The Interest Rate Risk Premium Is The

Holbox

Apr 03, 2025 · 6 min read

Table of Contents

- The Interest Rate Risk Premium Is The

- Table of Contents

- The Interest Rate Risk Premium: Understanding and Managing the Cost of Borrowing and Lending

- What is Interest Rate Risk?

- Duration Risk:

- Reinvestment Risk:

- Yield Curve Risk:

- Decoding the Interest Rate Risk Premium

- 1. Expected Inflation:

- 2. Economic Growth Expectations:

- 3. Monetary Policy:

- 4. Credit Risk:

- 5. Liquidity:

- 6. Market Sentiment:

- How the Premium Affects Borrowers and Lenders

- Impact on Borrowers:

- Impact on Lenders:

- Measuring the Interest Rate Risk Premium

- 1. Comparing Yields:

- 2. Using Option-Adjusted Spread (OAS):

- 3. Employing Statistical Models:

- Managing Interest Rate Risk

- For Borrowers:

- For Lenders:

- Conclusion: Navigating the Dynamic Landscape of Interest Rate Risk

- Latest Posts

- Latest Posts

- Related Post

The Interest Rate Risk Premium: Understanding and Managing the Cost of Borrowing and Lending

The interest rate risk premium is a crucial concept in finance, representing the extra compensation investors demand for bearing the risk of fluctuating interest rates. It's the difference between the yield on a fixed-income security and the yield on a comparable risk-free security (like a government bond). This premium isn't a fixed number; it's dynamic, reacting to market conditions, economic forecasts, and investor sentiment. Understanding this premium is vital for both borrowers and lenders, as it directly impacts the cost of borrowing and the return on lending.

What is Interest Rate Risk?

Before diving into the premium, let's clarify interest rate risk itself. This refers to the potential for investment losses stemming from unexpected changes in interest rates. Several aspects contribute to this risk:

Duration Risk:

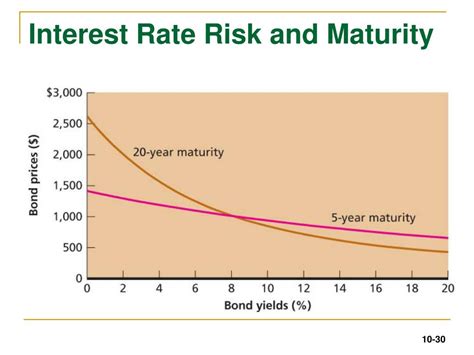

This is the sensitivity of a bond's price to changes in interest rates. Longer-maturity bonds have higher duration and are, therefore, more susceptible to interest rate fluctuations. A small increase in rates can lead to a significant drop in the price of a long-term bond.

Reinvestment Risk:

This risk affects the return of income-generating securities like bonds. If interest rates fall after a bond matures, the investor might struggle to reinvest the proceeds at a comparable yield. This reduces overall returns.

Yield Curve Risk:

The yield curve depicts the relationship between the yield and maturity of bonds. Changes in the shape of this curve (e.g., steepening, flattening, inverting) signify shifts in market expectations about future interest rates and can impact bond prices.

Decoding the Interest Rate Risk Premium

The interest rate risk premium serves as compensation for bearing these risks. Investors require a higher yield on securities with greater interest rate sensitivity (longer maturities, lower credit ratings) to offset the potential for losses. This premium is determined by several factors:

1. Expected Inflation:

Higher expected inflation generally leads to higher interest rates. Investors demand a higher premium to compensate for the erosion of their purchasing power due to inflation.

2. Economic Growth Expectations:

Strong economic growth often translates into higher interest rates as demand for credit increases. Consequently, the interest rate risk premium rises to reflect the increased uncertainty associated with a rapidly changing economic environment.

3. Monetary Policy:

Central bank actions significantly influence interest rates. When a central bank raises interest rates to combat inflation, the risk premium tends to increase, reflecting the higher cost of borrowing. Conversely, rate cuts can reduce the premium.

4. Credit Risk:

The creditworthiness of the issuer plays a crucial role. Investors demand a higher premium for bonds issued by companies with a higher risk of default, regardless of the interest rate environment.

5. Liquidity:

Highly liquid securities are easier to buy and sell, reducing price volatility. Securities with lower liquidity may command a higher interest rate risk premium to compensate for the added difficulty of trading them.

6. Market Sentiment:

Investor confidence and overall market sentiment influence the risk premium. During periods of economic uncertainty or market turmoil, investors demand a higher premium as a safety net.

How the Premium Affects Borrowers and Lenders

The interest rate risk premium has distinct consequences for both borrowers and lenders:

Impact on Borrowers:

- Higher Borrowing Costs: A higher risk premium translates directly into higher interest rates for borrowers. Businesses and individuals need to pay more for loans, impacting their investment decisions and affordability.

- Increased Financial Risk: Fluctuations in the risk premium can make it challenging for borrowers to predict future interest rate payments, adding to financial uncertainty.

- Sensitivity to Economic Cycles: The premium tends to be higher during economic downturns, making borrowing more expensive precisely when companies and individuals may need it most.

Impact on Lenders:

- Higher Potential Returns: Lenders receive a higher return on their investments if the interest rate risk premium is high. This compensates them for bearing the risks associated with interest rate fluctuations.

- Investment Strategy Considerations: Lenders must consider their risk tolerance when making investment choices. Those willing to accept higher risk may opt for securities with higher premiums, but that also carries greater price volatility.

- Diversification: To mitigate the impact of fluctuations in the risk premium, lenders can diversify their portfolio across various asset classes and maturities.

Measuring the Interest Rate Risk Premium

While there's no single, universally accepted method to precisely measure the interest rate risk premium, several approaches provide valuable insights:

1. Comparing Yields:

The simplest method involves comparing the yield of a fixed-income security (e.g., a corporate bond) to the yield of a comparable risk-free security (e.g., a government bond) with the same maturity. The difference represents the risk premium.

2. Using Option-Adjusted Spread (OAS):

OAS is used for complex securities like mortgage-backed securities (MBS). It adjusts the spread for the embedded options (e.g., prepayment options in MBS) to estimate the underlying interest rate risk premium.

3. Employing Statistical Models:

Sophisticated statistical models, often employing econometric techniques, can analyze historical data and macroeconomic variables to forecast the interest rate risk premium. These models consider various factors like inflation expectations, economic growth, and monetary policy.

Managing Interest Rate Risk

Both borrowers and lenders can employ strategies to mitigate the effects of interest rate risk:

For Borrowers:

- Hedging Techniques: Financial instruments like interest rate swaps and futures contracts can help hedge against interest rate fluctuations.

- Fixed-Rate Loans: Choosing fixed-rate loans protects against rising interest rates, while floating rate loans can be beneficial if rates are expected to decline.

- Debt Maturity Management: Careful planning of debt maturity profiles can reduce exposure to interest rate risk.

- Interest Rate Forecasts: Analyzing macroeconomic indicators and market trends can assist in predicting future interest rate movements and proactively adjust borrowing strategies.

For Lenders:

- Diversification: Spreading investments across various maturities and credit ratings reduces the overall impact of interest rate changes.

- Duration Matching: Matching the duration of assets and liabilities minimizes interest rate risk exposure.

- Immunization Strategies: These involve actively managing a portfolio to achieve a stable value despite changes in interest rates.

- Interest Rate Derivatives: Using derivatives like interest rate swaps and options can help manage interest rate risks in a portfolio.

Conclusion: Navigating the Dynamic Landscape of Interest Rate Risk

The interest rate risk premium is a fundamental aspect of the financial markets. It represents the extra compensation demanded for bearing the uncertainty of fluctuating interest rates, impacting both borrowers and lenders. Understanding the factors that influence this premium, and implementing appropriate risk management strategies, is crucial for making informed financial decisions in a dynamic and often unpredictable economic environment. Whether you're a seasoned investor or a first-time borrower, a grasp of this concept is essential for successful financial navigation. The interplay of economic indicators, monetary policy, and market sentiment constantly shapes this premium, emphasizing the need for continuous monitoring and strategic adaptation. By carefully analyzing these factors and applying appropriate risk management tools, individuals and institutions can effectively mitigate the impact of interest rate risk and achieve their financial objectives.

Latest Posts

Latest Posts

-

Essentials Of Corporate Finance 11th Edition

Apr 07, 2025

-

Exercise 22 Review Sheet Art Labeling Activity 1

Apr 07, 2025

-

Illnesses Such As Diabetes And Cancer Kill More

Apr 07, 2025

-

Delta Company Produces A Single Product

Apr 07, 2025

-

Theory And Practice Of Counseling And Psychotherapy 11th Edition

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about The Interest Rate Risk Premium Is The . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.