The Dupont Identity Can Be Accurately Defined As

Holbox

Mar 18, 2025 · 6 min read

Table of Contents

The DuPont Identity: A Deep Dive into Financial Statement Analysis

The DuPont identity isn't just a formula; it's a powerful tool for dissecting a company's financial health and performance. It breaks down Return on Equity (ROE), a crucial metric for investors, into its fundamental components, offering invaluable insights unavailable through a simple ROE calculation alone. Understanding the DuPont identity allows for a more nuanced and accurate assessment of a company's profitability, efficiency, and financial leverage. This in-depth exploration will define the DuPont identity, explore its variations, highlight its applications, and discuss its limitations.

What is the DuPont Identity?

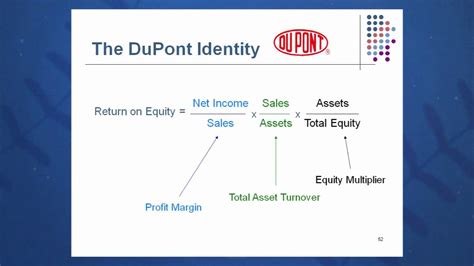

The DuPont identity, also known as the DuPont formula or DuPont analysis, decomposes Return on Equity (ROE) into three key components:

-

Net Profit Margin: Measures a company's profitability by showing the percentage of revenue that translates into net profit after all expenses are deducted. A higher net profit margin indicates greater efficiency in managing costs and generating profit from sales.

-

Asset Turnover: Reflects how efficiently a company uses its assets to generate sales. A higher asset turnover ratio suggests that a company is effectively utilizing its assets to maximize revenue generation.

-

Equity Multiplier: This measures the company's financial leverage, indicating the proportion of assets financed by equity versus debt. A higher equity multiplier signifies greater reliance on debt financing, which amplifies both potential returns and risks.

The DuPont identity is expressed mathematically as:

ROE = Net Profit Margin * Asset Turnover * Equity Multiplier

or, more specifically:

ROE = (Net Income / Sales) * (Sales / Total Assets) * (Total Assets / Total Equity)

Notice that "Sales" cancels out in the formula, leaving us with:

ROE = Net Income / Total Equity (the standard ROE calculation)

This decomposition provides a far richer understanding of the drivers of ROE than the simple calculation alone. It helps isolate the specific areas contributing to a high or low ROE, allowing for targeted improvements and strategic decision-making.

Decomposing the Components: A Closer Look

Let's analyze each component in more detail:

1. Net Profit Margin: The Profitability Factor

The net profit margin reveals how much profit a company generates for each dollar of sales. A higher margin indicates superior cost control, efficient pricing strategies, and strong competitive positioning. Factors influencing net profit margin include:

- Pricing power: Ability to set prices above costs.

- Cost management: Efficiency in controlling operational expenses.

- Research & Development (R&D): Investments in innovation to improve products and processes.

- Sales & Marketing: Effectiveness in promoting products and reaching target markets.

- Tax rates: Lower tax rates contribute to a higher net profit margin.

Analyzing changes in the net profit margin over time provides valuable insights into a company's ability to manage costs and maintain profitability in a dynamic market environment.

2. Asset Turnover: The Efficiency Factor

Asset turnover showcases a company's efficiency in using its assets to generate sales. A higher ratio indicates that the company is effectively employing its resources to maximize revenue. Factors affecting asset turnover include:

- Inventory management: Efficient inventory control minimizes storage costs and reduces the risk of obsolescence.

- Working capital management: Effective management of receivables and payables optimizes cash flow.

- Fixed asset utilization: Maximizing the utilization of production equipment and facilities improves efficiency.

- Operating efficiency: Streamlining operations minimizes waste and enhances productivity.

A consistently improving asset turnover ratio signals increasing efficiency and effective resource allocation within the business.

3. Equity Multiplier: The Financial Leverage Factor

The equity multiplier measures the degree of financial leverage employed by a company. It represents the proportion of assets financed by debt relative to equity. A higher equity multiplier indicates greater reliance on debt financing. While debt can amplify returns, it also increases financial risk. Factors influencing the equity multiplier include:

- Capital structure: The company's mix of debt and equity financing.

- Access to debt financing: The availability and cost of borrowing.

- Credit rating: A higher credit rating allows for more favorable borrowing terms.

- Industry norms: The typical leverage ratios within the specific industry.

A high equity multiplier can boost ROE but also increases the company's vulnerability to financial distress if earnings decline.

Variations of the DuPont Identity

While the three-component DuPont identity is the most common, variations exist to provide even deeper insights. These include:

-

Five-component DuPont model: This model further decomposes the net profit margin into components like operating margin, interest expense, and tax rate, offering a granular view of profitability drivers.

-

Extended DuPont model: This model incorporates additional financial ratios to analyze other aspects of company performance, such as liquidity, solvency, and market valuation.

These extended models enhance the analytical power of the basic DuPont identity, providing a more comprehensive assessment of a company's financial condition.

Applications of the DuPont Identity

The DuPont identity finds numerous applications in various contexts:

-

Investment analysis: Investors use the DuPont identity to evaluate the profitability, efficiency, and financial risk of potential investments. By analyzing each component, they can identify companies with strong fundamentals and sustainable growth potential.

-

Benchmarking: Comparing a company's DuPont ratios against industry peers helps assess its relative performance and identify areas for improvement.

-

Strategic planning: Managers use the DuPont identity to pinpoint weaknesses in their operations and develop strategies to enhance profitability, efficiency, and financial stability.

-

Credit risk assessment: Lenders use the DuPont identity to assess the creditworthiness of borrowers, helping them make informed lending decisions.

The flexibility and comprehensive nature of the DuPont identity make it a valuable tool across diverse applications.

Limitations of the DuPont Identity

While the DuPont identity provides valuable insights, it's essential to acknowledge its limitations:

-

Historical data: The analysis relies on past financial data, which may not accurately predict future performance.

-

Industry variations: Comparing companies across different industries requires caution, as industry-specific factors can significantly influence the ratios.

-

Accounting practices: Variations in accounting methods can affect the comparability of financial data across companies.

-

Qualitative factors: The analysis primarily focuses on quantitative data and may overlook important qualitative factors, such as management quality, brand reputation, and technological innovation.

Despite these limitations, the DuPont identity remains a powerful tool when used judiciously and in conjunction with other analytical techniques.

Conclusion

The DuPont identity is a cornerstone of financial statement analysis. By breaking down ROE into its core components, it provides a far richer understanding of a company's financial health than a simple ROE calculation alone. Understanding each component – net profit margin, asset turnover, and equity multiplier – allows for a nuanced assessment of profitability, efficiency, and financial leverage. While limitations exist, the DuPont identity, when used appropriately and in combination with other analyses, offers invaluable insights for investors, managers, and creditors alike. Its adaptability allows for customized analysis, providing a powerful framework for informed decision-making and strategic planning in the dynamic world of finance. Mastering the DuPont identity is a crucial step toward achieving a comprehensive understanding of corporate financial performance.

Latest Posts

Latest Posts

-

The Term For Pertaining To The Sun Is

Mar 18, 2025

-

Jack And Jill Exercise In A 25 0 M Long Swimming Pool

Mar 18, 2025

-

Which Of The Following Is True About Corporations

Mar 18, 2025

-

Which Letter Correctly Identifies The Part Of The Hydrologic Cycle

Mar 18, 2025

-

Management Is More Progressive Today There Is More Emphasis On

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about The Dupont Identity Can Be Accurately Defined As . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.