The Adjustment For Underapplied Overhead Blank______ Net Income.

Holbox

Mar 18, 2025 · 5 min read

Table of Contents

The Adjustment for Underapplied Overhead: Its Impact on Net Income

Understanding how overhead costs are applied and adjusted is crucial for accurate financial reporting. This article delves deep into the implications of underapplied overhead, its impact on net income, and the necessary accounting adjustments. We will explore various scenarios, accounting methods, and the overall significance of accurate overhead cost allocation.

What is Overhead?

Before diving into underapplied overhead, let's define what overhead encompasses. Manufacturing overhead, also known as factory overhead, represents indirect costs incurred in the production process. These costs aren't directly traceable to specific products but are essential for their creation. Examples include:

- Indirect labor: Salaries of supervisors, maintenance personnel, and quality control inspectors.

- Factory rent: Costs associated with the manufacturing facility.

- Utilities: Electricity, gas, and water used in the factory.

- Depreciation: The allocation of the cost of factory equipment over its useful life.

- Factory supplies: Consumables used in the production process.

- Insurance: Coverage for factory buildings and equipment.

These costs are significant and must be accurately accounted for to determine the true cost of production and ultimately, the profitability of a business.

Applying Overhead: The Predetermined Overhead Rate

Companies typically use a predetermined overhead rate to apply overhead costs to products. This is because it's impractical to track and allocate overhead costs directly to each product in real-time. The predetermined overhead rate is calculated at the beginning of the accounting period (usually annually) using a formula:

Predetermined Overhead Rate = Estimated Total Manufacturing Overhead Costs / Estimated Total Allocation Base

The allocation base is a measure of activity that drives overhead costs. Common allocation bases include:

- Direct labor hours: The total number of hours worked by direct labor employees.

- Machine hours: The total number of hours machines are used in production.

- Direct labor costs: The total cost of direct labor.

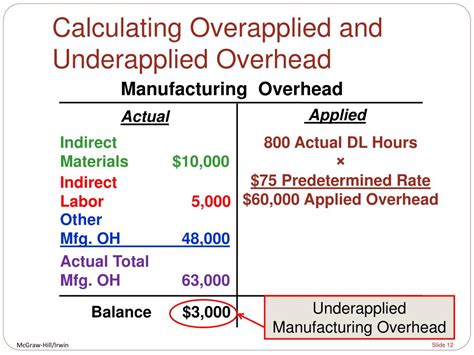

Understanding Underapplied Overhead

Underapplied overhead occurs when the actual overhead costs incurred during a period exceed the overhead costs applied to production using the predetermined overhead rate. In simpler terms, the company has spent more on overhead than it initially anticipated and allocated. This creates a discrepancy between the actual overhead costs and the applied overhead costs. This difference needs to be addressed before finalizing the financial statements.

The Impact of Underapplied Overhead on Net Income

Underapplied overhead directly affects net income. Because the applied overhead was less than the actual overhead, the cost of goods sold (COGS) was understated. This means that the reported net income was overstated. The adjustment for underapplied overhead will reduce the net income to reflect the true cost of production.

Adjusting for Underapplied Overhead: Accounting Treatment

The adjustment for underapplied overhead involves increasing the cost of goods sold (COGS) and decreasing net income. This is reflected in the closing entries at the end of the accounting period.

Journal Entry:

- Debit: Cost of Goods Sold (increases COGS)

- Credit: Manufacturing Overhead (closes the manufacturing overhead account)

The debit increases the cost of goods sold, reflecting the true amount of overhead incurred. The credit reduces the balance in the manufacturing overhead account to zero, ensuring that the overhead account correctly reflects the actual costs incurred during the period. This adjustment results in a lower net income than originally reported.

Analyzing the Causes of Underapplied Overhead

Identifying the reasons behind underapplied overhead is crucial for future cost management. Several factors can contribute to this:

- Inaccurate estimation of overhead costs: The initial estimation of overhead costs might have been too low. This can be due to unforeseen circumstances, changes in production methods, or unexpected increases in indirect costs (e.g., rising energy prices).

- Inaccurate estimation of the allocation base: If the estimated allocation base (e.g., direct labor hours) is significantly different from the actual allocation base, the predetermined overhead rate will be inaccurate.

- Changes in production volume: If the actual production volume is lower than expected, the overhead costs are spread over fewer units, resulting in a higher cost per unit and leading to underapplied overhead. Conversely, unexpectedly higher production could lead to overapplied overhead.

- Inefficiencies in production: Inefficiencies within the production process can lead to higher overhead costs than anticipated. This could stem from equipment breakdowns, production delays, or inefficient use of resources.

Overapplied Overhead: A Counterpoint

While this article focuses on underapplied overhead, it's essential to understand its counterpart: overapplied overhead. This occurs when the applied overhead exceeds the actual overhead costs. In this case, the cost of goods sold was overstated, and net income was understated. The adjustment is the opposite of underapplied overhead, reducing the cost of goods sold and increasing net income.

Journal Entry (Overapplied Overhead):

- Debit: Manufacturing Overhead (closes the manufacturing overhead account)

- Credit: Cost of Goods Sold (decreases COGS)

Methods for Disposing of Under/Overapplied Overhead

Several methods exist for disposing of underapplied or overapplied overhead:

- Cost of Goods Sold Method: This is the most common method, adjusting the cost of goods sold account.

- Proration Method: This method allocates the difference proportionally across the work-in-process (WIP), finished goods, and cost of goods sold accounts. This is more complex but provides a more accurate allocation of overhead costs.

- Direct Write-off Method: This method directly writes off the difference to the income statement. This approach is less precise and may not reflect the true cost of goods sold.

The Importance of Accurate Overhead Costing

Accurate overhead costing is vital for several reasons:

- Pricing decisions: Accurate overhead costs ensure that prices are set appropriately to cover all production costs and generate a profit.

- Inventory valuation: Correct overhead costing is crucial for properly valuing inventory.

- Performance evaluation: Tracking and analyzing overhead costs helps identify areas of inefficiency and improve cost control.

- Financial reporting: Accurate overhead costing is necessary for reliable and trustworthy financial statements.

Conclusion: Mastering Overhead Costing for Accurate Financial Reporting

The adjustment for underapplied overhead is a critical component of accurate financial reporting. Understanding the causes of underapplied overhead, the proper accounting treatment, and alternative disposal methods is paramount for businesses to effectively manage costs, make informed decisions, and present a true picture of their financial performance. Ignoring or mismanaging overhead can lead to inaccurate financial statements, misinformed decision-making, and ultimately, financial distress. By implementing robust cost accounting systems and regularly reviewing overhead variances, businesses can ensure the accuracy of their financial statements and maintain a healthy financial standing. The principles discussed here extend beyond manufacturing; similar concepts apply to service industries and other businesses needing to allocate indirect costs. Therefore, understanding these concepts remains essential for any business seeking to accurately represent its financial position.

Latest Posts

Latest Posts

-

Which Of The Following Best Describes The Operational Period Briefing

Mar 18, 2025

-

The Second Largest Number Of Pacs Are Those Associated With

Mar 18, 2025

-

The Accompanying Graph Represents Haydens Fro Yo

Mar 18, 2025

-

According To The Text Which Is True Of Leadership

Mar 18, 2025

-

Emmy Is Standing On A Moving Sidewalk

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about The Adjustment For Underapplied Overhead Blank______ Net Income. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.