Stagflation Occurs When High Inflation Combines With

Holbox

Mar 20, 2025 · 7 min read

Table of Contents

Stagflation: When High Inflation Combines with High Unemployment and Slow Economic Growth

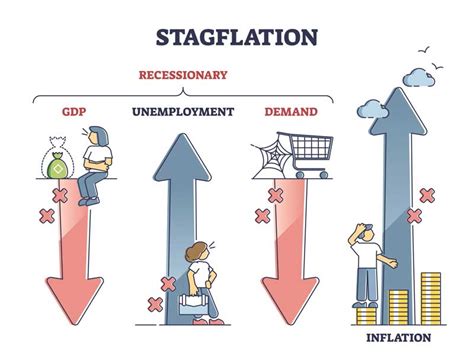

Stagflation, a portmanteau of "stagnation" and "inflation," describes a particularly nasty economic scenario. It's a period characterized by a simultaneous occurrence of slow economic growth, high unemployment, and high inflation. This seemingly paradoxical combination defies traditional economic theory, which often posits an inverse relationship between inflation and unemployment (the Phillips Curve). Understanding stagflation requires examining its causes, consequences, and potential policy responses. This article will delve deep into these aspects, providing a comprehensive overview of this challenging economic phenomenon.

The Paradox of Stagflation: Defying Traditional Economic Models

The core paradox of stagflation lies in its defiance of the Phillips Curve, a macroeconomic concept suggesting an inverse relationship between inflation and unemployment. Historically, lower unemployment rates have often been associated with higher inflation, and vice versa. This relationship stems from the idea that increased demand during periods of low unemployment pushes up prices. However, stagflation breaks this established pattern. During periods of stagflation, both inflation and unemployment are high, creating a difficult situation for policymakers. The economy stagnates, with limited growth, while prices soar, eroding purchasing power and creating widespread economic hardship.

This deviation from the traditional economic model is largely attributed to supply-side shocks, which disrupt the production and supply of goods and services. Unlike demand-pull inflation (caused by excessive demand), stagflation is often characterized by cost-push inflation, where rising production costs (e.g., energy prices, raw materials) are passed on to consumers in the form of higher prices, thereby reducing aggregate supply.

Key Characteristics of Stagflationary Periods

Several key indicators define stagflationary periods. These include:

-

High Inflation: A sustained and significant increase in the general price level of goods and services in an economy. This erodes purchasing power and reduces the value of savings.

-

High Unemployment: A significant portion of the workforce is unemployed, leading to lost income, reduced consumer spending, and increased social hardship.

-

Slow Economic Growth or Stagnation: The economy experiences little or no growth in real Gross Domestic Product (GDP), indicating a lack of overall economic progress.

-

Reduced Consumer Confidence: High inflation and unemployment erode consumer confidence, leading to decreased spending and investment, further exacerbating the economic slowdown.

-

Increased Government Debt: Governments often increase spending in attempts to stimulate the economy, leading to higher government debt levels.

Causes of Stagflation: Unraveling the Contributing Factors

The causes of stagflation are multifaceted and complex. However, several crucial factors are typically involved:

1. Supply Shocks: The Primary Culprit

Supply shocks are arguably the most significant cause of stagflation. These are unexpected events that disrupt the supply of goods and services, leading to a decrease in aggregate supply. Examples include:

-

Oil Price Shocks: Significant increases in oil prices, as seen in the 1970s, drastically increase production costs across various industries, fueling inflation. Simultaneously, reduced economic activity due to higher energy costs leads to unemployment and slower growth.

-

Natural Disasters: Major natural disasters like earthquakes, hurricanes, or floods can disrupt supply chains, leading to shortages and price increases.

-

Pandemics: Global pandemics, like the COVID-19 pandemic, can severely disrupt supply chains, leading to shortages of goods and services and a subsequent spike in prices.

2. Monetary Policy Mistakes: A Contributing Factor

Inappropriate monetary policy can exacerbate stagflation. For instance, if a central bank continues to pursue expansionary monetary policies (e.g., low interest rates, increased money supply) during periods of already high inflation, it can further fuel price increases without stimulating significant economic growth. This often leads to a situation where inflation rises without a corresponding reduction in unemployment.

3. Inefficient Government Regulations: Adding to the Problem

Excessive government regulations and interventions can stifle economic activity and contribute to stagflation. These regulations can increase production costs, reducing supply and contributing to cost-push inflation. Furthermore, inefficient regulations can hinder innovation and productivity growth, leading to slower economic growth and higher unemployment.

4. Global Economic Factors: A Wider Context

Global economic events can significantly impact a nation's susceptibility to stagflation. For example, global trade wars or financial crises can disrupt supply chains, increase uncertainty, and lead to reduced investment, all of which can contribute to stagflationary conditions.

Consequences of Stagflation: A Cascade of Negative Effects

Stagflation poses a considerable challenge to economies, leading to a range of severe consequences:

-

Reduced Living Standards: High inflation erodes purchasing power, reducing the real value of wages and incomes. This leads to a decline in living standards, especially for low- and middle-income households.

-

Increased Social Inequality: Stagflation disproportionately affects low-income individuals and households who often lack the resources to cope with rising prices and unemployment. This can widen the gap between the rich and the poor, leading to increased social inequality.

-

Political Instability: The economic hardship associated with stagflation can lead to social unrest, political instability, and even regime change. Citizens frustrated by declining living standards and lack of economic opportunity may turn to more extreme political ideologies.

-

Reduced Investment: High inflation and uncertainty discourage investment, leading to slower economic growth and reduced job creation. Businesses become hesitant to invest in new projects or expand their operations in an environment characterized by high inflation and low consumer demand.

-

Increased Government Debt: Governments often attempt to mitigate the effects of stagflation through fiscal stimulus, which increases government spending and borrowing. This can lead to unsustainable levels of government debt.

Policy Responses to Stagflation: Navigating a Difficult Terrain

Addressing stagflation requires a delicate balance of monetary and fiscal policies. There's no one-size-fits-all solution, and the effectiveness of specific policies depends on the underlying causes of the stagflation and the specific economic context. However, some potential policy responses include:

1. Supply-Side Policies: Boosting Production

Focusing on supply-side policies aims to increase the productive capacity of the economy. These include:

-

Deregulation: Reducing unnecessary regulations that increase production costs and hinder efficiency.

-

Investment in Infrastructure: Improving infrastructure (transportation, communication, energy) can lower production costs and enhance productivity.

-

Investment in Education and Training: Improving human capital through better education and training can enhance productivity and reduce unemployment.

-

Technological advancements: Fostering innovation and technological advancements can lead to increased efficiency and productivity.

2. Monetary Policy: A Cautious Approach

Monetary policy during stagflation needs a careful approach to avoid exacerbating either inflation or unemployment. The central bank might consider:

-

Targeted Interest Rate Hikes: Carefully calibrated interest rate hikes can help control inflation without significantly harming economic activity. This requires a fine balance to avoid triggering a recession.

-

Maintaining Price Stability as a Primary Goal: The primary objective should be to maintain price stability, as high and volatile inflation erodes purchasing power and increases uncertainty.

3. Fiscal Policy: Strategic Intervention

Fiscal policy choices during stagflation require careful consideration:

-

Targeted Fiscal Stimulus: Stimulus packages focused on boosting aggregate supply rather than aggregate demand can be effective. This might involve targeted tax cuts to businesses or incentives for investment in specific sectors.

-

Avoiding Excessive Government Spending: While fiscal stimulus can be beneficial, excessive government spending can worsen inflation and increase government debt.

-

Structural Reforms: Implementing structural reforms to improve the efficiency and productivity of the economy is crucial for long-term economic growth. This includes addressing issues such as labor market rigidity, tax inefficiencies, and outdated regulations.

Conclusion: Understanding and Addressing Stagflation's Complexities

Stagflation poses a severe economic challenge, demanding carefully calibrated policy responses. Its paradoxical nature – high inflation alongside high unemployment and slow growth – requires an understanding of its root causes, which often involve supply-side shocks, inappropriate monetary policies, and inefficient government regulations. Addressing stagflation necessitates a multi-pronged approach encompassing supply-side policies to boost productivity, carefully managed monetary policies to control inflation, and well-targeted fiscal policies to stimulate aggregate supply without fueling further inflation. Preventing and mitigating the consequences of stagflation requires robust economic forecasting, proactive policy measures, and a deep understanding of the intricate interplay between macroeconomic variables. The challenge lies in finding the optimal balance between controlling inflation and stimulating growth, a delicate balancing act that requires both skill and foresight.

Latest Posts

Latest Posts

-

Which Of These Would Organically Grow A Clients Instagram Followers

Mar 20, 2025

-

Two Plates Separated By Charge Are Separated To Distance D

Mar 20, 2025

-

Determine The Reactions At The Supports

Mar 20, 2025

-

The Intensity Of An Electromagnetic Wave Is 30 W M2

Mar 20, 2025

-

Hipaa Includes In Its Definition Of Research Activities Related To

Mar 20, 2025

Related Post

Thank you for visiting our website which covers about Stagflation Occurs When High Inflation Combines With . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.