The Fisher Effect Decomposes The Nominal Rate Into:

Holbox

Mar 25, 2025 · 6 min read

Table of Contents

- The Fisher Effect Decomposes The Nominal Rate Into:

- Table of Contents

- The Fisher Effect: Decomposing the Nominal Interest Rate

- Understanding the Components: Nominal, Real, and Expected Inflation

- 1. Nominal Interest Rate (i):

- 2. Real Interest Rate (r):

- 3. Expected Inflation Rate (π<sup>e</sup>):

- The Fisher Equation: A Simple Relationship

- The Logic Behind the Fisher Effect

- Assumptions and Limitations of the Fisher Effect

- Empirical Evidence and Deviations from the Fisher Effect

- Applications of the Fisher Effect

- Extended Fisher Effect: Incorporating Risk and Other Factors

- Conclusion: A Powerful Tool Despite its Limitations

- Latest Posts

- Latest Posts

- Related Post

The Fisher Effect: Decomposing the Nominal Interest Rate

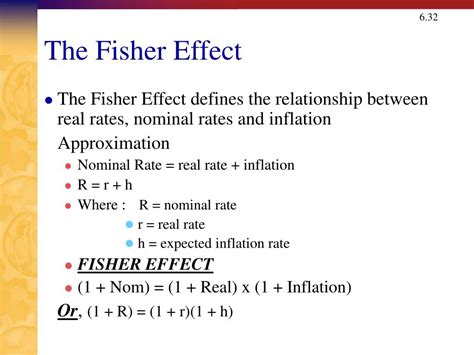

The Fisher effect, a cornerstone of macroeconomic theory, proposes a fundamental relationship between nominal interest rates, real interest rates, and expected inflation. It posits that the nominal interest rate is essentially the sum of the real interest rate and the expected inflation rate. Understanding this decomposition is crucial for investors, policymakers, and anyone seeking to navigate the complexities of financial markets. This article will delve deep into the Fisher effect, exploring its nuances, underlying assumptions, limitations, and practical applications.

Understanding the Components: Nominal, Real, and Expected Inflation

Before dissecting the Fisher effect, let's define its key components:

1. Nominal Interest Rate (i):

This is the rate of interest that is actually quoted or stated on a financial instrument. It's the raw, unadjusted figure you see on your savings account statement or loan agreement. It reflects the total return an investor receives, but doesn't account for the erosion of purchasing power due to inflation.

2. Real Interest Rate (r):

The real interest rate represents the true return on an investment after accounting for inflation. It's the increase in purchasing power an investor experiences. A positive real interest rate means your investment's growth outpaces inflation; a negative real interest rate means inflation is eating away at your returns.

3. Expected Inflation Rate (π<sup>e</sup>):

This is the rate of inflation that investors anticipate over the period of the investment. It's a crucial element because it reflects how much the purchasing power of money is expected to decrease. Expectations are formed through various means, including past inflation rates, current economic indicators, and market sentiment. Crucially, it's the expected inflation, not the actual inflation, that directly influences the nominal interest rate according to the Fisher effect.

The Fisher Equation: A Simple Relationship

The Fisher effect is mathematically expressed through a simple equation:

(1+i) = (1+r)(1+π<sup>e</sup>)

This equation highlights the multiplicative relationship between the components. A simplified, approximate version, often used for illustrative purposes, is:

i ≈ r + π<sup>e</sup>

This approximation holds true when inflation rates are relatively low. However, the first equation is more accurate, particularly when dealing with higher inflation environments.

The Logic Behind the Fisher Effect

The fundamental logic behind the Fisher effect is straightforward: investors are concerned with the real return on their investment, not just the nominal return. If they anticipate higher inflation, they will demand a higher nominal interest rate to compensate for the anticipated erosion of purchasing power. This ensures their real return remains attractive relative to their risk tolerance.

Imagine a scenario where you expect inflation to be 5% next year. If you lend money at a 5% nominal interest rate, your real return would be zero because the 5% return is completely offset by the 5% inflation. To get a real return of, say, 2%, you'd need a nominal interest rate of 7% (approximately 2% + 5%).

Assumptions and Limitations of the Fisher Effect

While the Fisher effect offers a valuable framework for understanding the relationship between nominal and real interest rates, it relies on certain assumptions that might not always hold true in the real world:

- Perfect Information: The model assumes investors have perfect foresight and accurately predict future inflation. This is, of course, unrealistic. Inflation forecasts are inherently uncertain.

- Rational Expectations: The model assumes investors' expectations are rational, meaning they use all available information efficiently to form their expectations. Behavioral biases and market inefficiencies can lead to deviations from rational expectations.

- No Risk Premium: The basic Fisher equation doesn't explicitly account for risk. In reality, investors demand a risk premium to compensate for the uncertainty associated with investments. Higher perceived risk will lead to higher nominal interest rates, irrespective of inflation expectations.

- Stable Economic Conditions: The Fisher effect is best suited for periods of relatively stable economic growth and inflation. In times of significant economic turmoil or hyperinflation, the relationship can break down.

Empirical Evidence and Deviations from the Fisher Effect

Empirical testing of the Fisher effect has yielded mixed results. While studies often show a positive correlation between inflation and nominal interest rates, the precise relationship can vary across countries, time periods, and asset classes. Deviations from the expected relationship can be attributed to the limitations mentioned above, including imperfect information, irrational expectations, and risk premia.

Furthermore, the Fisher effect puzzle refers to the observed phenomenon that nominal interest rates sometimes respond less than one-for-one to changes in expected inflation. This suggests that real interest rates aren't entirely constant and can fluctuate independently of inflation expectations.

Applications of the Fisher Effect

Despite its limitations, the Fisher effect remains a valuable tool with several important applications:

- Investment Decision-Making: Investors use the Fisher effect to estimate the real return on investments, allowing for better comparisons across different assets. They adjust their investment strategies considering expected inflation to achieve their desired real return.

- Monetary Policy Analysis: Central banks use the Fisher effect to guide monetary policy decisions. Understanding the relationship between nominal and real interest rates is crucial for controlling inflation and maintaining price stability. By manipulating nominal interest rates, central banks attempt to influence real interest rates and, consequently, aggregate demand.

- Bond Valuation: The Fisher effect plays a role in the pricing of bonds. Expected inflation directly influences the yield to maturity on bonds, affecting their market value.

- International Finance: The Fisher effect has implications for exchange rate determination. Differences in expected inflation rates between countries can influence the relative value of their currencies.

Extended Fisher Effect: Incorporating Risk and Other Factors

Several extensions of the basic Fisher effect attempt to address its limitations:

- The Augmented Fisher Effect: This incorporates a risk premium into the equation, acknowledging that investors demand higher returns for taking on greater risk. The equation could look like this: i ≈ r + π<sup>e</sup> + ρ, where ρ represents the risk premium.

- The Expectations-Augmented Phillips Curve: This links inflation expectations to the unemployment rate and wage growth, providing a more comprehensive view of the dynamics influencing inflation and interest rates. The unemployment gap and expected inflation become important determinants of wage and price changes.

Conclusion: A Powerful Tool Despite its Limitations

The Fisher effect provides a valuable framework for understanding the interplay between nominal and real interest rates and expected inflation. While its simplicity is appealing, it’s crucial to recognize its limitations. The assumptions of perfect information, rational expectations, and the absence of a risk premium rarely hold completely in the real world. Nevertheless, the Fisher effect remains a powerful tool for investors, policymakers, and economists in analyzing financial markets and making informed decisions. By acknowledging its limitations and considering extensions that incorporate risk and other factors, we can gain a more nuanced and accurate understanding of the dynamic relationship between interest rates and inflation. Continuous research and empirical analysis refine our understanding of this crucial economic relationship and its implications for the global economy. The ongoing debate and refinement surrounding the Fisher effect showcase the ongoing quest for a more comprehensive and accurate understanding of macroeconomic dynamics.

Latest Posts

Latest Posts

-

When Caring For Terminally Ill Patients You Should

Mar 26, 2025

-

On October 1 A Client Pays

Mar 26, 2025

-

Campaign Fundraising Tends To Be A Much Greater Challenge For

Mar 26, 2025

-

50 00 50 00 100 00 25 00 200 00 50 00 50 00 50 00 25 00

Mar 26, 2025

-

Ppra Gives Parents Some Level Of Control Over Their Childs

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about The Fisher Effect Decomposes The Nominal Rate Into: . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.