Revenue Should Not Be Recognized Until

Holbox

Mar 23, 2025 · 8 min read

Table of Contents

- Revenue Should Not Be Recognized Until

- Table of Contents

- Revenue Should Not Be Recognized Until… A Deep Dive into Revenue Recognition Principles

- The Core Principles of Revenue Recognition

- 1. Identify the Contract with a Customer

- 2. Identify the Separate Performance Obligations in the Contract

- 3. Determine the Transaction Price

- 4. Allocate the Transaction Price to the Separate Performance Obligations

- 5. Recognize Revenue When (or as) Each Performance Obligation is Satisfied

- Scenarios Where Revenue Recognition is Delayed or Deferred

- 1. Significant Financing Component

- 2. Performance Obligations Satisfied Over Time

- 3. Performance Obligations Satisfied at a Point in Time

- 4. Uncertainty Regarding Collection

- 5. Right of Return

- 6. Warranties

- 7. Consignment Sales

- 8. Bill and Hold Arrangements

- Conclusion: Navigating the Complexities of Revenue Recognition

- Latest Posts

- Latest Posts

- Related Post

Revenue Should Not Be Recognized Until… A Deep Dive into Revenue Recognition Principles

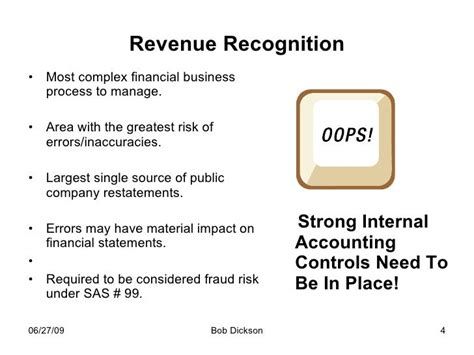

Recognizing revenue is a critical accounting process that significantly impacts a company's financial statements and overall valuation. Getting it wrong can lead to misrepresentation of financial performance, attract regulatory scrutiny, and even result in legal ramifications. Therefore, understanding the precise conditions under which revenue should be recognized is paramount for any business, regardless of size or industry. This article delves deep into the principles of revenue recognition, exploring the key criteria that must be met before revenue can be booked, and examining common scenarios where revenue recognition may be delayed or deferred.

The Core Principles of Revenue Recognition

The generally accepted accounting principles (GAAP) and the International Financial Reporting Standards (IFRS) provide a framework for revenue recognition. Both converge on the core principle that revenue should only be recognized when it is earned. This seemingly simple statement encapsulates a complex process involving several crucial elements. These elements, often referred to as the five steps to revenue recognition, are:

1. Identify the Contract with a Customer

A contract is an agreement between two or more parties that creates enforceable rights and obligations. To recognize revenue, a contract must exist that is legally enforceable and has commercially substantive terms. This means the contract must be approved by all parties involved, and it should outline the specific goods or services to be provided, the payment terms, and any other relevant conditions. A simple purchase order might not suffice as a contract in all cases; the contract needs to clearly delineate the transaction's specifics.

Key Considerations:

- Oral contracts: While oral contracts can exist, they present greater challenges for substantiation and are generally less desirable for revenue recognition purposes due to the difficulty of proving their existence and terms. Written contracts provide a much clearer and more auditable record.

- Multiple contracts: Several contracts might be bundled together and treated as a single contract, especially if they are interdependent or are intended to achieve a unified commercial objective. Careful evaluation is required to determine whether this is the case.

- Modifications to contracts: Any significant changes to an existing contract might trigger a re-evaluation of revenue recognition, particularly regarding the allocation of transaction price and the timing of revenue recognition.

2. Identify the Separate Performance Obligations in the Contract

A performance obligation is a promise in a contract to transfer a distinct good or service to a customer. A contract might include multiple performance obligations. A performance obligation is distinct if the customer can benefit from it on its own, or if it's separately identifiable from other promises in the contract. Identifying these obligations is crucial because revenue recognition is performed at the point each distinct performance obligation is satisfied.

Key Considerations:

- Bundled goods or services: If a contract involves a bundle of goods or services, they must be analyzed to determine whether each component represents a distinct performance obligation. For example, a software package with installation and training might comprise three distinct performance obligations.

- Customization: Highly customized goods or services might create several distinct performance obligations based on the different stages of the customization process.

- Integration: The degree of integration between different promises impacts their distinctness. Closely integrated components are less likely to represent separate performance obligations.

3. Determine the Transaction Price

The transaction price is the amount a company expects to be entitled to receive from a customer in exchange for transferring goods or services. This price should reflect the consideration promised in the contract and should be adjusted for variable considerations, such as discounts, rebates, or returns. Accurately estimating the transaction price is essential for appropriate revenue recognition.

Key Considerations:

- Variable consideration: Contracts often include variable considerations, such as bonuses, penalties, or discounts. Companies need to estimate the amount of variable consideration they expect to receive and adjust the transaction price accordingly. This estimation should be based on historical data, market trends, and other relevant information.

- Significant financing components: If the contract includes a significant financing component, the transaction price must be adjusted to reflect the time value of money.

- Non-cash consideration: Revenue recognition also extends to transactions where consideration isn't purely monetary. This might include stock options, property, or other non-cash assets. Appropriate valuation is necessary to determine the transaction price.

4. Allocate the Transaction Price to the Separate Performance Obligations

Once the transaction price is determined, it must be allocated to each distinct performance obligation within the contract. Allocation is typically based on the relative standalone selling prices of the individual performance obligations. If the standalone selling prices are not readily available, they must be estimated using appropriate methods.

Key Considerations:

- Market data: Market data, such as competitor pricing, provides a strong basis for estimating standalone selling prices.

- Cost-plus methods: In the absence of reliable market data, cost-plus methods, which add a margin to the cost of providing the service, can be used.

- Residual approach: The residual approach allocates the remaining transaction price to a performance obligation after allocating the price to other distinct performance obligations. This should be used with caution and only as a last resort.

5. Recognize Revenue When (or as) Each Performance Obligation is Satisfied

Revenue is recognized when (or as) each performance obligation is satisfied. Satisfaction occurs when the customer obtains control of the goods or services. Control is the ability to direct the use and obtain substantially all of the remaining benefits from the asset. This is a critical point, determining the timing of revenue recognition. For goods, this typically happens upon transfer to the customer. For services, satisfaction usually occurs over time, requiring revenue to be recognized over the performance period.

Key Considerations:

- Goods: Transfer of control typically occurs upon delivery to the customer, although the specific timing can depend on the contract terms.

- Services: Revenue recognition for services can be more complex. If the customer receives benefits over time, revenue is recognized over the performance period. If the customer receives all benefits at a single point in time, revenue is recognized then.

- Points of satisfaction: The contract often explicitly or implicitly specifies the points at which each performance obligation is satisfied.

Scenarios Where Revenue Recognition is Delayed or Deferred

Several situations might delay or defer revenue recognition. Understanding these scenarios is crucial for accurate financial reporting:

1. Significant Financing Component

If the contract involves a significant financing component, the transaction price must be discounted to reflect the time value of money. Revenue is then recognized over the period of the financing arrangement. This is frequently the case with long-term contracts or installment sales.

2. Performance Obligations Satisfied Over Time

If a performance obligation is satisfied over time, revenue is recognized proportionally as the service is provided. This necessitates a reliable method for measuring progress toward completion. This often involves the use of objective measures such as milestones, time elapsed, or resources consumed.

3. Performance Obligations Satisfied at a Point in Time

If a performance obligation is satisfied at a point in time, revenue is recognized when the customer obtains control. This usually occurs upon delivery or completion of the goods or services.

4. Uncertainty Regarding Collection

If there's significant uncertainty about the customer's ability to pay, revenue might not be recognized until the uncertainty is resolved. This often involves assessing the customer's creditworthiness and considering factors like payment history and financial condition. A high likelihood of non-payment could necessitate a delay in revenue recognition.

5. Right of Return

If there's a significant right of return, revenue might be recognized only after the return period has expired or when the return likelihood becomes low. Companies need to estimate the expected returns and adjust the revenue recognized accordingly.

6. Warranties

Warranties often accompany the sale of goods or services. Revenue should only be recognized for the sale of the good or service itself; the warranty is a separate performance obligation accounted for separately and often deferred over the warranty period.

7. Consignment Sales

In consignment sales, the seller retains ownership of the goods until they are sold by the consignee. Revenue is recognized only when the consignee sells the goods to a third party.

8. Bill and Hold Arrangements

Bill and hold arrangements involve billing a customer for goods that remain in the seller's possession. Revenue is generally not recognized until the customer obtains control of the goods. This requires demonstrating that the goods are distinct and that substantial reasons exist for the goods to remain in the seller's possession, such as customer's logistical constraints.

Conclusion: Navigating the Complexities of Revenue Recognition

Revenue recognition is a complex area of accounting that demands careful attention to detail. Failure to adhere to the principles outlined above can lead to significant financial reporting errors and potential regulatory sanctions. Understanding the five key steps and the various scenarios that might necessitate delays or deferrals is critical for accurate and compliant financial reporting. Companies should establish robust internal controls and processes to ensure that revenue is recognized appropriately, providing a reliable reflection of their financial performance. Regular review and updates of revenue recognition procedures are also essential in light of evolving business models and accounting standards. By prioritizing accuracy and transparency in revenue recognition, businesses can build credibility with investors, lenders, and regulators, fostering a strong foundation for sustained growth and success.

Latest Posts

Latest Posts

-

Ethical Behavior At Work Is Learned By

Mar 26, 2025

-

The Us Government Has Subsidized Ethanol Production Since 1978

Mar 26, 2025

-

If You Suspect Information Has Been Improperly Or Unnecessarily Classified

Mar 26, 2025

-

The Terms Multiple Sclerosis And Atherosclerosis Are Similar

Mar 26, 2025

-

Which Of The Following Inequalities Matches The Graph

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about Revenue Should Not Be Recognized Until . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.