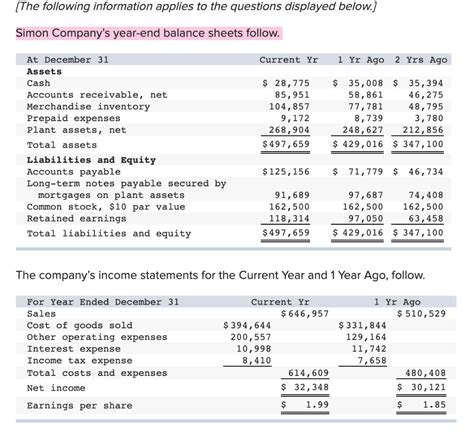

Simon Company's Year End Balance Sheets Follow

Holbox

Mar 18, 2025 · 6 min read

Table of Contents

Decoding Simon Company's Year-End Balance Sheets: A Deep Dive into Financial Health

Simon Company, a hypothetical entity for illustrative purposes, presents a compelling case study for analyzing year-end balance sheets. This in-depth analysis will dissect key aspects of its financial statements, exploring trends, ratios, and the overall health of the company. We'll examine how to interpret the balance sheet data to understand Simon Company's liquidity, solvency, and financial flexibility. This analysis aims to equip readers with the skills to perform similar analyses on real-world company financial statements. Remember, all financial data used here is hypothetical and for educational purposes only.

Understanding the Balance Sheet's Structure

Before delving into Simon Company's specific data, let's establish a firm understanding of the balance sheet's fundamental structure. The balance sheet adheres to the basic accounting equation: Assets = Liabilities + Equity. This equation emphasizes that a company's assets are financed by either liabilities (what it owes) or equity (what its owners have invested).

-

Assets: These represent what a company owns. They can be further categorized as current assets (easily converted to cash within a year) and non-current assets (long-term investments). Examples include cash, accounts receivable, inventory, property, plant, and equipment (PP&E), and intangible assets.

-

Liabilities: These are the company's obligations to others. Similar to assets, they are divided into current liabilities (due within a year) and non-current liabilities (due beyond a year). Examples include accounts payable, salaries payable, loans payable, and bonds payable.

-

Equity: This represents the owners' stake in the company. It includes contributed capital (investment from shareholders) and retained earnings (accumulated profits reinvested in the business).

Simon Company's Hypothetical Year-End Balance Sheets (2022-2024)

For this analysis, we'll use hypothetical data to represent Simon Company's balance sheets for three consecutive years: 2022, 2023, and 2024.

(Table 1: Simon Company Balance Sheets - 2022, 2023, and 2024 (in thousands))

| Item | 2022 | 2023 | 2024 |

|---|---|---|---|

| Assets | |||

| Current Assets | |||

| Cash | $100 | $120 | $150 |

| Accounts Receivable | $250 | $300 | $350 |

| Inventory | $300 | $350 | $400 |

| Total Current Assets | $650 | $770 | $900 |

| Non-Current Assets | |||

| Property, Plant & Equip. | $800 | $900 | $1000 |

| Less: Accumulated Deprec. | $200 | $250 | $300 |

| Net PP&E | $600 | $650 | $700 |

| Total Assets | $1250 | $1420 | $1600 |

| Liabilities & Equity | |||

| Current Liabilities | |||

| Accounts Payable | $200 | $220 | $250 |

| Salaries Payable | $50 | $60 | $70 |

| Total Current Liabilities | $250 | $280 | $320 |

| Non-Current Liabilities | |||

| Long-Term Debt | $400 | $350 | $300 |

| Total Liabilities | $650 | $630 | $620 |

| Equity | |||

| Common Stock | $300 | $300 | $300 |

| Retained Earnings | $300 | $490 | $680 |

| Total Equity | $600 | $790 | $980 |

| Total Liabilities & Equity | $1250 | $1420 | $1600 |

Analysis of Simon Company's Financial Position

Now, let's analyze the key aspects of Simon Company's financial health based on the presented balance sheets:

1. Liquidity Analysis:

Liquidity refers to a company's ability to meet its short-term obligations. We'll use the current ratio and the quick ratio to assess Simon Company's liquidity:

-

Current Ratio: Current Assets / Current Liabilities

- 2022: $650 / $250 = 2.6

- 2023: $770 / $280 = 2.75

- 2024: $900 / $320 = 2.81

The current ratio has consistently remained above 2, indicating a strong ability to meet short-term obligations. The slight increase over the three years suggests improved liquidity.

-

Quick Ratio: (Current Assets - Inventory) / Current Liabilities. The quick ratio is a more conservative measure as it excludes inventory, which may not be easily liquidated.

- 2022: ($650 - $300) / $250 = 1.4

- 2023: ($770 - $350) / $280 = 1.5

- 2024: ($900 - $400) / $320 = 1.56

While the quick ratio is lower than the current ratio, it still demonstrates acceptable liquidity. The gradual improvement mirrors the trend seen in the current ratio.

2. Solvency Analysis:

Solvency refers to a company's ability to meet its long-term obligations. We'll examine the debt-to-equity ratio and the times interest earned ratio to evaluate Simon Company's solvency:

-

Debt-to-Equity Ratio: Total Liabilities / Total Equity

- 2022: $650 / $600 = 1.08

- 2023: $630 / $790 = 0.80

- 2024: $620 / $980 = 0.63

The debt-to-equity ratio has significantly decreased over the three years, suggesting a substantial improvement in the company's solvency. A lower ratio indicates less reliance on debt financing.

(Note: To accurately calculate the times interest earned ratio, we would need Simon Company's income statement data, which is not provided here. This ratio measures a company's ability to cover its interest expenses with its earnings.)

3. Profitability Analysis (Indirect):

While we don't have the income statement, we can indirectly assess profitability through the balance sheet by observing the increase in retained earnings. The substantial increase in retained earnings from $300,000 in 2022 to $680,000 in 2024 strongly suggests profitability. This increase reflects successful operations and reinvestment of profits.

4. Working Capital Management:

Analyzing working capital (Current Assets - Current Liabilities) reveals how efficiently Simon Company manages its short-term resources.

- 2022: $650 - $250 = $400

- 2023: $770 - $280 = $490

- 2024: $900 - $320 = $580

The consistent and substantial increase in working capital indicates effective management of current assets and liabilities, allowing for better operational flexibility.

5. Trend Analysis:

Observing trends across the three years provides valuable insights:

- Consistent Asset Growth: Simon Company demonstrates consistent growth in both current and non-current assets, suggesting expansion and investment.

- Decreasing Debt: The reduction in long-term debt suggests a proactive approach to debt management.

- Increasing Equity: The rise in retained earnings significantly contributes to increased equity, indicating strong profitability and reinvestment.

Limitations and Further Analysis:

This analysis is based solely on the balance sheet. A comprehensive financial health assessment requires integrating information from the income statement and cash flow statement. Further analysis could include:

- Detailed Inventory Analysis: Examining inventory turnover ratios would provide insights into inventory management efficiency.

- Accounts Receivable Analysis: Analyzing the days sales outstanding (DSO) would reveal the effectiveness of credit collection policies.

- Detailed Debt Analysis: Examining the types and terms of debt would offer a more nuanced understanding of the company's financial risk.

- Industry Benchmarks: Comparing Simon Company's ratios to industry averages provides a valuable context for assessing its performance relative to its peers.

Conclusion:

Based on this hypothetical analysis, Simon Company appears to be in a strong financial position. It exhibits healthy liquidity, improving solvency, and significant profitability. The consistent growth in assets and equity, coupled with decreased debt, indicates successful management and sustainable growth. However, a complete picture requires integrating data from other financial statements and conducting a more detailed ratio analysis within the context of its industry peers. This analysis provides a framework for understanding the information contained within balance sheets and applying it to assess the financial health of any company. Remember to always conduct thorough research and utilize multiple financial statements for a comprehensive and accurate assessment.

Latest Posts

Related Post

Thank you for visiting our website which covers about Simon Company's Year End Balance Sheets Follow . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.