The Carrying Value Of Bonds At Maturity Always Equals

Holbox

Mar 25, 2025 · 6 min read

Table of Contents

- The Carrying Value Of Bonds At Maturity Always Equals

- Table of Contents

- The Carrying Value of Bonds at Maturity Always Equals: A Comprehensive Guide

- Understanding Bond Carrying Value

- Amortization Methods: Impact on Carrying Value

- 1. Straight-Line Amortization

- 2. Effective Interest Amortization

- The Convergence at Maturity: Why Carrying Value Equals Face Value

- Illustrative Examples

- Implications and Importance

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

The Carrying Value of Bonds at Maturity Always Equals: A Comprehensive Guide

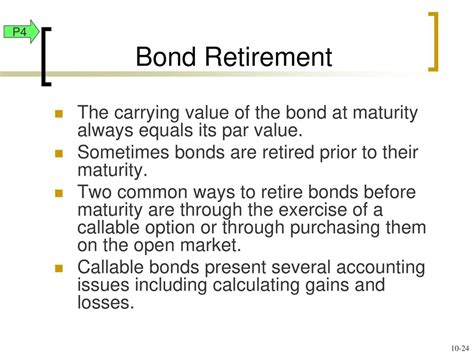

The carrying value of a bond is a crucial concept in accounting and finance. Understanding how it's calculated and its behavior over the life of a bond, especially at maturity, is essential for investors, analysts, and accounting professionals. This comprehensive guide delves into the intricacies of bond carrying value, focusing specifically on its inevitable equality to the face value at maturity. We'll explore the underlying principles, the impact of different accounting methods, and practical examples to solidify your understanding.

Understanding Bond Carrying Value

Before diving into the maturity aspect, let's establish a firm grasp of what bond carrying value represents. The carrying value of a bond is the net amount at which the bond is reported on a company's balance sheet. It's the bond's face value (par value) adjusted for any premiums or discounts.

What are Premiums and Discounts?

- Premium: A bond is sold at a premium when its market interest rate is lower than the stated interest rate (coupon rate) on the bond. Investors are willing to pay more than the face value to receive a higher yield.

- Discount: A bond sells at a discount when the market interest rate is higher than its coupon rate. Investors are willing to pay less than the face value to compensate for the lower yield.

The difference between the bond's face value and its issue price (the price at which it was initially sold) constitutes the premium or discount. This premium or discount is amortized over the bond's life, affecting the carrying value over time.

Amortization Methods: Impact on Carrying Value

The method used to amortize the premium or discount significantly impacts the bond's carrying value throughout its life. Two primary methods are used:

1. Straight-Line Amortization

This method allocates the premium or discount equally over the bond's life. It's simple to calculate but might not accurately reflect the time value of money. The amortization amount is calculated by dividing the total premium or discount by the number of periods the bond is outstanding.

Example: A bond with a face value of $1,000, issued at $1,050 (a $50 premium) and maturing in 5 years, would have a yearly amortization of $10 ($50 / 5 years).

2. Effective Interest Amortization

This method is generally preferred and is considered more accurate. It recognizes the time value of money by allocating a larger portion of the premium or discount to the earlier years of the bond's life. The interest expense is calculated each period based on the carrying value of the bond and the effective interest rate (market rate at the time of issuance).

Example: Let's say a bond with a face value of $1,000 is issued at a discount of $50 with an effective interest rate of 8%. The interest expense in the first year would be calculated as 8% of the carrying value ($950), resulting in $76. The difference between the cash interest payment (based on the coupon rate) and the interest expense is the amortization of the discount.

The Convergence at Maturity: Why Carrying Value Equals Face Value

Regardless of the amortization method used (straight-line or effective interest), the carrying value of a bond always converges to its face value at maturity. This is a fundamental principle of bond accounting.

Here's why:

-

Amortization's Purpose: The entire premium or discount is systematically amortized over the bond's life. The amortization process is designed to gradually adjust the carrying value until it matches the face value when the bond matures.

-

Accrual Accounting: Accrual accounting principles dictate that all premiums and discounts must be fully accounted for by the maturity date. This ensures that the bond is accurately reflected on the balance sheet at maturity.

-

Final Payment: At maturity, the issuer repays the face value of the bond. This payment settles the bond obligation, and since the carrying value has already adjusted to reflect the amortization of the premium or discount, the final carrying value precisely equals the face value.

Illustrative Examples

Let's illustrate this with concrete examples using both amortization methods.

Example 1: Straight-Line Amortization

Consider a bond with a face value of $1,000 issued at a premium of $50, maturing in 5 years, with a 6% coupon rate. Using straight-line amortization, the annual premium amortization is $10 ($50/5).

| Year | Beginning Carrying Value | Amortization | Interest Expense | Ending Carrying Value |

|---|---|---|---|---|

| 1 | $1,050 | $10 | $60 | $1,040 |

| 2 | $1,040 | $10 | $60 | $1,030 |

| 3 | $1,030 | $10 | $60 | $1,020 |

| 4 | $1,020 | $10 | $60 | $1,010 |

| 5 | $1,010 | $10 | $60 | $1,000 |

As you can see, the carrying value steadily decreases until it reaches the face value of $1,000 at maturity.

Example 2: Effective Interest Amortization

Let's consider the same bond but use the effective interest method. Assume the effective interest rate is 5%.

| Year | Beginning Carrying Value | Interest Expense (5% of Carrying Value) | Cash Interest Payment (6% of Face Value) | Amortization of Premium | Ending Carrying Value |

|---|---|---|---|---|---|

| 1 | $1,050 | $52.50 | $60 | $7.50 | $1,042.50 |

| 2 | $1,042.50 | $52.13 | $60 | $7.87 | $1,034.63 |

| 3 | $1,034.63 | $51.73 | $60 | $8.27 | $1,026.36 |

| 4 | $1,026.36 | $51.32 | $60 | $8.68 | $1,017.68 |

| 5 | $1,017.68 | $50.88 | $60 | $9.12 | $1,000 |

Again, the carrying value gradually decreases, finally reaching the face value of $1,000 at maturity. Note that the amortization amounts vary slightly each year under the effective interest method.

Implications and Importance

The convergence of carrying value to face value at maturity is not merely an accounting detail; it has several crucial implications:

-

Financial Reporting Accuracy: Ensuring the carrying value accurately reflects the bond's true value at each point is vital for accurate financial reporting.

-

Investor Confidence: Transparent and accurate bond accounting builds investor confidence and trust.

-

Debt Management: Companies use this information to manage their debt effectively.

-

Regulatory Compliance: Accurate accounting practices are crucial for regulatory compliance.

Conclusion

The carrying value of bonds at maturity always equals the face value. This principle is a cornerstone of bond accounting, driven by the systematic amortization of premiums or discounts. Understanding this fundamental concept, along with the nuances of different amortization methods, is essential for anyone working with bonds, from investors and analysts to accounting professionals. This knowledge ensures accurate financial reporting, builds investor trust, aids in effective debt management, and facilitates regulatory compliance. Mastering this concept enhances your understanding of the intricacies of bond valuation and financial reporting practices.

Latest Posts

Latest Posts

-

Match Each Term To The Correct Definition

Mar 26, 2025

-

Identify The Three Major Modes Of Action Of Antiviral Drugs

Mar 26, 2025

-

Label The Structures Of The Urinary Tract In The Figure

Mar 26, 2025

-

Which Of The Following Is A Function Of Protein

Mar 26, 2025

-

Campaigning Its A Process Answer Key

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about The Carrying Value Of Bonds At Maturity Always Equals . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.