The Allowance Method Is Required By

Holbox

Mar 14, 2025 · 6 min read

Table of Contents

The Allowance Method: Required by GAAP and Why You Should Use It

The allowance method for bad debts is a crucial accounting practice mandated by Generally Accepted Accounting Principles (GAAP) for businesses extending credit to customers. Understanding its intricacies is vital for maintaining accurate financial records and adhering to regulatory requirements. This comprehensive guide delves into the allowance method, explaining its necessity, implementation, and the benefits it offers.

Why is the Allowance Method Required?

The allowance method is not just a suggestion; it's a requirement under GAAP because it provides a more accurate and realistic portrayal of a company's financial position. Unlike the direct write-off method (which is generally only acceptable for immaterial amounts of bad debts), the allowance method anticipates potential bad debts before they actually occur. This proactive approach ensures that financial statements reflect a more accurate picture of accounts receivable and the company's overall financial health.

The primary reason for this requirement stems from the principle of matching. GAAP dictates that expenses should be recognized in the same accounting period as the revenues they help generate. Since the extension of credit is intrinsically linked to potential bad debts, the expense associated with these uncollectible accounts should be recognized in the same period as the related sales revenue. The direct write-off method violates this principle by recognizing the expense only when the account is definitively deemed uncollectible, potentially misrepresenting the company's profitability and financial position in the periods leading up to the write-off.

Furthermore, the allowance method provides a more conservative approach to accounting. By estimating and setting aside funds for potential bad debts, businesses present a more realistic view of their true financial standing, avoiding an overly optimistic picture that could mislead investors, creditors, and other stakeholders.

How the Allowance Method Works

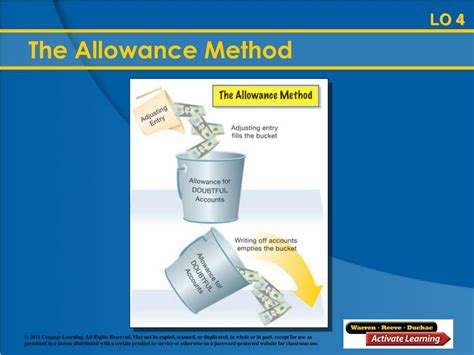

The allowance method utilizes a contra-asset account called the "Allowance for Doubtful Accounts." This account reduces the balance of Accounts Receivable, resulting in a net realizable value that reflects the amount the company realistically expects to collect. The process involves two key steps:

1. Estimating Bad Debts

This is the crucial first step. There are several methods for estimating the amount of bad debts:

-

Percentage of Sales Method: This method estimates bad debts as a percentage of net credit sales. For instance, a company might estimate that 1% of its credit sales will be uncollectible. This percentage is determined based on historical data, industry benchmarks, and economic conditions. This is a relatively simple method, but it may not accurately reflect the age of receivables.

-

Percentage of Accounts Receivable Method: This method estimates bad debts as a percentage of the ending balance of accounts receivable. This approach considers the age of the receivables, with older receivables generally having a higher probability of being uncollectible. This method offers a more refined estimation compared to the percentage of sales method. Different percentages can be applied to different age groups of receivables (e.g., 0-30 days, 31-60 days, 61-90 days, over 90 days), offering even greater accuracy.

-

Aging of Accounts Receivable Method: This method is a more detailed version of the percentage of accounts receivable method. It categorizes accounts receivable by age and applies different percentages to each age category, reflecting the increasing likelihood of non-collection as accounts age. This is the most accurate but also the most time-consuming method.

The choice of method depends on the nature of the business, its historical data, and the level of detail desired. Larger companies often use the aging method due to its higher accuracy, while smaller businesses may find the percentage of sales method sufficient.

2. Adjusting the Allowance Account

Once the estimated bad debt expense is calculated, the company must adjust the Allowance for Doubtful Accounts. This is done through a journal entry. If the balance in the Allowance for Doubtful Accounts is insufficient to cover the estimated bad debts, an additional amount is debited to Bad Debt Expense and credited to Allowance for Doubtful Accounts. Conversely, if the balance in the Allowance for Doubtful Accounts is excessive, a debit to Allowance for Doubtful Accounts and a credit to Bad Debt Expense reduces the account to the appropriate level.

Writing Off Uncollectible Accounts

When an account is definitively deemed uncollectible, it's written off. This involves debiting the Allowance for Doubtful Accounts and crediting Accounts Receivable. This reduces both the allowance account and the accounts receivable balance, reflecting the reality that the amount is unlikely to be collected.

Restoring Written-Off Accounts

Sometimes, accounts previously written off are unexpectedly recovered. In these cases, the company reverses the previous write-off. This involves debiting Accounts Receivable and crediting the Allowance for Doubtful Accounts. Subsequently, the cash received is recorded with a debit to Cash and a credit to Accounts Receivable.

Benefits of the Allowance Method

Beyond compliance with GAAP, the allowance method offers several significant advantages:

-

Accurate Financial Reporting: Provides a more accurate and realistic picture of a company's financial position by recognizing bad debts expense in the same period as related sales revenue.

-

Improved Credit Risk Management: Forces companies to actively assess and manage their credit risk by regularly reviewing and estimating potential bad debts. This proactive approach can lead to better credit policies and improved collection efforts.

-

Better Decision-Making: Allows for more informed decision-making regarding credit extension, pricing, and other financial strategies based on a realistic assessment of the risk of uncollectible accounts.

-

Enhanced Credibility: Demonstrates to investors, creditors, and other stakeholders that the company employs sound accounting practices and adheres to regulatory requirements. This enhances the company's credibility and trustworthiness.

-

Tax Benefits: Bad debt expense is deductible for tax purposes, offering potential tax savings.

Comparison to the Direct Write-Off Method

The direct write-off method, while simpler to implement, suffers from several significant drawbacks. It only recognizes bad debt expense when an account is definitively uncollectible. This results in:

-

Inaccurate Financial Statements: Misrepresents the company's financial position by understating bad debts expense and overstating accounts receivable.

-

Violation of GAAP: Does not comply with GAAP's matching principle, leading to potential audit issues and regulatory penalties.

-

Poor Credit Risk Management: Fails to provide a proactive approach to credit risk management, increasing the risk of accumulating significant uncollectible accounts.

-

Limited Decision-Making Information: Provides limited information for informed decision-making regarding credit extension, pricing, and other financial strategies.

Conclusion

The allowance method for bad debts is not merely a regulatory requirement; it's a fundamental accounting practice that contributes to accurate financial reporting, effective credit risk management, and improved decision-making. While more complex than the direct write-off method, its benefits far outweigh the added effort. By adhering to GAAP and employing the allowance method, businesses present a more realistic and transparent view of their financial health, fostering trust with stakeholders and contributing to the long-term success of the company. The choice of the specific method within the allowance method (percentage of sales, percentage of receivables, or aging) should be made based on the company’s size, complexity, and the level of detail required for accurate reporting. Regular review and adjustment of the allowance account are critical to ensure its accuracy and relevance.

Latest Posts

Latest Posts

-

Determine Which Is The Larger Species

Mar 14, 2025

-

Modern Real Estate Practice Workbook 5th Edition

Mar 14, 2025

-

Karst Processes And Topography Activity 12 4

Mar 14, 2025

-

Question New York Select All The Reagets

Mar 14, 2025

-

The Media Perform The Signaling Role By

Mar 14, 2025

Related Post

Thank you for visiting our website which covers about The Allowance Method Is Required By . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.