P Is The Insured On A Participating Life Policy

Holbox

Mar 26, 2025 · 6 min read

Table of Contents

- P Is The Insured On A Participating Life Policy

- Table of Contents

- P is the Insured on a Participating Life Policy: A Comprehensive Guide

- What is a Participating Life Insurance Policy?

- Key Features of Participating Policies:

- P as the Insured: Understanding the Implications

- 1. Death Benefit Recipient:

- 2. Policy Ownership:

- 3. Premium Payments:

- 4. Medical Underwriting:

- 5. Policy Control and Decisions:

- Scenarios involving P as the Insured

- Scenario 1: P is both the Insured and Policy Owner

- Scenario 2: P is the Insured, and a Spouse is the Policy Owner

- Scenario 3: P is the Insured, and a Trust is the Policy Owner

- Scenario 4: P is a Minor Insured

- Tax Implications for Participating Policies with P as Insured

- Choosing the Right Participating Policy for P

- Conclusion: Understanding P's Role is Crucial

- Latest Posts

- Latest Posts

- Related Post

P is the Insured on a Participating Life Policy: A Comprehensive Guide

Understanding the intricacies of life insurance can be daunting, especially when navigating the nuances of participating policies and the role of the insured. This comprehensive guide will delve deep into the concept of "P" being the insured on a participating life policy, exploring its implications, benefits, and potential considerations. We'll cover everything from the basic definitions to advanced scenarios, aiming to provide clarity and empower you with the knowledge to make informed decisions.

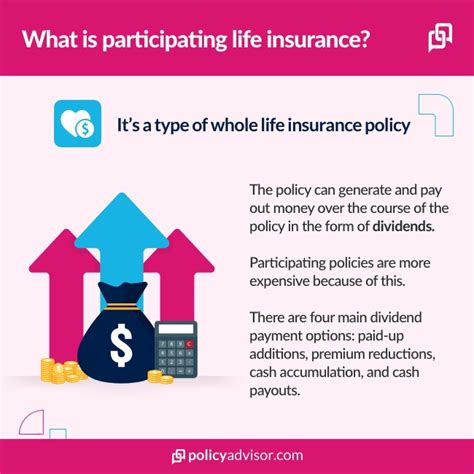

What is a Participating Life Insurance Policy?

Before we focus on "P" as the insured, let's establish a firm understanding of participating life insurance. Unlike term life insurance, which offers a death benefit for a specified period, participating policies are permanent life insurance offering lifelong coverage. Crucially, they are also participating in the insurer's profits. This means policyholders (like "P") share in the company's investment success through dividends. These dividends aren't guaranteed but represent a return on the policy's performance. They can be taken as cash, used to reduce premiums, accumulate within the policy (increasing its cash value), or applied to purchase additional paid-up insurance.

Key Features of Participating Policies:

- Cash Value: Participating policies build cash value over time, growing tax-deferred. This cash value can be borrowed against or withdrawn, offering flexibility and financial security.

- Dividends: As mentioned, the potential for dividends is a significant advantage. These are not guaranteed but represent a share of the insurer's profits.

- Higher Premiums: Generally, participating policies come with slightly higher premiums than comparable term life insurance policies due to the dividend feature and the longer-term coverage.

- Long-Term Coverage: The permanent nature of these policies ensures lifelong coverage, providing peace of mind for the insured and their beneficiaries.

P as the Insured: Understanding the Implications

Now, let's focus on the core topic: "P" as the insured. "P" simply represents the individual whose life is insured under the policy. This is a crucial element as the policy's death benefit will be paid out to the designated beneficiaries upon "P's" death. The implications of "P" being the insured are multifaceted:

1. Death Benefit Recipient:

The death benefit, the primary payout of the policy, is payable to the beneficiaries named by "P." "P" has the power to designate beneficiaries and alter these designations throughout the policy's life. This is a critical aspect of financial planning, allowing "P" to ensure their loved ones are protected. The beneficiaries could be a spouse, children, parents, or any other individual "P" chooses.

2. Policy Ownership:

While "P" is the insured, they might not necessarily be the policy owner. The policy owner is the individual who holds all rights and responsibilities associated with the policy, including paying premiums, making changes to the beneficiary designations, and accessing the policy's cash value. In some cases, "P" and the policy owner might be the same person, but this is not always the case. For instance, a spouse might own a policy on their partner’s life.

3. Premium Payments:

The policy owner is responsible for paying the premiums on the policy. If "P" is also the owner, they are directly responsible for making these payments. Failure to pay premiums will result in the policy lapsing, potentially leading to the loss of coverage and cash value accumulation. This highlights the importance of responsible financial planning and consistent premium payments.

4. Medical Underwriting:

When applying for a participating life insurance policy, "P" will undergo a medical underwriting process. This involves providing medical history, undergoing medical examinations (sometimes), and possibly providing further information to assess the risk associated with insuring "P's" life. The results of this process determine the premium rate and policy terms.

5. Policy Control and Decisions:

"P" might have some say in policy decisions, especially if they are also the owner. However, the policy owner ultimately controls the policy's direction. This includes decisions about dividend allocation, loans against cash value, and changes to beneficiary designations. This control aspect is vital in managing the policy's financial and protective features effectively.

Scenarios involving P as the Insured

Let's look at some common scenarios involving "P" as the insured, highlighting the nuances of different situations.

Scenario 1: P is both the Insured and Policy Owner

This is the most straightforward scenario. "P" is both the individual whose life is insured and the one responsible for managing the policy. They control all aspects of the policy, including premium payments, beneficiary designations, and dividend allocation. This gives them complete control over the financial protection and benefits the policy provides.

Scenario 2: P is the Insured, and a Spouse is the Policy Owner

This scenario is common, especially when estate planning is involved. The spouse ("X") owns the policy on "P's" life. "X" is responsible for paying premiums and making key decisions about the policy. This offers control and facilitates estate planning, providing "X" with the means to manage the financial implications of "P's" passing.

Scenario 3: P is the Insured, and a Trust is the Policy Owner

This is a more complex arrangement, often used for estate planning and asset protection. A trust holds the policy, managing it according to the terms outlined in the trust document. The trustee is responsible for administering the policy, and beneficiaries are designated within the trust agreement. This provides greater control over the distribution of assets after "P's" death.

Scenario 4: P is a Minor Insured

When a minor is the insured, a guardian or parent usually acts as the policy owner. This ensures that the policy is managed appropriately until the minor reaches legal adulthood. The focus is on securing financial protection for the child, with provisions made for future needs.

Tax Implications for Participating Policies with P as Insured

The tax implications of participating policies can be complex and depend on several factors, including the type of policy, the policy owner, and how dividends are treated. However, some general principles apply:

- Premiums: Premiums paid are not tax-deductible.

- Death Benefit: The death benefit paid to beneficiaries is generally tax-free.

- Cash Value Growth: Cash value grows tax-deferred, meaning taxes are only paid when withdrawn or upon death.

- Dividends: Dividends can be taxed depending on how they are used. If taken as cash, they are typically taxed as ordinary income. If they are left to accumulate or used to purchase paid-up additions, they are generally tax-deferred.

Choosing the Right Participating Policy for P

Selecting the appropriate participating policy depends on "P's" specific needs and circumstances. Factors to consider include:

- Age and Health: Younger individuals might benefit from policies with longer-term growth potential.

- Financial Goals: The policy should align with "P's" overall financial goals, considering retirement planning, estate planning, and legacy preservation.

- Risk Tolerance: Understanding the inherent risks and rewards of participating policies is crucial.

- Professional Advice: Seeking guidance from a qualified financial advisor is highly recommended.

Conclusion: Understanding P's Role is Crucial

Understanding the role of "P" as the insured on a participating life insurance policy is fundamental to effective financial planning. Whether "P" is also the owner or not, grasping the implications of this role is crucial for making informed decisions about coverage, benefits, and future financial security. This comprehensive guide has attempted to cover the essential elements, from basic definitions to complex scenarios, equipping you with the knowledge to navigate the intricacies of participating life insurance policies. Remember to always seek personalized advice from a qualified professional to determine the best course of action for your individual circumstances. Proper planning and understanding can significantly impact your financial well-being and the future security of your loved ones.

Latest Posts

Latest Posts

-

160 400 320 5 30 720

Mar 30, 2025

-

Excel 2021 In Practice Ch 3 Advanced Project 3 7

Mar 30, 2025

-

Body Cells That Respond To Insulin Include

Mar 30, 2025

-

Accurate Reporting Of Adverse Events Is Most Important For

Mar 30, 2025

-

Why Is Create Such A Popular Hootsuite Feature

Mar 30, 2025

Related Post

Thank you for visiting our website which covers about P Is The Insured On A Participating Life Policy . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.