The Balance In The Accumulated Depreciation Account Represents The

Holbox

Mar 20, 2025 · 6 min read

Table of Contents

The Balance in the Accumulated Depreciation Account Represents the Total Depreciation Taken

The balance in the accumulated depreciation account is a crucial figure in a company's financial statements. It doesn't represent the value of assets that have been physically "used up," but rather, the total depreciation expense that has been recognized since an asset was put into service. Understanding this distinction is key to accurate financial reporting and analysis. This article will delve deep into the meaning and significance of the accumulated depreciation balance, exploring its impact on the balance sheet, income statement, and overall financial health of a business.

What is Accumulated Depreciation?

Accumulated depreciation is a contra-asset account, meaning it reduces the value of an asset on the balance sheet. It's not a separate asset or liability; it's a running total of depreciation expense recorded over the asset's useful life. Think of it as a cumulative record of how much the asset's value has been written down due to wear and tear, obsolescence, or other factors.

In essence, the balance represents the total reduction in the asset's book value since its acquisition. This book value, calculated as the original cost minus accumulated depreciation, is what the asset is worth according to the company's accounting records. It's important to remember that this book value often differs significantly from the asset's fair market value (what it could be sold for in the current market).

How is Accumulated Depreciation Calculated?

The calculation of accumulated depreciation is straightforward: it's the sum of all depreciation expense recorded for a particular asset over its useful life. The depreciation expense itself is calculated using various methods, including:

- Straight-Line Depreciation: This is the simplest method, allocating equal depreciation expense over the asset's useful life. The formula is: (Cost - Salvage Value) / Useful Life.

- Declining Balance Depreciation: This method accelerates depreciation, recognizing higher expense in the earlier years of the asset's life. A fixed percentage is applied to the asset's net book value each year.

- Units of Production Depreciation: This method bases depreciation on the asset's actual use. Expense is calculated based on the number of units produced or hours used.

- Sum-of-the-Years' Digits Depreciation: This method also accelerates depreciation, but at a slower rate than the declining balance method. It assigns a fraction to each year based on the sum of the years in the asset's useful life.

Regardless of the depreciation method used, the accumulated depreciation account keeps a running total of the expense recorded each period. This total is what appears on the balance sheet.

Example:

Let's say a company purchased equipment for $10,000 with a useful life of 5 years and no salvage value. Using straight-line depreciation, the annual depreciation expense is $2,000 ($10,000 / 5).

- Year 1: Accumulated Depreciation = $2,000

- Year 2: Accumulated Depreciation = $4,000 ($2,000 + $2,000)

- Year 3: Accumulated Depreciation = $6,000

- Year 4: Accumulated Depreciation = $8,000

- Year 5: Accumulated Depreciation = $10,000

At the end of year 5, the accumulated depreciation equals the original cost of the equipment, resulting in a net book value of zero.

Where Accumulated Depreciation Appears on Financial Statements

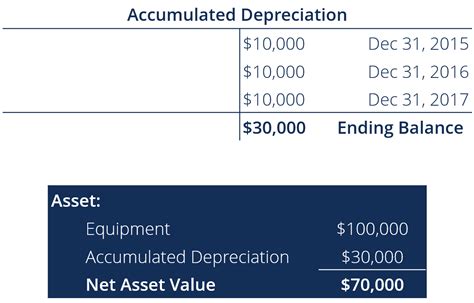

Accumulated depreciation is presented on the balance sheet as a deduction from the related asset's cost. It's shown as a negative number, reducing the asset's reported value. For example:

Balance Sheet (Extract):

- Assets:

- Equipment: $10,000

- Less: Accumulated Depreciation: ($10,000)

- Net Book Value of Equipment: $0

The impact on the income statement is seen through the depreciation expense itself. Depreciation expense is recorded as an operating expense, reducing net income. This expense reflects the cost allocation of the asset over its useful life. The amount of depreciation expense in a given period will influence the company's profitability for that period.

The Significance of Accumulated Depreciation

The accumulated depreciation balance provides valuable insights into several aspects of a company's financial health:

- Asset Valuation: It directly impacts the reported value of assets on the balance sheet. This is crucial for assessing a company's net worth and overall financial position.

- Tax Implications: Depreciation is a tax-deductible expense, reducing taxable income and the amount of tax owed. The accumulated depreciation balance is directly related to the tax benefits realized through depreciation.

- Investment Decisions: Potential investors and lenders use accumulated depreciation to analyze the age and condition of a company's assets. High accumulated depreciation might indicate older assets needing replacement, impacting the company's future profitability and competitiveness.

- Financial Reporting Compliance: Accurate calculation and reporting of accumulated depreciation are crucial for compliance with accounting standards (like GAAP or IFRS). Incorrect reporting could lead to penalties and financial misrepresentation.

- Asset Replacement Planning: The level of accumulated depreciation can help companies plan for future asset replacements. High accumulated depreciation can be a signal that an asset is nearing the end of its useful life, requiring investment in new equipment or infrastructure.

- Company Performance Evaluation: By analyzing accumulated depreciation in conjunction with other financial metrics, investors and analysts can evaluate a company's efficiency in managing its assets and its overall performance.

Potential Problems with Accumulated Depreciation

While crucial for financial reporting, accumulated depreciation can also present some challenges:

- Overestimation of Depreciation: Using an overly aggressive depreciation method could lead to an understated asset value and potentially mislead investors or creditors about the company's financial health.

- Underestimation of Depreciation: Conversely, underestimating depreciation could overstate the value of assets and present a misleadingly positive financial picture.

- Impairment of Assets: The book value might not reflect the asset's fair market value. If the market value falls significantly below the book value (net of accumulated depreciation), the asset is considered impaired and requires an impairment charge.

- Lack of Transparency: The complexity of depreciation calculations can sometimes obscure the true condition and value of a company's assets, requiring careful analysis of the methodology employed.

Conclusion: Understanding the Full Picture

The balance in the accumulated depreciation account is a critical element of a company's financial statements, representing the total depreciation expense recognized since an asset was placed in service. It's a cumulative measure that plays a significant role in asset valuation, tax planning, investment decisions, and overall financial health assessment. Understanding its calculation and implications is essential for investors, creditors, and managers alike to make informed decisions. While the accumulated depreciation itself does not represent the physical wear and tear, it reflects the systematic allocation of the asset's cost over its useful life according to sound accounting principles. Therefore, interpreting the accumulated depreciation balance requires careful consideration of the applied depreciation method, the asset's remaining useful life, and the overall financial context of the company. Using this information in conjunction with other financial data provides a more comprehensive understanding of a business's financial position and future prospects. Remember that consistent application of appropriate depreciation methods and thorough financial analysis are critical for reliable and transparent financial reporting.

Latest Posts

Latest Posts

-

What Makes Lethal Means Counseling Effective

Mar 21, 2025

-

Readings For Diversity And Social Justice 4th Edition

Mar 21, 2025

-

The Determination Of An Equilibrium Constant Lab Answers Vernier

Mar 21, 2025

-

The Term Discrimination Is Defined In The Text As

Mar 21, 2025

-

Focus Forecasting Is Based On The Principle That

Mar 21, 2025

Related Post

Thank you for visiting our website which covers about The Balance In The Accumulated Depreciation Account Represents The . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.