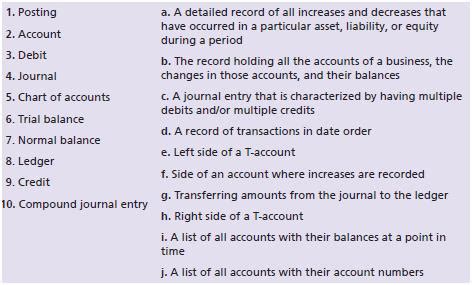

Match The Accounting Terms With The Corresponding Definitions

Holbox

Mar 17, 2025 · 8 min read

Table of Contents

Match the Accounting Terms with Their Corresponding Definitions: A Comprehensive Guide

Understanding accounting terminology is crucial for anyone involved in finance, business management, or even personal budgeting. This comprehensive guide provides a detailed explanation of key accounting terms, matching them with their accurate definitions. We'll cover fundamental concepts, crucial processes, and essential financial statements, ensuring you build a solid foundation in accounting vocabulary. By the end, you'll be confidently navigating the world of financial statements and reports.

Fundamental Accounting Terms and Concepts

Let's start with the bedrock of accounting – the core terms that underpin all financial transactions and reporting.

1. Assets:

-

Definition: Assets are resources controlled by a company as a result of past events and from which future economic benefits are expected to flow to the entity. They represent what a company owns.

-

Examples: Cash, accounts receivable (money owed to the company), inventory, equipment, land, buildings, and investments.

-

Importance: Understanding assets is paramount because they represent a company's economic resources and contribute to its overall value.

2. Liabilities:

-

Definition: Liabilities are present obligations of an entity arising from past events, the settlement of which is expected to result in an outflow of resources embodying economic benefits. Simply put, these are what a company owes.

-

Examples: Accounts payable (money owed to suppliers), salaries payable, loans payable, taxes payable, and deferred revenue (payment received for goods or services not yet delivered).

-

Importance: Liabilities show a company's financial obligations and are essential for assessing its financial stability and creditworthiness.

3. Equity (or Owner's Equity):

-

Definition: Equity represents the residual interest in the assets of an entity after deducting all its liabilities. In simpler terms, it's the owner's stake in the company.

-

Examples: For a sole proprietorship, it's the owner's capital. For a corporation, it includes common stock, retained earnings, and other contributed capital.

-

Importance: Equity shows the owners' investment in the business and the accumulated profits that haven't been distributed as dividends.

4. Accounting Equation:

-

Definition: The fundamental accounting equation is the cornerstone of double-entry bookkeeping. It states: Assets = Liabilities + Equity. This equation must always balance; every transaction affects at least two accounts.

-

Importance: The accounting equation ensures the accuracy and consistency of financial records. It's the foundation upon which all accounting transactions are recorded and reported.

5. Revenue:

-

Definition: Revenue is the income generated from the sale of goods or services. It represents the inflow of economic benefits during a specific period.

-

Examples: Sales revenue, service revenue, interest revenue, and rental revenue.

-

Importance: Revenue is a key performance indicator (KPI) indicating the success of a business in generating income from its primary operations.

6. Expenses:

-

Definition: Expenses are the costs incurred in generating revenue. They represent the outflow of economic benefits during a specific period.

-

Examples: Cost of goods sold (COGS), salaries expense, rent expense, utilities expense, marketing expense, and depreciation expense.

-

Importance: Expenses are crucial for determining profitability. Analyzing expenses helps identify areas for cost reduction and improvement in efficiency.

7. Net Income (or Profit):

-

Definition: Net income is the difference between total revenues and total expenses. It represents the profit earned during a specific period.

-

Calculation: Net Income = Total Revenues - Total Expenses

-

Importance: Net income is a critical metric used to evaluate a company's financial performance and profitability.

8. Net Loss:

-

Definition: A net loss occurs when total expenses exceed total revenues. It signifies that the business has incurred losses during a specific period.

-

Calculation: Net Loss = Total Expenses - Total Revenues

-

Importance: A net loss indicates financial difficulties and requires immediate attention to improve business operations and profitability.

Key Accounting Processes and Procedures

Understanding the processes involved in recording and reporting financial information is equally vital.

9. Debits and Credits:

-

Definition: Debits and credits are the foundation of double-entry bookkeeping. Debits increase the balance of asset, expense, and dividend accounts, while decreasing the balance of liability, equity, and revenue accounts. Credits do the opposite.

-

Importance: The debit/credit system ensures that the accounting equation always remains balanced. Every transaction requires at least one debit and one credit entry of equal value.

10. Journal Entries:

-

Definition: Journal entries are chronological records of business transactions. They detail the accounts affected and the amounts debited and credited.

-

Importance: Journal entries provide a detailed history of all financial activities, which are crucial for auditing and financial reporting.

11. General Ledger:

-

Definition: The general ledger is a collection of all the accounts used by a company. It shows the balances of each account over time.

-

Importance: The general ledger provides a centralized and organized record of all financial transactions, enabling efficient financial reporting.

12. Trial Balance:

-

Definition: A trial balance is a summary of all the general ledger accounts. It lists the debit and credit balances of each account to ensure that the debits equal the credits.

-

Importance: The trial balance helps detect errors in the recording process before preparing financial statements.

13. Adjusting Entries:

-

Definition: Adjusting entries are made at the end of an accounting period to update accounts that haven't been accurately reflected during the period.

-

Examples: Accrued revenue, accrued expenses, prepaid expenses, and depreciation.

-

Importance: Adjusting entries ensure that financial statements accurately represent the financial position and performance of the company.

14. Closing Entries:

-

Definition: Closing entries are made at the end of an accounting period to transfer the balances of temporary accounts (revenue, expense, and dividend accounts) to retained earnings.

-

Importance: Closing entries prepare the accounts for the next accounting period, ensuring a clean start and accurate financial reporting.

Essential Financial Statements

These statements summarize financial information and provide valuable insights into a company's performance and financial health.

15. Income Statement (Profit & Loss Statement):

-

Definition: The income statement reports a company's financial performance over a specific period, usually a month, quarter, or year.

-

Components: Revenues, expenses, and net income (or net loss).

-

Importance: The income statement shows the profitability of a company during a specific period.

16. Balance Sheet:

-

Definition: The balance sheet presents a company's financial position at a specific point in time. It shows the company's assets, liabilities, and equity.

-

Importance: The balance sheet displays the company's overall financial health, demonstrating its liquidity, solvency, and financial stability.

17. Statement of Cash Flows:

-

Definition: The statement of cash flows reports the movement of cash in and out of a company during a specific period.

-

Sections: Operating activities, investing activities, and financing activities.

-

Importance: This statement provides insights into a company's cash management capabilities, ability to meet its obligations, and overall financial flexibility.

18. Statement of Changes in Equity:

-

Definition: The statement of changes in equity shows the changes in the company's equity over a specific period.

-

Components: Beginning equity, net income (or net loss), dividends, and other equity changes.

-

Importance: This statement provides transparency about how equity has changed over time, helping investors understand the company's growth and financial decisions.

Advanced Accounting Terms

While the above terms are fundamental, several advanced terms are also important to understand for a more complete comprehension of accounting.

19. Depreciation:

-

Definition: Depreciation is the systematic allocation of the cost of a tangible asset over its useful life.

-

Importance: Depreciation reflects the decline in the value of an asset due to wear and tear, obsolescence, or other factors. It's a crucial non-cash expense that impacts a company’s profitability and tax liability.

20. Amortization:

-

Definition: Amortization is the systematic allocation of the cost of an intangible asset over its useful life.

-

Examples: Patents, copyrights, trademarks, and goodwill.

-

Importance: Similar to depreciation, amortization reflects the decline in the value of an intangible asset over time.

21. Accrual Accounting:

-

Definition: Accrual accounting recognizes revenues when earned and expenses when incurred, regardless of when cash is received or paid.

-

Importance: Accrual accounting provides a more accurate picture of a company's financial performance than cash accounting, aligning revenue and expense recognition with the economic substance of transactions.

22. Cash Accounting:

-

Definition: Cash accounting recognizes revenues when cash is received and expenses when cash is paid.

-

Importance: Cash accounting is simpler than accrual accounting, but it can provide a less accurate representation of financial performance. It's often used by smaller businesses.

23. Generally Accepted Accounting Principles (GAAP):

-

Definition: GAAP are the common set of accounting rules, standards, and procedures issued by the Financial Accounting Standards Board (FASB) in the United States.

-

Importance: GAAP ensures consistency and comparability in financial reporting across different companies.

24. International Financial Reporting Standards (IFRS):

-

Definition: IFRS are a set of international accounting standards issued by the International Accounting Standards Board (IASB).

-

Importance: IFRS aims to harmonize accounting practices globally, making it easier to compare financial statements from companies in different countries.

25. Audit:

-

Definition: An audit is an independent examination of a company's financial statements to ensure their accuracy and compliance with accounting standards.

-

Importance: Audits provide assurance to investors and other stakeholders that the financial information is reliable and free from material misstatements.

This comprehensive guide provides a solid foundation in accounting terminology. Understanding these terms is crucial for anyone working with financial information, whether in a business setting, personal finance, or investment management. Remember that accounting is a complex field, and continuous learning is essential to staying updated on new standards and best practices. Further research and study will solidify your understanding and allow you to navigate the world of finance with greater confidence.

Latest Posts

Latest Posts

-

Drag And Drop The Correct Response Into The Empty Box

Mar 17, 2025

-

The Criteria Retailer Must Meet To Receive

Mar 17, 2025

-

What Are The Effects Of Unanticipated Deflation

Mar 17, 2025

-

How To Cite Surveys In Mla

Mar 17, 2025

-

Wordpress Is Popular Free And Open Source

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Match The Accounting Terms With The Corresponding Definitions . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.