The Credit Terms 2 10 N 30 Are Interpreted As

Holbox

Mar 16, 2025 · 5 min read

Table of Contents

Decoding Credit Terms: 2/10, Net 30 Explained

Understanding credit terms is crucial for both businesses offering credit and those taking advantage of it. One of the most common credit terms you'll encounter is 2/10, net 30. This seemingly simple notation holds significant financial implications, and misunderstanding it can lead to missed savings or penalties. This comprehensive guide will dissect the meaning of 2/10, net 30, explore its advantages and disadvantages, and provide practical examples to solidify your understanding.

What Does 2/10, Net 30 Mean?

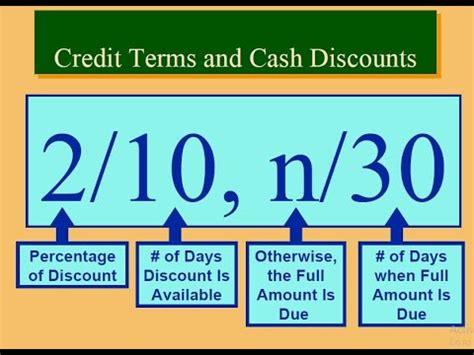

The credit term "2/10, net 30" is a shorthand way of expressing payment terms offered by a seller to a buyer. Let's break it down:

-

2/10: This part signifies a 2% discount if the invoice is paid within 10 days of the invoice date. This is an incentive for early payment.

-

Net 30: This indicates that the full amount is due within 30 days of the invoice date. This is the standard payment deadline if the discount isn't taken.

In essence, 2/10, net 30 offers a choice: pay early and receive a discount, or pay later and pay the full amount.

Advantages of 2/10, Net 30 for Buyers

For buyers, the advantages of 2/10, net 30 terms are clear:

-

Cost Savings: The 2% discount represents a significant saving, especially for businesses with high purchasing volumes. This discount can improve profit margins and enhance cash flow.

-

Improved Cash Flow (Potential): While paying early requires sufficient cash on hand, it can lead to better cash flow management over the long term by avoiding potential late payment penalties and improving relationships with suppliers. Strategic use of short-term financing might be necessary to take advantage of this.

-

Stronger Supplier Relationships: Taking advantage of early payment discounts demonstrates financial responsibility and builds positive relationships with suppliers. This can translate into better negotiating power and potentially more favorable credit terms in the future.

Disadvantages of 2/10, Net 30 for Buyers

Despite the advantages, there are potential drawbacks for buyers:

-

Cash Flow Constraints: Paying early requires sufficient cash reserves. Businesses experiencing cash flow challenges might find it difficult to take advantage of the discount. This is especially true for smaller businesses or those operating on tight margins.

-

Opportunity Cost: The money used to pay invoices early could be invested elsewhere, potentially generating higher returns. The attractiveness of the discount needs to be weighed against these alternative investment opportunities.

-

Complexity: For businesses with a large number of invoices, managing the timing of payments to optimize discount opportunities can become administratively complex.

Advantages of 2/10, Net 30 for Sellers

For sellers, offering 2/10, net 30 terms brings several benefits:

-

Faster Cash Flow: A significant portion of buyers will take advantage of the early payment discount, resulting in quicker access to funds. This can improve the seller's liquidity and reduce reliance on external financing.

-

Improved Sales: Attractive payment terms can incentivize buyers to make purchases, boosting sales volumes. The discount can act as a powerful marketing tool.

-

Reduced Bad Debts: Offering a clear payment schedule can minimize late payments and outstanding debts, streamlining accounts receivables management.

Disadvantages of 2/10, Net 30 for Sellers

While offering this credit term can be beneficial, sellers should consider these potential disadvantages:

-

Reduced Revenue (Potential): If many buyers choose to pay within the 30-day period instead of taking the discount, the seller will receive less revenue than expected. This needs to be factored into pricing strategies.

-

Administrative Costs: Managing accounts receivables, tracking payments, and issuing reminders involves administrative costs. This is a hidden cost associated with offering credit terms.

-

Credit Risk: There's always a risk that some buyers will fail to pay on time, leading to potential losses. A robust credit assessment process is crucial for mitigating this risk.

Calculating the Effective Annual Interest Rate (EAR)

Failing to take the discount on a 2/10, net 30 invoice essentially equates to borrowing money from the supplier. To understand the true cost of not taking the discount, we need to calculate the effective annual interest rate (EAR). The formula is complex, but here's a simplified approach:

Step 1: Determine the discount period. In our example, the discount period is 20 days (30 days – 10 days).

Step 2: Calculate the implied interest rate for the discount period. The discount is 2%, meaning you're paying 98% of the invoice amount (100% - 2%). The implied interest for 20 days is (2%/98%) = 2.04%.

Step 3: Annualize the implied interest rate. There are approximately 365 days in a year. To annualize, we use the following formula: (1 + implied interest rate)^(365/discount period) -1.

In this case: (1 + 0.0204)^(365/20) - 1 ≈ 37.25%

This means that failing to take the 2% discount on a 2/10, net 30 invoice effectively equates to paying an annual interest rate of approximately 37.25%. This is a significant cost!

Example Scenarios Illustrating 2/10, Net 30

Let's consider a few examples to solidify your understanding:

Scenario 1: Taking the Discount

Invoice amount: $1,000 Invoice date: October 26, 2024 Payment date: November 5, 2024 (within 10 days)

Payment = $1,000 * (1 - 0.02) = $980

Scenario 2: Not Taking the Discount

Invoice amount: $1,000 Invoice date: October 26, 2024 Payment date: November 25, 2024 (within 30 days)

Payment = $1,000

Scenario 3: Late Payment

Invoice amount: $1,000 Invoice date: October 26, 2024 Payment date: December 26, 2024 (beyond 30 days)

Payment = $1,000 + potential late payment penalties (depending on supplier's policy)

Negotiating Credit Terms

It's important to remember that credit terms are negotiable, particularly for businesses with strong credit ratings and consistent payment history. Negotiating better terms, such as extending the net period or increasing the discount, can significantly improve your cash flow and profitability.

Conclusion: Understanding the Power of 2/10, Net 30

The credit term "2/10, net 30" is a powerful tool that affects both buyers and sellers significantly. Understanding its implications—the potential savings from early payment, the effective cost of late payment, and the broader implications for cash flow and supplier relationships—is crucial for financial success. By carefully evaluating the advantages and disadvantages and strategically managing your payment schedules, businesses can optimize their financial performance. Remember to always carefully read and understand the payment terms on every invoice and proactively manage your accounts payable. This attention to detail will ultimately lead to more efficient financial management and a stronger bottom line.

Latest Posts

Latest Posts

-

Susan Prepared A Meatloaf And Cooked It To 155

Mar 16, 2025

-

A Response Strategy Requires Suppliers Be Selected Based Primarily On

Mar 16, 2025

-

Select The True Statements About Dopamine

Mar 16, 2025

-

How Many Vehicles Can Be Quoted In Integrated Auto

Mar 16, 2025

-

Suppliers Are People Or Organizations That

Mar 16, 2025

Related Post

Thank you for visiting our website which covers about The Credit Terms 2 10 N 30 Are Interpreted As . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.