The Accounting Equation May Be Expressed As

Holbox

Mar 20, 2025 · 6 min read

Table of Contents

The Accounting Equation: A Comprehensive Guide

The accounting equation is the fundamental building block of double-entry bookkeeping. Understanding it is crucial for anyone involved in finance, accounting, or business management. This comprehensive guide will delve into the accounting equation, exploring its components, applications, and importance in financial statement preparation. We'll also address common misconceptions and demonstrate its practical application through various scenarios.

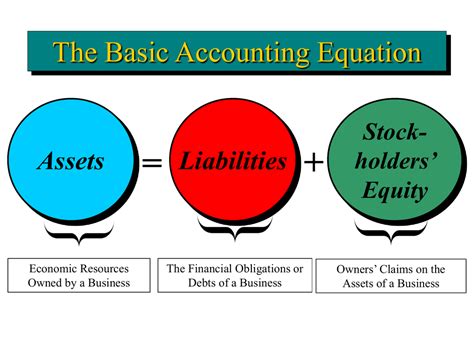

Understanding the Accounting Equation: Assets = Liabilities + Equity

The accounting equation, often referred to as the balance sheet equation, is expressed as:

Assets = Liabilities + Equity

This simple yet powerful equation represents the fundamental relationship between a company's assets, liabilities, and equity. Let's break down each component:

Assets: What a Company Owns

Assets are resources controlled by a company as a result of past events and from which future economic benefits are expected to flow to the entity. Assets can be tangible (physical) or intangible (non-physical). Examples include:

-

Current Assets: These are assets expected to be converted into cash or used within one year. Examples include:

- Cash: Money readily available for use.

- Accounts Receivable: Money owed to the company by customers.

- Inventory: Goods held for sale in the ordinary course of business.

- Prepaid Expenses: Expenses paid in advance, such as insurance or rent.

-

Non-Current Assets: These are assets expected to provide economic benefits for more than one year. Examples include:

- Property, Plant, and Equipment (PP&E): Land, buildings, machinery, and equipment.

- Intangible Assets: Patents, copyrights, trademarks, and goodwill.

- Long-term Investments: Investments held for more than one year.

Liabilities: What a Company Owes

Liabilities are present obligations of an entity arising from past events, the settlement of which is expected to result in an outflow of resources embodying economic benefits. They represent what a company owes to others. Examples include:

-

Current Liabilities: These are obligations due within one year. Examples include:

- Accounts Payable: Money owed to suppliers for goods or services received.

- Salaries Payable: Wages owed to employees.

- Short-term Loans: Loans due within one year.

- Taxes Payable: Taxes owed to the government.

-

Non-Current Liabilities: These are obligations due in more than one year. Examples include:

- Long-term Loans: Loans due in more than one year.

- Bonds Payable: Money owed to bondholders.

- Deferred Revenue: Revenue received but not yet earned.

Equity: The Owners' Stake

Equity represents the residual interest in the assets of an entity after deducting all its liabilities. It is the owners' stake in the company. For a sole proprietorship or partnership, this is simply the owner's capital. For a corporation, equity includes:

- Common Stock: The amount invested by shareholders.

- Retained Earnings: Accumulated profits that have not been distributed as dividends.

The Importance of the Accounting Equation

The accounting equation is fundamental because it:

-

Ensures the balance of the double-entry bookkeeping system: Every transaction affects at least two accounts, ensuring the equation always remains balanced. If a transaction increases an asset, it must also increase a liability or equity, or decrease another asset.

-

Provides a framework for financial statement preparation: The equation forms the basis for the balance sheet, one of the three primary financial statements.

-

Helps assess a company's financial health: By analyzing the relationship between assets, liabilities, and equity, stakeholders can gain insights into the company's financial position and solvency. A higher equity-to-liability ratio generally indicates a stronger financial position.

-

Facilitates financial analysis and decision-making: The equation is used in various financial ratios and analyses, providing valuable information for investors, creditors, and management.

Practical Applications of the Accounting Equation

Let's illustrate the accounting equation with some practical examples:

Example 1: Starting a Business

Imagine you start a business by investing $10,000 of your own money. This transaction would be recorded as follows:

- Assets (Cash): +$10,000

- Equity (Owner's Capital): +$10,000

The equation remains balanced: $10,000 = $0 + $10,000

Example 2: Purchasing Equipment

Suppose you purchase equipment for $5,000 using a $2,000 cash payment and a $3,000 loan. This involves multiple accounts:

- Assets (Equipment): +$5,000

- Assets (Cash): -$2,000

- Liabilities (Loan Payable): +$3,000

The equation remains balanced: ($5,000 - $2,000) = $3,000 + $0

Example 3: Generating Revenue and Incurring Expenses

Let's say your business generates $10,000 in revenue and incurs $6,000 in expenses. Assuming all revenue is collected in cash and all expenses are paid in cash:

- Assets (Cash): +$10,000 (Revenue) - $6,000 (Expenses) = +$4,000

- Equity (Retained Earnings): +$4,000 (Net Income)

The equation remains balanced: $X + $4000 = Y + $4000 (where X represents prior assets and Y represents prior liabilities + equity)

Common Misconceptions about the Accounting Equation

It's important to address some common misconceptions surrounding the accounting equation:

-

The equation is only applicable to large corporations: This is incorrect. The accounting equation applies to all types of businesses, regardless of size or structure.

-

Only monetary items are included: While the equation primarily deals with monetary values, it's important to remember that non-monetary items are indirectly represented through their impact on monetary values. For example, the value of goodwill reflects a non-monetary asset, but it’s represented monetarily in the accounting equation.

-

The equation is static: The equation is dynamic and changes with every transaction. It's a snapshot of the financial position at a particular point in time.

Expanding the Accounting Equation: Analyzing the Components in Detail

To gain a deeper understanding, let's analyze each component of the equation more deeply:

Assets: Careful classification of assets is critical for accurate financial reporting. Understanding the different types of assets and their liquidity is essential for assessing a company's short-term and long-term financial health.

Liabilities: A thorough understanding of liabilities is crucial for evaluating a company's solvency and its ability to meet its financial obligations. Analyzing the maturity profile of liabilities (i.e., when they are due) helps assess potential liquidity risks.

Equity: Equity analysis provides insights into the company's profitability and the return on investment for shareholders. Analyzing retained earnings helps understand the company's historical profitability and dividend policy.

The Accounting Equation and Financial Statements

The accounting equation is intrinsically linked to the balance sheet. The balance sheet presents a snapshot of a company's financial position at a specific point in time. The equation is directly reflected in the balance sheet's fundamental structure:

Assets = Liabilities + Equity

The balance sheet's assets are listed on one side, and liabilities and equity are listed on the other side. The total of assets must always equal the total of liabilities and equity.

Conclusion: Mastering the Fundamentals of Accounting

The accounting equation is more than just a formula; it’s a cornerstone of accounting principles. Understanding its components, application, and implications is paramount for anyone involved in financial management. By mastering this fundamental concept, you can gain a deeper appreciation of financial reporting, analysis, and decision-making. It serves as a solid foundation for further explorations into more advanced accounting concepts and financial analysis techniques. Continuous learning and practical application will solidify your understanding and pave the way for success in the world of finance.

Latest Posts

Latest Posts

-

Managers Can Use An Action Plan To

Mar 20, 2025

-

A Customer Associate Is Assisting A Customer

Mar 20, 2025

-

The Main Workspace Of A Windows Computer Is Called The

Mar 20, 2025

-

Using The Formula You Obtained In B 11

Mar 20, 2025

-

How To Cite A Letter In Apa

Mar 20, 2025

Related Post

Thank you for visiting our website which covers about The Accounting Equation May Be Expressed As . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.