The Interest Rate That Banks Charge Their Best Customers.

Holbox

Mar 13, 2025 · 7 min read

Table of Contents

The Interest Rate That Banks Charge Their Best Customers: A Deep Dive

The interest rate a bank charges its best customers is a complex topic influenced by numerous factors. While it might seem straightforward – the lower the better – the reality is far more nuanced. This rate, often referred to as the prime rate, isn't just a random number; it serves as a benchmark for a vast array of other loan products and significantly impacts the broader economy. Understanding what determines this rate, how it affects borrowers, and the strategies employed by banks to attract and retain their best clientele is crucial for both businesses and individuals.

Defining the Prime Rate: More Than Just a Number

The prime rate is the interest rate that commercial banks charge their most creditworthy customers for short-term loans. Think of it as the benchmark interest rate. It's the foundation upon which other interest rates, such as those for mortgages, auto loans, credit cards, and business loans, are built. These rates are often expressed as a percentage above the prime rate. For example, a loan might carry an interest rate of "prime plus 2%."

Why is it important? Because it's a key indicator of the overall health of the economy. A rising prime rate usually signifies tightening monetary policy by the central bank (like the Federal Reserve in the US or the Bank of England in the UK), aimed at curbing inflation. Conversely, a falling prime rate suggests looser monetary policy, often used to stimulate economic growth.

Factors Influencing the Prime Rate: A Complex Interplay

The prime rate isn't arbitrarily set by banks. Several interconnected factors come into play, including:

1. The Federal Funds Rate (or Equivalent Central Bank Rate):

This is the target rate set by the central bank for overnight lending between banks. It's a crucial determinant of the prime rate because it reflects the overall cost of borrowing for banks. When the federal funds rate increases, banks' borrowing costs go up, leading them to adjust their prime rate upward.

2. Economic Conditions:

Strong economic growth often leads to increased inflation, prompting central banks to raise interest rates to cool down the economy. This, in turn, pushes up the prime rate. Conversely, during economic downturns or recessions, central banks may lower interest rates to stimulate borrowing and spending, resulting in a lower prime rate.

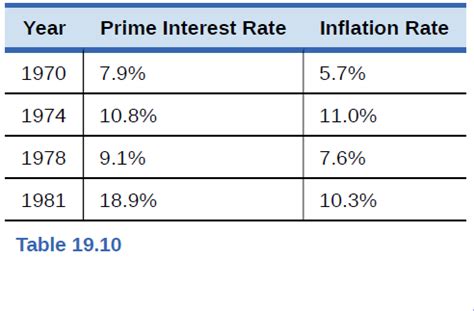

3. Inflation Rates:

High inflation erodes the purchasing power of money, prompting central banks to raise interest rates to control it. This increase is directly reflected in the prime rate, making borrowing more expensive.

4. Government Regulations:

Government regulations and banking policies can influence the prime rate. Changes in reserve requirements or capital adequacy ratios can affect banks' lending capacity and their willingness to offer lower prime rates.

5. Bank's Own Profitability and Risk Assessment:

While the factors mentioned above heavily influence the prime rate, each bank ultimately makes its own determination. The bank's own assessment of risk, profitability targets, and competitive landscape all play a part in the final number. A bank might offer a slightly more competitive prime rate to attract high-value customers.

Who Benefits From a Low Prime Rate?

A low prime rate is generally considered positive for borrowers, making borrowing cheaper and more accessible. This can boost economic activity as businesses and individuals are more inclined to take out loans for investments, expansions, or personal spending.

Businesses: Lower borrowing costs enable companies to invest in new equipment, expand operations, hire more employees, and increase production.

Individuals: Consumers benefit from lower interest rates on mortgages, auto loans, and credit cards, freeing up more disposable income for other expenses.

Who Might Be Affected Negatively by a Low Prime Rate?

While a low prime rate benefits many, it can have downsides:

Savers: Lower interest rates mean lower returns on savings accounts and other interest-bearing investments. This can reduce the purchasing power of savings over time.

Retirees: Retirees who rely on fixed-income investments are particularly vulnerable to lower interest rates, as their income may not keep pace with inflation.

How Banks Identify and Attract Their Best Customers

Banks employ sophisticated strategies to identify and attract their most creditworthy clients, those who qualify for the prime rate:

1. Credit Score and History: A high credit score is the cornerstone of qualifying for the prime rate. A history of responsible borrowing and timely repayments is essential.

2. Income and Financial Stability: Banks assess the borrower's income, assets, and overall financial stability to gauge their ability to repay the loan. Consistent income and a healthy debt-to-income ratio are critical.

3. Relationship Banking: Long-standing relationships with a bank often lead to preferential treatment and better interest rates. Banks value loyal customers who consistently utilize their services.

4. Collateral: For secured loans (like mortgages), the value of the collateral plays a crucial role. The higher the value of the asset pledged as collateral, the lower the perceived risk for the bank, and consequently, a better interest rate.

5. Account Activity: Active account usage, including regular deposits, high account balances, and utilization of various bank services, can signal a high-value customer.

The Importance of Understanding Your Creditworthiness

Understanding your creditworthiness is crucial in securing the best possible interest rate. This involves:

- Monitoring your credit report: Regularly review your credit report for inaccuracies and take steps to improve your credit score.

- Paying bills on time: Timely payments are essential for maintaining a good credit history.

- Managing debt wisely: Keep your debt-to-income ratio low by avoiding excessive borrowing.

- Building a strong financial history: A long history of responsible financial management demonstrates creditworthiness to banks.

Prime Rate vs. Other Interest Rates: A Comparative Look

The prime rate is not the only interest rate that matters. Many other interest rates are based on the prime rate, including:

- Mortgage rates: Typically, mortgage rates are set at a certain percentage points above the prime rate, varying based on factors like loan term, down payment, and credit score.

- Auto loan rates: Similar to mortgages, auto loan rates are also often pegged to the prime rate, with variations based on the car's value, loan term, and creditworthiness.

- Credit card interest rates: Credit card interest rates are usually significantly higher than the prime rate, reflecting the higher risk associated with unsecured credit.

- Business loan rates: Businesses can obtain loans at rates that are based on the prime rate, with the exact rate varying greatly based on the business's financial health, the type of loan, and the loan amount.

Strategies for Securing the Best Interest Rates

Several strategies can help you secure the best possible interest rates:

- Improve your credit score: A higher credit score significantly improves your chances of getting a lower interest rate.

- Shop around: Compare interest rates from multiple banks and lenders before committing to a loan.

- Negotiate: Don't be afraid to negotiate with lenders for a better interest rate.

- Consider your loan term: Longer loan terms often come with higher interest rates, but lower monthly payments.

- Make a larger down payment: A larger down payment on a secured loan can reduce the interest rate.

- Maintain a strong financial profile: Show lenders that you are financially stable and able to manage debt.

Conclusion: Navigating the World of Prime Rates

The prime rate is more than just a number; it's a key indicator of the economy and a crucial factor in the cost of borrowing. Understanding how it's determined, its impact on borrowers, and the strategies banks employ to attract their best customers is vital for both individuals and businesses. By carefully managing your credit, shopping around, and understanding your financial strengths, you can significantly improve your chances of securing the best possible interest rates and maximizing your financial well-being. The journey to securing a prime rate loan involves continuous financial responsibility and a proactive approach to managing your credit profile. It's a journey worth undertaking.

Latest Posts

Latest Posts

-

Natural Convection Glass Pane Problems And Solutions

Mar 13, 2025

-

Suppose The Rate Of Plant Growth On Isle Royale

Mar 13, 2025

-

Input The Number That Corresponds To The Product Composition

Mar 13, 2025

-

Which Statement Describes An Extended Star Topology

Mar 13, 2025

-

When Should The Project Manager Prepare The Final Report

Mar 13, 2025

Related Post

Thank you for visiting our website which covers about The Interest Rate That Banks Charge Their Best Customers. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.