Stockholders In A Publicly Held Corporation Have Limited Liability.

Holbox

Mar 29, 2025 · 5 min read

Table of Contents

- Stockholders In A Publicly Held Corporation Have Limited Liability.

- Table of Contents

- Stockholders in a Publicly Held Corporation Have Limited Liability: A Deep Dive

- Understanding Limited Liability

- How Limited Liability Works

- Benefits of Limited Liability for Stockholders

- Exceptions to Limited Liability: Piercing the Corporate Veil

- 1. Fraud or Misrepresentation:

- 2. Inadequate Capitalization:

- 3. Commingling of Assets:

- 4. Alter Ego Theory:

- 5. Failure to Maintain Corporate Formalities:

- Limited Liability and Different Corporate Structures

- Publicly Held Corporations:

- Privately Held Corporations (Close Corporations):

- S Corporations and LLCs:

- The Importance of Legal Counsel

- Conclusion: A Crucial Protection for Stockholders

- Latest Posts

- Latest Posts

- Related Post

Stockholders in a Publicly Held Corporation Have Limited Liability: A Deep Dive

Stockholders in publicly held corporations enjoy a crucial legal protection: limited liability. This means their personal assets are generally protected from the corporation's debts and liabilities. This article delves into the intricacies of limited liability for stockholders, exploring its benefits, limitations, and implications. We will examine different types of corporations, pierce-the-corporate-veil scenarios, and the overall significance of this principle in the world of finance and business.

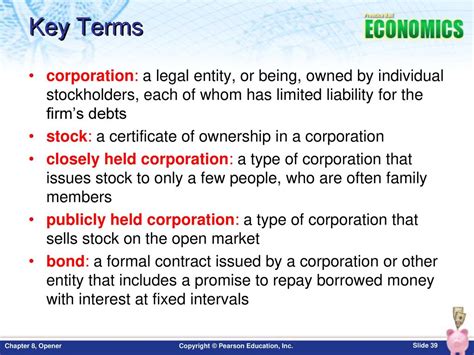

Understanding Limited Liability

The cornerstone of corporate law, limited liability shields individual stockholders from bearing the brunt of a company's financial misfortunes. Unlike sole proprietorships and partnerships where owners are personally liable for business debts, stockholders' personal assets (houses, cars, savings accounts, etc.) remain separate from the corporation's assets. This separation provides significant protection and encourages investment.

How Limited Liability Works

Limited liability functions because the corporation is treated as a separate legal entity from its owners. This means the corporation can enter into contracts, own property, and incur debts independently. If the corporation incurs debt or faces lawsuits, creditors can only pursue the corporation's assets, not the stockholders' personal assets. This principle is enshrined in various corporate laws and statutes across jurisdictions.

Benefits of Limited Liability for Stockholders

The benefits of limited liability are substantial, driving the appeal of investing in publicly held corporations:

-

Reduced Risk: Investors are shielded from potentially catastrophic financial losses. Even if the corporation faces bankruptcy, their personal wealth remains largely untouched. This reduced risk encourages broader participation in the stock market and facilitates capital formation.

-

Attracting Investment: Limited liability makes it easier for corporations to raise capital. Investors are more willing to invest in a company knowing their personal risk is limited to their investment in the company's stock.

-

Facilitating Growth: The ability to attract investment translates to greater opportunities for corporate growth and expansion. Companies can take on more ambitious projects and pursue strategic acquisitions without the fear of devastating personal liability for its shareholders.

-

Encouraging Entrepreneurship: Limited liability fosters entrepreneurship by reducing the personal financial barriers to starting and operating a business. Entrepreneurs can pursue their visions without the fear of unlimited personal liability for business debts.

Exceptions to Limited Liability: Piercing the Corporate Veil

While limited liability is a powerful protection, it's not absolute. Courts can "pierce the corporate veil," holding stockholders personally liable under specific circumstances. This typically occurs when there's evidence of:

1. Fraud or Misrepresentation:

If stockholders engage in fraudulent activities or make material misrepresentations to creditors or other parties, the court may disregard the corporate form and hold them personally liable. This often involves situations where the corporation was created specifically to commit fraud or evade obligations.

2. Inadequate Capitalization:

If a corporation is significantly undercapitalized at its inception, meaning it doesn't have enough assets to meet its foreseeable liabilities, courts may hold shareholders liable if the company fails to meet its obligations. This reflects the idea that shareholders should have reasonably anticipated the business's financial needs.

3. Commingling of Assets:

When the corporation's assets and the stockholders' personal assets are inappropriately commingled (mixed together), the distinction between the two becomes blurred. This can lead a court to disregard the corporate form and hold stockholders liable. For example, using corporate funds for personal expenses without proper documentation or record-keeping would raise serious concerns.

4. Alter Ego Theory:

If the corporation is used as a mere alter ego of the stockholder(s), meaning the corporation's actions are indistinguishable from the actions of its owners, the court may disregard the corporate form. This occurs when the corporate formalities are not followed (e.g., holding regular meetings, maintaining separate bank accounts) and the corporation acts solely as an extension of the shareholders' personal interests.

5. Failure to Maintain Corporate Formalities:

Failure to maintain proper corporate formalities, such as holding regular shareholder meetings, keeping accurate records, and maintaining separate bank accounts, can increase the likelihood of a court piercing the corporate veil. These actions blur the lines between the corporation and its shareholders, diminishing the protection of limited liability.

Limited Liability and Different Corporate Structures

The concept of limited liability applies primarily to corporations, but its application and strength can vary depending on the specific type of corporation:

Publicly Held Corporations:

These corporations have many shareholders whose shares are traded on a public stock exchange. The limited liability protection is strong in this context due to the separation between the corporation and its many shareholders.

Privately Held Corporations (Close Corporations):

In privately held corporations, with a smaller number of shareholders, the limited liability protection remains, but the risk of the corporate veil being pierced might be slightly higher due to closer relationships and less formal operations.

S Corporations and LLCs:

While S corporations and Limited Liability Companies (LLCs) offer some variations in tax treatment and operational structure, they also provide significant limited liability protection for their owners or members.

The Importance of Legal Counsel

Navigating the complexities of corporate law and limited liability requires expert guidance. Engaging legal counsel is crucial for:

-

Corporate Formation: Properly establishing the corporation with appropriate documentation and procedures can significantly strengthen the limited liability protection.

-

Maintaining Corporate Formalities: Attorneys can provide advice on maintaining proper corporate governance to minimize the risk of the corporate veil being pierced.

-

Contract Negotiation: Legal advice ensures that contracts and agreements reflect the corporation's separate legal entity status, further protecting shareholders' personal assets.

-

Litigation Defense: If a lawsuit involves a challenge to limited liability, an attorney can effectively defend against attempts to pierce the corporate veil.

Conclusion: A Crucial Protection for Stockholders

Limited liability is a fundamental tenet of corporate law that offers significant protection to stockholders in publicly held corporations. It reduces the personal risk associated with investing, attracts capital, and fuels economic growth. While the corporate veil can be pierced under specific circumstances, understanding these exceptions and adhering to proper corporate formalities are crucial for maximizing the benefits of this important legal protection. By understanding the intricacies of limited liability and seeking professional legal guidance, stockholders can safeguard their personal assets and confidently participate in the dynamic world of corporate investment. This deep understanding allows for more informed decision-making, reducing risk, and fostering a more stable and secure investment environment. The implications of limited liability extend beyond individual investors, influencing economic development, capital formation, and the overall stability of the financial system.

Latest Posts

Latest Posts

-

When Should You Decide On Your Strategic Rpa Platform

Apr 02, 2025

-

The Long Run Is Best Defined As A Time Period

Apr 02, 2025

-

An Example Of An Internal Stressor Would Be Homework Assignments

Apr 02, 2025

-

Indicate The Action Of The Highlighted Muscle Of The Eye

Apr 02, 2025

-

Peggy Accepts A Job Offer As An Advertising Copywriter

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about Stockholders In A Publicly Held Corporation Have Limited Liability. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.