The C Corporation Is Another Term For

Holbox

Mar 18, 2025 · 6 min read

Table of Contents

The C Corporation: A Deep Dive into its Meaning, Structure, and Implications

The term "C corporation" often evokes images of large, established businesses. But what exactly is a C corporation, and what sets it apart from other business structures? This comprehensive guide will delve into the intricacies of C corporations, exploring their definition, formation, taxation, advantages, and disadvantages. By the end, you'll have a clear understanding of why the phrase "C corporation" is synonymous with a specific type of corporate entity and how it impacts business operations.

Understanding the Meaning of "C Corporation"

A C corporation, often shortened to "C corp," is a legal structure for a business that is separate and distinct from its owners (shareholders). This separation offers significant liability protection, shielding personal assets from business debts and lawsuits. It's crucial to understand that "C corporation" isn't just another term; it's a precise legal designation, referring to a specific type of corporation under the Internal Revenue Code. This designation determines how the corporation is taxed, unlike other business entities like sole proprietorships, partnerships, or S corporations. The term itself doesn't offer a descriptive overview of the business's operations but instead categorizes it based on its legal and tax structure.

Key Characteristics Defining a C Corporation

Several key characteristics differentiate a C corporation from other business structures:

-

Separate Legal Entity: This is the cornerstone of a C corp. It's a separate legal entity, meaning it can enter contracts, own property, and be sued independently of its shareholders. This is a critical aspect of liability protection.

-

Double Taxation: A C corp is subject to double taxation. The corporation pays taxes on its profits, and then shareholders pay taxes again on any dividends they receive. This is a significant difference compared to other business structures.

-

Complex Formation and Compliance: Forming a C corporation and maintaining compliance with legal and regulatory requirements is significantly more complex than setting up a sole proprietorship or partnership. This often necessitates professional assistance.

-

Unlimited Life: A C corporation can continue to exist even if shareholders change or die. Its lifespan isn't tied to the lives of its owners.

-

Ownership Structure: Ownership in a C corporation is represented by shares of stock. These shares can be easily transferred, making it easier to raise capital through the sale of shares.

The C Corporation vs. Other Business Structures

Understanding the nuances of C corporations requires comparing them to other common business structures:

C Corporation vs. S Corporation

While both are corporations, they differ significantly in how they're taxed. An S corporation ("S corp") avoids double taxation. Profits and losses are passed through directly to the shareholders' personal income taxes, avoiding the corporate tax level. However, S corps have stricter eligibility requirements, limiting the number and type of shareholders. A C corp, while subject to double taxation, has no such restrictions, making it a more attractive option for larger businesses with numerous shareholders or those planning for future growth and investment.

C Corporation vs. Limited Liability Company (LLC)

LLCs offer a blend of limited liability and pass-through taxation (like an S corp). They generally offer simpler administration than a C corp. However, LLCs lack the established prestige and access to capital that a C corporation can provide. The choice between a C corp and an LLC often depends on long-term growth plans, liability concerns, and tax implications specific to the business and its owners.

C Corporation vs. Sole Proprietorship and Partnership

Sole proprietorships and partnerships are simpler to establish but offer significantly less liability protection. The business owner's personal assets are at risk if the business incurs debt or faces lawsuits. C corporations provide a much higher level of liability protection, shielding personal assets from business liabilities.

Formation and Operation of a C Corporation

Establishing a C corporation requires navigating various legal and administrative hurdles:

Incorporating the Business

The process typically involves choosing a state for incorporation (Delaware is a popular choice for its corporate-friendly laws), filing articles of incorporation with the secretary of state, creating bylaws outlining the corporation's internal operations, and appointing directors and officers. Professional legal and accounting assistance is often advisable during this stage.

Ongoing Compliance Requirements

Maintaining a C corporation requires ongoing compliance, including filing annual reports with the state, holding regular shareholder and board meetings, maintaining accurate financial records, and adhering to corporate governance best practices. Non-compliance can lead to severe penalties.

Capital Acquisition

C corporations typically raise capital through the sale of stock, either publicly through an initial public offering (IPO) or privately to investors. This access to capital is a significant advantage for large-scale projects and expansion.

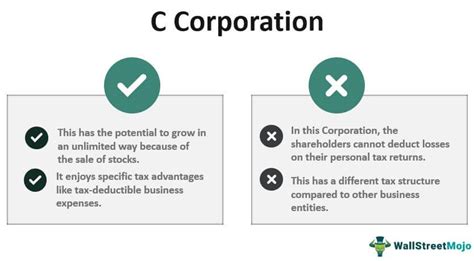

Advantages of a C Corporation

Choosing a C corporation offers several advantages:

-

Limited Liability: This is perhaps the most significant benefit. Shareholders are generally not personally liable for the corporation's debts or lawsuits.

-

Access to Capital: C corporations can more easily raise significant amounts of capital compared to other structures.

-

Perpetual Existence: The corporation continues to exist irrespective of changes in ownership.

-

Attractive to Investors: The established structure and limited liability make C corps attractive to potential investors.

-

Clearer Organizational Structure: The defined roles and responsibilities within the corporate structure ensure smoother operations.

Disadvantages of a C Corporation

Despite its advantages, a C corporation has certain drawbacks:

-

Double Taxation: This is a significant disadvantage, as profits are taxed at the corporate level and again when distributed as dividends to shareholders.

-

Complex Setup and Maintenance: Formation and compliance requirements are significantly more complex and expensive than other business structures.

-

Higher Administrative Costs: Ongoing administrative costs are typically higher due to the need for regular meetings, record-keeping, and compliance filings.

-

Regulatory Scrutiny: C corporations face greater regulatory scrutiny compared to smaller entities.

When to Choose a C Corporation

The decision to form a C corporation should be carefully considered. It's generally a suitable choice for:

-

Larger Businesses: Businesses anticipating significant growth and needing substantial capital.

-

Businesses Seeking Investor Funding: The established structure and limited liability are attractive to investors.

-

Businesses Needing Strong Liability Protection: The separate legal entity provides robust protection for personal assets.

-

Businesses Planning for Long-Term Existence: The perpetual nature of the corporation is ideal for businesses with long-term goals.

However, if the business is small, has limited growth prospects, or the owner desires simpler administration and tax management, other business structures might be more appropriate.

Conclusion: The Significance of the C Corporation Designation

The term "C corporation" is not just a casual descriptor; it's a precise legal and tax classification with far-reaching implications for the business and its owners. Understanding its meaning, structure, and operational requirements is vital for anyone considering this business structure. While the double taxation and administrative complexities are significant factors, the limited liability and access to capital often outweigh these drawbacks for larger businesses seeking substantial growth and investor interest. Careful consideration of the advantages and disadvantages, along with professional consultation, is essential before choosing a C corporation as the legal structure for your business. The ultimate decision will depend heavily on individual circumstances and long-term business goals.

Latest Posts

Latest Posts

-

The Second Largest Number Of Pacs Are Those Associated With

Mar 18, 2025

-

The Accompanying Graph Represents Haydens Fro Yo

Mar 18, 2025

-

According To The Text Which Is True Of Leadership

Mar 18, 2025

-

Emmy Is Standing On A Moving Sidewalk

Mar 18, 2025

-

What Are The 2 Broad Types Of Health Problems

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about The C Corporation Is Another Term For . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.