Match Each Situation With The Fraud Triangle Factor

Holbox

Mar 28, 2025 · 7 min read

Table of Contents

- Match Each Situation With The Fraud Triangle Factor

- Table of Contents

- Matching Fraud Situations to the Fraud Triangle Factors

- Understanding the Fraud Triangle

- Matching Situations to the Fraud Triangle Factors

- Scenario 1: The Embezzling Accountant

- Scenario 2: The Inventory Theft Ring

- Scenario 3: The Expense Report Fraud

- Scenario 4: The Insider Trading Scheme

- Scenario 5: The Payroll Fraud

- Scenario 6: The Accounts Payable Scheme

- Scenario 7: The Data Breach and Extortion

- Scenario 8: The Bid-Rigging Conspiracy

- Preventing Fraud: Addressing the Fraud Triangle

- Latest Posts

- Latest Posts

- Related Post

Matching Fraud Situations to the Fraud Triangle Factors

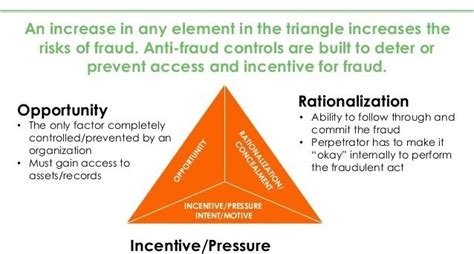

The Fraud Triangle is a foundational model in fraud examination, explaining the three factors that typically must converge for occupational fraud to occur: Opportunity, Pressure (Motivation), and Rationalization. Understanding this model is crucial for preventing and detecting fraud. This article will explore each element of the Fraud Triangle in detail, providing numerous real-world examples of fraudulent situations and explaining how each element contributes to the commission of the crime.

Understanding the Fraud Triangle

Before diving into specific scenarios, let's define each element of the Fraud Triangle:

-

Opportunity: This refers to the circumstances that allow a fraud to occur. It involves a weakness in internal controls, a lack of oversight, or a situation where an individual has access to assets or information they shouldn't. This is often the easiest element to identify and address.

-

Pressure (Motivation): This represents the internal or external pressures that incentivize someone to commit fraud. This can include financial difficulties, gambling debts, addiction, job insecurity, or pressure to meet unrealistic performance goals. This is often the most difficult element to detect proactively, as it stems from individual circumstances and pressures.

-

Rationalization: This is the mental justification that allows a person to commit a fraudulent act and reconcile it with their moral compass. They convince themselves that their actions are justified, perhaps by believing they deserve the money, that the company is unfair, or that their actions will go undetected. This element is crucial because it allows the perpetrator to overcome their ethical inhibitions.

Matching Situations to the Fraud Triangle Factors

Let's now explore various fraud scenarios and analyze how each element of the Fraud Triangle plays a role:

Scenario 1: The Embezzling Accountant

Situation: An accountant at a small business secretly diverts company funds into their personal account over several months. They use sophisticated accounting entries to mask the theft.

-

Opportunity: Weak internal controls (lack of segregation of duties, insufficient oversight of financial transactions). The accountant had unchecked access to the financial system and bank accounts.

-

Pressure (Motivation): Significant personal debt, gambling addiction, or a desire for a lavish lifestyle they couldn't otherwise afford.

-

Rationalization: The accountant may rationalize their actions by believing the company is unfair, underpaying them, or that they deserve the money due to their hard work and dedication. They might also believe the theft is inconsequential compared to the company's overall financial position.

Scenario 2: The Inventory Theft Ring

Situation: A group of warehouse employees colludes to steal inventory, selling it to outside buyers and splitting the profits.

-

Opportunity: Poor inventory management practices, lack of security cameras, infrequent physical inventory counts, and minimal employee background checks. The employees had easy access to the goods and inadequate supervision.

-

Pressure (Motivation): Low wages, financial hardships, and a desire for extra income to support their families or fund a particular lifestyle.

-

Rationalization: The employees might justify their actions by believing they are underpaid and deserve the extra income. They may also feel that the company wouldn't miss the stolen goods.

Scenario 3: The Expense Report Fraud

Situation: A sales manager repeatedly submits inflated expense reports, claiming reimbursement for fictitious expenses or exaggerating legitimate expenses.

-

Opportunity: Inadequate expense report review process, lack of independent verification, and absence of clear expense guidelines. The manager had the opportunity to submit false expenses without being closely scrutinized.

-

Pressure (Motivation): Pressure to meet sales targets, fear of job loss if sales quotas aren't met, or a personal financial crisis.

-

Rationalization: The manager might rationalize their behavior by believing it's a small amount compared to the company's overall revenue or that the company "owes" them extra compensation for their hard work and commitment.

Scenario 4: The Insider Trading Scheme

Situation: A high-level executive uses confidential company information to make profitable trades in the stock market before the information is publicly released.

-

Opportunity: Access to non-public, material information; lack of policies regarding insider trading; and weak oversight of employee trading activities.

-

Pressure (Motivation): Desire for immense wealth, greed, or a need to enhance personal financial standing quickly.

-

Rationalization: The executive may rationalize their actions by believing that everyone does it, that they deserve the profits due to their position and knowledge, or that the company wouldn’t be significantly impacted.

Scenario 5: The Payroll Fraud

Situation: A payroll clerk adds fictitious employees to the payroll, receiving the payments directly into their own account.

-

Opportunity: Lack of segregation of duties in the payroll department; absence of robust payroll verification processes; ineffective employee background checks; and weak oversight.

-

Pressure (Motivation): Significant debt, addiction, financial hardship, or the desire for quick money.

-

Rationalization: The clerk may rationalize their actions by claiming it is temporary, that they'll pay the money back, or that they are entitled to the extra compensation because of their hard work.

Scenario 6: The Accounts Payable Scheme

Situation: A purchasing manager creates fictitious vendors and submits invoices to the company for payment, pocketing the funds.

-

Opportunity: Weak internal controls over vendor creation and invoice processing, inadequate review of purchase orders and invoices, lack of independent verification of vendor legitimacy.

-

Pressure (Motivation): Financial difficulties, gambling debts, addiction, or simply the desire for additional income.

-

Rationalization: The manager might rationalize by believing the company is large enough to absorb the loss, that they are entitled to the money because of their hard work, or that the actions are temporary and will be rectified.

Scenario 7: The Data Breach and Extortion

Situation: An employee steals sensitive customer data from the company's network and demands a ransom for its return.

-

Opportunity: Weak network security, inadequate access controls, lack of employee training on cybersecurity best practices, and absence of robust data loss prevention measures.

-

Pressure (Motivation): Financial difficulties, desire for quick money, or possible involvement in a criminal organization.

-

Rationalization: The employee might rationalize by believing they are not harming anyone directly, that the company has insurance to cover losses, or that they deserve compensation for their skills and access.

Scenario 8: The Bid-Rigging Conspiracy

Situation: Several companies collude to manipulate bids on a government contract, ensuring that one of them wins and shares the profits among the conspirators.

-

Opportunity: Lack of competition in bidding processes, weak regulatory oversight, and inadequate monitoring of bidding activities.

-

Pressure (Motivation): Desire for a competitive edge, greed, and the opportunity to secure lucrative contracts.

-

Rationalization: The conspirators might believe that their actions are justified because everyone else does it, or that it is a victimless crime.

Preventing Fraud: Addressing the Fraud Triangle

Preventing fraud requires a multi-faceted approach that directly addresses each element of the Fraud Triangle. Here are some key strategies:

-

Mitigating Opportunity: Strengthening internal controls is paramount. This includes implementing segregation of duties, regular audits, robust access controls, and advanced technology such as data analytics and machine learning to identify suspicious patterns. Regular inventory counts, security cameras, and background checks are vital.

-

Reducing Pressure: Creating a supportive work environment, ensuring fair compensation and benefits, providing open communication channels for employees to voice concerns, and fostering a culture of ethics and integrity can help reduce financial and job-related pressures. Implementing a robust whistleblower protection program is essential.

-

Promoting Ethical Conduct: Regular ethics training, promoting a strong code of conduct, and providing clear guidelines and policies can help to deter fraud by addressing rationalization. Open communication channels for reporting misconduct, ethical decision-making frameworks, and anonymous reporting mechanisms are vital components.

By understanding and addressing the Fraud Triangle, organizations can significantly reduce their risk of fraud and build a culture of integrity and trust. Continuous monitoring, regular reviews of internal controls, and proactive fraud detection measures are crucial in maintaining a strong defense against fraudulent activity. The key is a holistic approach combining strong controls, fair compensation, and a focus on ethical conduct.

Latest Posts

Latest Posts

-

Which Of The Following Best Describes A Component Of Consent

Apr 01, 2025

-

Big Data Is Processed Using Relational Databases

Apr 01, 2025

-

Use Or To Compare The Following Numbers

Apr 01, 2025

-

The Roi Formula Typically Uses Blank

Apr 01, 2025

-

5x 15 20x 10

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Match Each Situation With The Fraud Triangle Factor . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.