the role of self-interest, he didn't advocate for amorality. His focus was on the unintended social benefits that can arise from self-interested actions within a properly functioning market, not on the inherent morality of self-interest itself.

3. Ignoring Inequality:

The invisible hand doesn't inherently address issues of inequality. While it can lead to overall economic growth, it doesn't guarantee equitable distribution of wealth. This necessitates policies aimed at reducing inequality, such as progressive taxation and social safety nets.

Conclusion: A Balanced Perspective

The invisible hand remains a powerful and relevant concept in economics. It highlights the often-unintended positive consequences of individual actions within a competitive market, explaining how self-interest can lead to societal benefit. However, it's crucial to avoid simplistic interpretations and acknowledge the limitations of the invisible hand. A balanced perspective recognizes the efficiency of free markets while also acknowledging the need for government intervention to address market failures, promote social equity, and ensure a well-functioning economy. The invisible hand isn't a magic wand; it's a powerful mechanism that requires careful management and oversight to maximize its benefits and minimize its shortcomings. The ongoing debate around the appropriate balance between free markets and government regulation continues to shape economic policy and reflects the enduring complexity of Adam Smith's insightful concept. It's a dynamic process, requiring constant evaluation and adaptation to the ever-changing economic landscape. Understanding the nuances of the invisible hand is key to navigating the complexities of the modern economy and formulating effective economic policies.

Latest Posts

Latest Posts

-

New Cars Use Embedded Computers To Make Driving Safer

Apr 02, 2025

-

Traces Of Pesticide Are Found On Raw Poultry

Apr 02, 2025

-

The First Stage In The Rational Decision Making Process Involves

Apr 02, 2025

-

Which Of The Following Accounts Is An Asset

Apr 02, 2025

-

This Type Of Chemical Initiates Irreversible Alterations

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about The Invisible Hand Refers To The . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.