Statement Of Cash Flows For Snowdrop A Limited Company

Holbox

Mar 13, 2025 · 7 min read

Table of Contents

- Statement Of Cash Flows For Snowdrop A Limited Company

- Table of Contents

- Statement of Cash Flows for Snowdrop a Limited Company: A Comprehensive Guide

- What is a Statement of Cash Flows?

- 1. Operating Activities:

- 2. Investing Activities:

- 3. Financing Activities:

- Analyzing Snowdrop's Statement of Cash Flows: A Hypothetical Example

- Interpreting Snowdrop's Cash Flow Statement

- Key Ratios Derived from the Cash Flow Statement

- Limitations of the Cash Flow Statement

- Conclusion: The Importance of Analyzing Snowdrop's Cash Flows

- Latest Posts

- Related Post

Statement of Cash Flows for Snowdrop a Limited Company: A Comprehensive Guide

Understanding a company's financial health goes beyond just looking at profits and losses. A crucial component of this understanding lies in analyzing its cash flow. This article delves deep into the Statement of Cash Flows for a hypothetical limited company, Snowdrop, illustrating the key elements, interpretations, and importance of this critical financial statement. We'll explore how analyzing cash flows can reveal insights into Snowdrop's liquidity, solvency, and overall financial strength.

What is a Statement of Cash Flows?

The Statement of Cash Flows, also known as the Cash Flow Statement, provides a detailed picture of how a company's cash has changed over a specific period (typically a quarter or a year). Unlike the income statement, which uses accrual accounting (recording revenue when earned and expenses when incurred), the cash flow statement focuses solely on actual cash inflows (money coming in) and outflows (money going out). It categorizes these cash flows into three primary activities:

1. Operating Activities:

This section reflects the cash generated or used by the company's core business operations. Examples include:

- Cash received from customers: Money received for goods sold or services rendered.

- Cash paid to suppliers: Payments for raw materials, inventory, and other operating expenses.

- Cash paid for salaries and wages: Compensation paid to employees.

- Cash paid for taxes: Income taxes and other relevant taxes paid to government authorities.

- Cash received from interest: Interest income earned on investments.

- Cash paid for interest: Interest expenses paid on loans.

For Snowdrop, a detailed analysis of operating activities might reveal, for instance, a strong increase in cash from customers due to successful marketing campaigns, offset by increased cash outflows for raw materials due to higher production volumes. Understanding these nuances provides valuable insight into the company's operational efficiency and profitability.

2. Investing Activities:

This section details cash flows related to the acquisition and disposal of long-term assets. Examples include:

- Purchase of property, plant, and equipment (PP&E): Capital expenditures on new equipment, buildings, or other long-term assets.

- Proceeds from the sale of PP&E: Cash received from selling existing assets.

- Purchase of investments: Acquisitions of securities or other investments.

- Proceeds from the sale of investments: Cash received from selling investments.

- Loans made to other entities: Providing loans to other businesses or individuals.

- Receipts from loan repayments: Cash received from the repayment of loans.

For Snowdrop, significant investing activities might involve purchasing new machinery to increase production capacity, reflecting a growth strategy. Conversely, a large outflow might indicate significant investments in research and development, potentially signaling future innovation and growth. Analyzing these activities gives a clear picture of Snowdrop's capital allocation strategies and long-term growth prospects.

3. Financing Activities:

This section focuses on cash flows related to how Snowdrop raises and repays capital. Examples include:

- Proceeds from issuing equity: Cash raised by issuing new shares to investors.

- Repurchase of equity: Cash used to buy back the company's own shares.

- Proceeds from issuing debt: Cash raised by taking out loans or issuing bonds.

- Repayment of debt: Cash used to repay loans or bonds.

- Payment of dividends: Cash paid to shareholders as dividends.

For Snowdrop, a significant inflow from financing activities could stem from securing a bank loan to fund expansion plans. Conversely, a large outflow could indicate significant debt repayments, potentially suggesting a focus on improving its financial leverage. Analyzing these activities helps assess Snowdrop's capital structure, its reliance on debt, and its ability to manage its financial obligations.

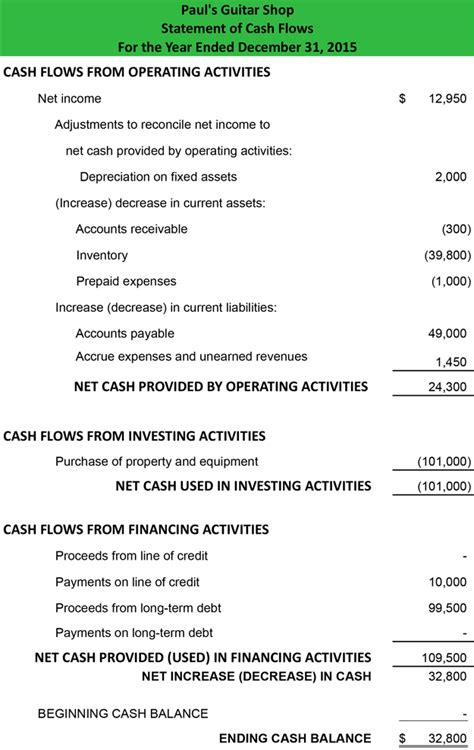

Analyzing Snowdrop's Statement of Cash Flows: A Hypothetical Example

Let's consider a hypothetical Statement of Cash Flows for Snowdrop for the fiscal year 2023:

Snowdrop Limited Company

Statement of Cash Flows

For the Year Ended December 31, 2023

(Amounts in thousands)

Cash Flow from Operating Activities:

- Net Income: $500

- Depreciation: $100

- Increase in Accounts Receivable: ($50)

- Increase in Inventory: ($20)

- Increase in Accounts Payable: $30

- Net Cash from Operating Activities: $560

Cash Flow from Investing Activities:

- Purchase of Property, Plant, and Equipment: ($200)

- Proceeds from Sale of Investments: $50

- Net Cash from Investing Activities: ($150)

Cash Flow from Financing Activities:

- Proceeds from Issuance of Debt: $100

- Repayment of Debt: ($50)

- Payment of Dividends: ($20)

- Net Cash from Financing Activities: $30

Net Increase in Cash: $440

Beginning Cash Balance: $100

Ending Cash Balance: $540

Interpreting Snowdrop's Cash Flow Statement

This hypothetical example reveals several key aspects of Snowdrop's financial health:

-

Strong Operating Cash Flow: Snowdrop generated substantial cash from its core operations ($560,000), indicating strong sales and efficient management of working capital. This is a positive sign, suggesting the business model is viable and generating sufficient cash to cover its day-to-day expenses.

-

Significant Investing Activities: The significant investment in property, plant, and equipment suggests Snowdrop is actively investing in its future growth, potentially expanding its capacity or upgrading its technology. This is a long-term investment that might not immediately generate profits but could contribute significantly to future cash flows.

-

Moderate Financing Activities: Snowdrop's financing activities show a moderate level of debt financing, with proceeds from new debt partially offset by debt repayments and dividend payments. This indicates a balanced approach to funding its operations and returning value to shareholders.

-

Positive Net Cash Increase: The net increase in cash of $440,000 reflects Snowdrop's overall strong financial position. The company generated more cash than it spent during the year, strengthening its liquidity position.

Key Ratios Derived from the Cash Flow Statement

Several key ratios can be derived from the cash flow statement to further enhance the analysis:

-

Cash Flow to Revenue Ratio: This ratio (Net Cash from Operating Activities / Revenue) measures the efficiency of generating cash from sales. A higher ratio indicates better operational efficiency.

-

Free Cash Flow: This is calculated as Net Cash from Operating Activities – Capital Expenditures. It represents the cash available to the company after covering its operating expenses and capital investments. A high free cash flow signifies strong financial health and the potential for dividends, share repurchases, or debt reduction.

-

Cash Flow Coverage Ratio: This ratio (Net Cash from Operating Activities / Total Debt Payments) shows the company's ability to meet its debt obligations using its operating cash flow. A higher ratio suggests a lower risk of default.

For Snowdrop, calculating these ratios would provide a more granular understanding of its financial strength and efficiency. For instance, a high cash flow to revenue ratio would indicate efficient operations, while a substantial free cash flow would demonstrate its ability to invest in future growth or reward shareholders.

Limitations of the Cash Flow Statement

While the statement of cash flows is a valuable tool, it's essential to acknowledge its limitations:

-

Non-Cash Transactions: The statement only reflects cash transactions, ignoring non-cash transactions such as depreciation and amortization, which are important for evaluating profitability.

-

Window Dressing: Companies might manipulate their cash flows through aggressive accounting practices, making it crucial to scrutinize the underlying details.

-

Dependence on Other Financial Statements: A complete analysis requires integrating the cash flow statement with the balance sheet and income statement to gain a comprehensive picture of the company's financial performance.

Conclusion: The Importance of Analyzing Snowdrop's Cash Flows

Analyzing Snowdrop's statement of cash flows, in conjunction with other financial statements, provides a robust assessment of its financial health. It reveals valuable insights into its operational efficiency, investment strategies, financing decisions, and overall liquidity. The strong operating cash flow, significant investment in growth, and positive net cash increase all point towards a healthy and growing company. However, it’s crucial to consider the limitations of the statement and perform a comprehensive analysis using other financial data for a complete picture. By understanding these factors, investors, creditors, and managers can make informed decisions about Snowdrop's future prospects. Regularly monitoring the statement of cash flows is essential for making sound financial decisions and ensuring the long-term sustainability of the business. The information provided here is for educational purposes and should not be considered financial advice. Consulting with a financial professional is recommended for personalized guidance.

Latest Posts

Related Post

Thank you for visiting our website which covers about Statement Of Cash Flows For Snowdrop A Limited Company . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.