Record The Entry To Close The Expense Accounts

Holbox

Mar 15, 2025 · 6 min read

Table of Contents

Recording Entries to Close Expense Accounts: A Comprehensive Guide

Closing the books at the end of an accounting period is a crucial step in maintaining accurate financial records. This process involves closing temporary accounts, including expense accounts, to prepare for the next accounting period. Understanding how to correctly record these closing entries is essential for accurate financial reporting and decision-making. This comprehensive guide will delve into the intricacies of closing expense accounts, providing a step-by-step process, illustrative examples, and best practices to ensure accuracy and efficiency.

Understanding the Need to Close Expense Accounts

Expense accounts track the costs incurred by a business during a specific accounting period. These accounts are temporary accounts, meaning their balances are reset to zero at the end of each period. This is unlike permanent accounts like assets, liabilities, and equity, which carry their balances forward from one period to the next. Closing expense accounts is necessary for several key reasons:

-

Accurate Financial Reporting: Accumulating expenses over multiple periods would distort the financial statements for any given period. Closing these accounts ensures that each period’s income statement accurately reflects the expenses incurred during that specific time.

-

Preparing for the Next Period: Resetting the expense accounts to zero allows for a clean start in tracking expenses for the next accounting period. This prevents confusion and ensures that the new period's financial data is accurate.

-

Determining Profitability: Closing entries allow for the accurate calculation of net income or net loss for the period. By correctly summarizing expenses, businesses can understand their profitability and make informed decisions.

-

Maintaining the Accounting Equation: The accounting equation (Assets = Liabilities + Equity) must always remain balanced. Closing temporary accounts helps maintain this balance by transferring the expense balances to retained earnings.

The Closing Entry Process: A Step-by-Step Guide

The process of closing expense accounts typically involves debiting the Income Summary account and crediting each individual expense account. Let's break down the steps involved:

Step 1: Identify all Expense Accounts

Begin by identifying all the expense accounts in your general ledger. This may include accounts like:

- Rent Expense: Costs associated with renting business premises.

- Salaries Expense: Payments made to employees.

- Utilities Expense: Costs related to electricity, water, gas, etc.

- Supplies Expense: Costs of using office supplies.

- Advertising Expense: Costs related to marketing and advertising.

- Depreciation Expense: Allocation of the cost of assets over their useful lives.

- Insurance Expense: Premiums paid for insurance coverage.

- Interest Expense: Costs associated with borrowing money.

Step 2: Calculate the Total Expenses

Once all expense accounts are identified, calculate the total amount of expenses for the period. This is done by summing up the debit balances of each expense account.

Step 3: Debit the Income Summary Account

The Income Summary account acts as a temporary holding account. It summarizes the revenue and expense accounts to determine net income or net loss. To close the expense accounts, you will debit the Income Summary account for the total amount of expenses calculated in Step 2.

Step 4: Credit Each Expense Account

For each individual expense account, you will credit the account with its debit balance. This reduces the balance of each expense account to zero.

Step 5: Post the Closing Entries

After recording the closing entries in the general journal, these entries must be posted to the general ledger. This updates the balances of the affected accounts, ensuring that the expense accounts show a zero balance and the Income Summary account reflects the total expenses.

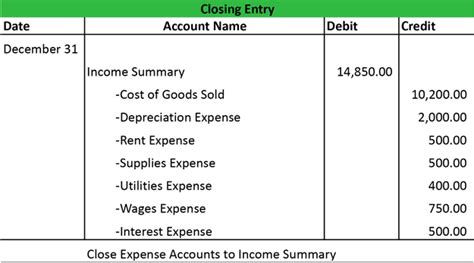

Illustrative Example

Let's illustrate the closing entry process with a simplified example. Assume the following debit balances for expense accounts at the end of the accounting period:

- Rent Expense: $2,000

- Salaries Expense: $10,000

- Utilities Expense: $1,000

- Supplies Expense: $500

The total expenses are $13,500 ($2,000 + $10,000 + $1,000 + $500). The closing entry would be:

Debit: Income Summary $13,500

Credit: Rent Expense $2,000 Credit: Salaries Expense $10,000 Credit: Utilities Expense $1,000 Credit: Supplies Expense $500

This entry reduces the balances of each expense account to zero and transfers the total expenses to the Income Summary account.

Advanced Considerations: Multiple Expense Categories and Complex Scenarios

While the basic process remains consistent, several factors can add complexity:

Handling Multiple Expense Categories

Businesses often have numerous expense accounts categorized further by department, project, or other criteria. The process remains the same; you'll simply have more credit entries, one for each expense account. Accurate categorization and detailed bookkeeping are crucial for effective analysis and reporting.

Dealing with Contra-Expense Accounts

Some accounts, like Purchase Discounts or Sales Returns and Allowances, act as contra-expense accounts. These accounts reduce the overall expense amount. These are handled differently and will usually have a debit balance at the end of the accounting period that will need to be closed with a credit to the account. Ensure accurate handling of these accounts to avoid misrepresentation of total expenses.

Impact of Adjusting Entries

Before closing the books, any necessary adjusting entries must be made. These entries adjust accounts at the end of the period to ensure that the financial statements are accurate. For example, if supplies were used during the period, a supplies expense adjusting entry would be made before closing the expense account. Failing to make necessary adjustments before closing entries will lead to inaccurate financial reports.

Using Accounting Software

Most modern accounting software automates many of these steps. Software will often generate closing entries automatically based on the balances in your general ledger. While automation is helpful, understanding the underlying principles remains crucial for accurate interpretation and troubleshooting.

Best Practices for Closing Expense Accounts

-

Accuracy is paramount: Double-check all calculations and entries to ensure accuracy. Errors in closing entries can lead to significant inaccuracies in financial reporting.

-

Maintain a clear audit trail: Document all closing entries thoroughly and maintain a clear record of each transaction and the supporting documentation.

-

Regular reconciliation: Reconcile bank statements and other accounts regularly to ensure the accuracy of your records. This helps identify potential discrepancies before they become major issues.

-

Seek professional guidance: If you're unsure about any aspect of closing entries, don't hesitate to seek professional accounting assistance.

-

Use a consistent chart of accounts: Establish and maintain a consistent chart of accounts to ensure uniformity in recording expenses across different periods.

-

Regularly review your processes: Evaluate the efficiency and accuracy of your closing processes periodically. Identify areas for improvement to increase efficiency and reduce errors.

Conclusion

Closing expense accounts is a vital part of the accounting cycle. A thorough understanding of the process and adherence to best practices are critical for accurate financial reporting, effective decision-making, and maintaining the integrity of your company's financial records. By carefully following the steps outlined above and paying attention to detail, you can ensure that your expense accounts are closed correctly and your financial statements accurately reflect your business's performance. Remember, accuracy and consistency are key to effective financial management.

Latest Posts

Latest Posts

-

An Example Of Rebating Would Be

Mar 15, 2025

-

Rn Mental Health Online Practice 2023 B

Mar 15, 2025

-

Which Of The Following Is Not A Type Of Hair

Mar 15, 2025

-

Which Compound Has The Atom With The Highest Oxidation Number

Mar 15, 2025

-

The Terms Multiple Sclerosis And Atherosclerosis Both Refer To

Mar 15, 2025

Related Post

Thank you for visiting our website which covers about Record The Entry To Close The Expense Accounts . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.