The Flexible-budget Variance For Operating Income Is

Holbox

Mar 13, 2025 · 7 min read

Table of Contents

- The Flexible-budget Variance For Operating Income Is

- Table of Contents

- The Flexible-Budget Variance for Operating Income: A Comprehensive Guide

- What is a Flexible Budget?

- Key Differences Between Static and Flexible Budgets

- Calculating the Flexible-Budget Variance for Operating Income

- Analyzing the Flexible-Budget Variance

- 1. Sales Price Variance

- 2. Sales Volume Variance

- 3. Cost Variances

- Reconciling the Variances

- Practical Applications of Flexible Budget Variance Analysis

- Conclusion

- Latest Posts

- Related Post

The Flexible-Budget Variance for Operating Income: A Comprehensive Guide

Understanding your business's performance requires more than just looking at actual results. A crucial tool for insightful financial analysis is the flexible budget. Unlike a static budget, which remains unchanged regardless of actual activity levels, a flexible budget adjusts to reflect different sales volumes or production levels. This adaptability allows for a more accurate assessment of performance by isolating variances caused by factors other than simply differing activity levels. This article delves deep into the flexible-budget variance for operating income, explaining its calculation, interpretation, and practical applications.

What is a Flexible Budget?

A flexible budget is a dynamic budget that adapts to various activity levels. Instead of relying on a single, predetermined activity level (like a static budget), it uses a formula to calculate budgeted amounts based on the actual activity level achieved. This allows for a fairer comparison between budgeted and actual results because it removes the distortion caused by differences in sales volume or production. Think of it as a "what-if" scenario generator for your financial projections.

For example, a static budget might assume 10,000 units sold, with a budgeted operating income of $50,000. However, if only 8,000 units were actually sold, a direct comparison between the $50,000 budget and actual results wouldn't be meaningful. A flexible budget, on the other hand, would recalculate the budgeted operating income based on the actual 8,000 units sold, providing a more accurate benchmark for evaluation.

Key Differences Between Static and Flexible Budgets

| Feature | Static Budget | Flexible Budget |

|---|---|---|

| Activity Level | Fixed, predetermined | Variable, adjusts to actual activity level |

| Budget Amounts | Fixed, regardless of actual activity | Variable, recalculated based on actual activity |

| Comparison | Direct comparison can be misleading | Provides a more accurate comparison |

| Usefulness | Useful for planning and initial projections | More useful for performance evaluation |

Calculating the Flexible-Budget Variance for Operating Income

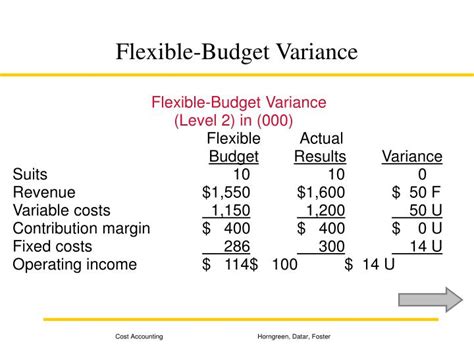

The flexible-budget variance for operating income measures the difference between the actual operating income and the flexible budget's operating income. It isolates the impact of factors other than changes in sales volume or production levels. The formula is straightforward:

Flexible-Budget Variance = Actual Operating Income - Flexible Budget Operating Income

A positive variance indicates that actual operating income exceeded the flexible budget's projection, suggesting favorable performance. A negative variance, conversely, indicates that actual operating income fell short of the flexible budget, signaling areas requiring further investigation.

To calculate the flexible budget operating income, we need to analyze the components contributing to operating income:

- Sales Revenue: This is usually calculated based on the actual sales volume multiplied by the budgeted selling price per unit. Any variance in sales price (price variance) will be factored in later.

- Variable Costs: These costs change in direct proportion to the activity level (e.g., direct materials, direct labor). The flexible budget calculates these costs by multiplying the actual activity level by the budgeted variable cost per unit.

- Fixed Costs: These costs remain relatively constant regardless of the activity level (e.g., rent, salaries). The flexible budget uses the original budgeted fixed costs.

Let's illustrate with an example:

Example:

Suppose a company budgeted to sell 10,000 units at $20 per unit, with variable costs of $10 per unit and fixed costs of $40,000. However, they actually sold 8,000 units at $22 per unit, with actual variable costs of $70,000 and actual fixed costs of $42,000.

1. Calculate the Flexible Budget Operating Income:

- Sales Revenue (Flexible Budget): 8,000 units * $20/unit = $160,000

- Variable Costs (Flexible Budget): 8,000 units * $10/unit = $80,000

- Fixed Costs (Flexible Budget): $40,000 (remains unchanged)

- Flexible Budget Operating Income: $160,000 - $80,000 - $40,000 = $40,000

2. Calculate the Actual Operating Income:

- Actual Sales Revenue: 8,000 units * $22/unit = $176,000

- Actual Variable Costs: $70,000

- Actual Fixed Costs: $42,000

- Actual Operating Income: $176,000 - $70,000 - $42,000 = $64,000

3. Calculate the Flexible-Budget Variance:

- Flexible-Budget Variance: $64,000 (Actual) - $40,000 (Flexible Budget) = $24,000 (Favorable)

This positive $24,000 variance indicates that the company performed better than expected, even considering the lower-than-budgeted sales volume.

Analyzing the Flexible-Budget Variance

The flexible-budget variance doesn't tell the whole story. It's crucial to investigate the underlying causes of this variance. We can break down the variance further into its components to gain deeper insights. This typically involves examining sales price variances, sales volume variances, and cost variances.

1. Sales Price Variance

This variance arises from differences between the actual selling price and the budgeted selling price. It's calculated as follows:

Sales Price Variance = (Actual Selling Price - Budgeted Selling Price) * Actual Units Sold

In our example:

- Sales Price Variance: ($22 - $20) * 8,000 = $16,000 (Favorable)

This favorable variance suggests effective pricing strategies.

2. Sales Volume Variance

This variance isolates the impact of differences in the number of units sold compared to the budgeted number.

Sales Volume Variance = (Actual Units Sold - Budgeted Units Sold) * Budgeted Contribution Margin per Unit

Where the contribution margin is the selling price minus the variable cost per unit.

In our example:

- Contribution Margin per Unit: $20 - $10 = $10

- Sales Volume Variance: (8,000 - 10,000) * $10 = -$20,000 (Unfavorable)

This unfavorable variance highlights the impact of lower sales volume on operating income.

3. Cost Variances

Cost variances can be further dissected into variances for variable costs and fixed costs.

-

Variable Cost Variance: This variance compares actual variable costs to flexible budget variable costs.

- Variable Cost Variance = Actual Variable Costs - (Actual Units Sold * Budgeted Variable Cost per Unit)

- In our example: $70,000 - (8,000 * $10) = -$10,000 (Unfavorable) This suggests higher-than-expected variable costs.

-

Fixed Cost Variance: This variance compares actual fixed costs to budgeted fixed costs.

- Fixed Cost Variance = Actual Fixed Costs - Budgeted Fixed Costs

- In our example: $42,000 - $40,000 = $2,000 (Unfavorable) This shows an increase in fixed costs beyond the budget.

Reconciling the Variances

It's important to note that the sum of the sales price variance, sales volume variance, and cost variances should ideally reconcile with the flexible-budget variance for operating income. Minor discrepancies might arise due to rounding. Any significant difference warrants a thorough review of the calculations.

In our example:

- Sales Price Variance: $16,000 (Favorable)

- Sales Volume Variance: -$20,000 (Unfavorable)

- Variable Cost Variance: -$10,000 (Unfavorable)

- Fixed Cost Variance: $2,000 (Unfavorable)

- Total Variance: $16,000 - $20,000 - $10,000 + $2,000 = -$22,000

There's a slight discrepancy here. This highlights the importance of careful calculation and review. The flexible budget variance is the key metric to use for management decision making.

Practical Applications of Flexible Budget Variance Analysis

The analysis of flexible budget variances provides invaluable insights for managerial decision-making. It helps identify areas of strength and weakness within the organization, leading to improved operational efficiency and profitability.

- Performance Evaluation: Flexible budget variances offer a more accurate assessment of managerial performance by separating the effects of controllable factors from the effects of uncontrollable factors such as sales volume.

- Cost Control: By analyzing cost variances, management can pinpoint areas where costs are exceeding budgets and implement corrective actions. This could involve negotiating better deals with suppliers, streamlining processes, or improving efficiency.

- Pricing Strategies: Analyzing sales price variances helps evaluate the effectiveness of pricing strategies and identify opportunities to optimize pricing for greater profitability.

- Sales Forecasting: Understanding sales volume variances can inform future sales forecasts, leading to more accurate budgeting and resource allocation.

- Strategic Planning: The insights gained from flexible budget analysis can guide strategic decision-making, such as product development, market expansion, and investment decisions.

Conclusion

The flexible-budget variance for operating income is a powerful tool for assessing business performance. By adjusting for changes in sales volume, it allows for a more accurate and insightful analysis of operational efficiency and profitability. Understanding how to calculate and interpret these variances, along with their constituent parts, is crucial for effective management and strategic planning. By systematically analyzing these variances, businesses can identify areas for improvement, optimize their operations, and ultimately enhance their overall financial performance. Remember to regularly review and refine your budgeting processes to ensure they remain relevant and effective in guiding your business toward success.

Latest Posts

Related Post

Thank you for visiting our website which covers about The Flexible-budget Variance For Operating Income Is . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.