The Constance Corporation's Inventory At December 31

Holbox

Mar 14, 2025 · 6 min read

Table of Contents

- The Constance Corporation's Inventory At December 31

- Table of Contents

- Constance Corporation's Inventory at December 31: A Deep Dive Analysis

- Understanding Constance Corporation's Inventory Composition

- Inventory Valuation Methods: A Critical Examination

- Analyzing Inventory Turnover: A Key Performance Indicator

- Assessing the Risk of Obsolescence and Damage

- Implications for Investors and Stakeholders

- Conclusion: The Importance of Continuous Monitoring

- Latest Posts

- Related Post

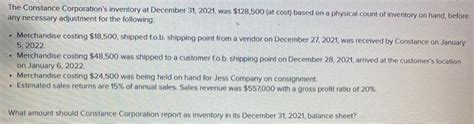

Constance Corporation's Inventory at December 31: A Deep Dive Analysis

Analyzing a company's inventory is crucial for understanding its financial health and future prospects. Inventory represents a significant portion of a company's assets, and its effective management directly impacts profitability. This in-depth analysis delves into the intricacies of Constance Corporation's inventory at December 31, exploring various aspects, including valuation methods, potential issues, and implications for investors and stakeholders. We will examine the inventory's composition, its turnover rate, and the potential impact of obsolescence and damage. This analysis assumes access to Constance Corporation's financial statements, including the balance sheet and notes to the financial statements.

Understanding Constance Corporation's Inventory Composition

To begin our analysis, we need a clear understanding of the types of inventory held by Constance Corporation. This typically includes:

-

Raw Materials: The basic inputs used in the production process. This could include everything from raw commodities like lumber or steel to more specialized components. The value of raw materials held at December 31 will be a crucial element of our analysis. Fluctuations in raw material prices directly impact the value and profitability of the finished goods.

-

Work-in-Progress (WIP): Partially completed goods that are still undergoing the manufacturing process. The valuation of WIP is complex, often requiring estimates of the costs incurred up to December 31. A high WIP balance might indicate production bottlenecks or inefficiencies.

-

Finished Goods: Completed products ready for sale. This is the most straightforward category to value, as the cost is typically well-defined. However, a large finished goods inventory could suggest weak sales, potential obsolescence, or overproduction.

The specific composition of Constance Corporation's inventory will depend heavily on its industry and business model. A company manufacturing complex machinery will have a different inventory profile than a retailer selling consumer goods. Understanding this composition is paramount to assessing the inventory's overall health. Detailed breakdowns in the company's financial statements are essential for a comprehensive analysis.

Inventory Valuation Methods: A Critical Examination

The method used to value inventory significantly affects its reported value on the balance sheet. Several methods are commonly employed:

-

First-In, First-Out (FIFO): This method assumes that the oldest inventory items are sold first. In times of inflation, FIFO results in a higher net income due to lower cost of goods sold. However, it can overstate inventory value, particularly if the inventory is subject to obsolescence or price declines.

-

Last-In, First-Out (LIFO): This method assumes that the newest inventory items are sold first. In times of inflation, LIFO results in a lower net income due to higher cost of goods sold. This method can lead to a lower tax burden during inflationary periods. It can also better reflect the current cost of replacing inventory.

-

Weighted-Average Cost: This method calculates the average cost of all inventory items and assigns that average cost to each item sold. It provides a more smoothed-out valuation compared to FIFO and LIFO.

Constance Corporation's choice of inventory valuation method has a direct impact on its reported profit margins, taxes, and balance sheet values. Identifying the method used is crucial for accurate interpretation of the financial statements. The notes to the financial statements should clearly specify the method employed. The choice of method can also reflect management's views on future pricing and inventory turnover.

Analyzing Inventory Turnover: A Key Performance Indicator

Inventory turnover is a critical ratio that measures the efficiency of inventory management. It indicates how quickly a company is selling its inventory. A high inventory turnover suggests efficient sales and potentially strong demand, while a low turnover could indicate weak sales, obsolete inventory, or overstocking.

The inventory turnover ratio is calculated as:

Cost of Goods Sold / Average Inventory

The average inventory is usually calculated as the average of the beginning and ending inventory balances for the period. A healthy inventory turnover rate varies significantly across industries. Comparing Constance Corporation's turnover rate to industry benchmarks is crucial for a meaningful assessment. A declining turnover rate, even if still within the industry average, warrants further investigation into potential underlying issues.

Assessing the Risk of Obsolescence and Damage

Inventory is subject to various risks, including obsolescence and damage. Technological advancements, changes in consumer preferences, and physical damage can all significantly impact the value of inventory. Constance Corporation's inventory might be particularly susceptible to obsolescence in industries with rapid technological changes or short product lifecycles.

The company's financial statements should provide some indication of the risk of obsolescence and damage. Allowance for obsolete or damaged inventory is a crucial adjustment that impacts the reported inventory value. The magnitude of this allowance provides insights into the management's assessment of these risks. A significant increase in the allowance compared to previous periods requires careful scrutiny and should be investigated further.

Implications for Investors and Stakeholders

The analysis of Constance Corporation's inventory at December 31 has significant implications for investors and stakeholders. The inventory value directly affects the company's reported assets and profitability. Investors need to carefully evaluate the inventory turnover rate, the valuation method used, and the potential for obsolescence and damage. A high inventory level coupled with a low turnover rate might signal overstocking, weak sales, or inefficient inventory management, potentially leading to write-downs and decreased profitability.

Stakeholders, including creditors and suppliers, are also interested in the company's inventory management. High inventory levels might indicate increased financing needs, while a low inventory turnover could raise concerns about the company's ability to meet its obligations. Effective inventory management is a key element of a company's overall financial health and operational efficiency. A comprehensive analysis of inventory is therefore essential for making informed investment and business decisions.

Conclusion: The Importance of Continuous Monitoring

Analyzing Constance Corporation's inventory at December 31 requires a multi-faceted approach, taking into account its composition, valuation methods, turnover rate, and potential risks. Continuous monitoring of inventory levels, turnover rates, and associated risks is crucial for effective management and financial reporting. By thoroughly examining these factors and comparing them to industry benchmarks, investors and stakeholders can gain valuable insights into the company's financial health and future performance. Understanding the inventory position is essential for a comprehensive assessment of Constance Corporation's overall financial situation and its ability to generate future profits. This analysis should be a part of a broader due diligence process that considers many other factors contributing to the overall success of the company. This deeper understanding of inventory allows for more informed and accurate financial forecasting and risk assessment.

Latest Posts

Related Post

Thank you for visiting our website which covers about The Constance Corporation's Inventory At December 31 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.