Marginal Revenue Curve For A Price Taking Business

Holbox

Mar 10, 2025 · 7 min read

Table of Contents

The Marginal Revenue Curve for a Price-Taking Business: A Comprehensive Guide

The marginal revenue curve is a crucial concept in microeconomics, particularly for understanding the behavior of firms in different market structures. This article delves deep into the marginal revenue curve specifically for a price-taking business, also known as a perfectly competitive firm. We'll explore its characteristics, its relationship with other key economic concepts like demand, average revenue, and profit maximization, and provide practical examples to illustrate its significance.

Understanding Price-Taking Businesses

Before we dive into the marginal revenue curve, it's essential to grasp the defining characteristics of a price-taking business. These businesses operate in a perfectly competitive market, characterized by:

- Many buyers and sellers: No single buyer or seller can influence the market price.

- Homogenous products: Products offered by different firms are identical or nearly identical.

- Free entry and exit: Firms can easily enter or exit the market.

- Perfect information: Buyers and sellers have complete knowledge of market prices and product characteristics.

In such a market, individual firms are price takers. They have no power to set their own prices; they must accept the prevailing market price determined by the interaction of overall market supply and demand. This is unlike firms in monopolies or oligopolies, which have some market power to influence price.

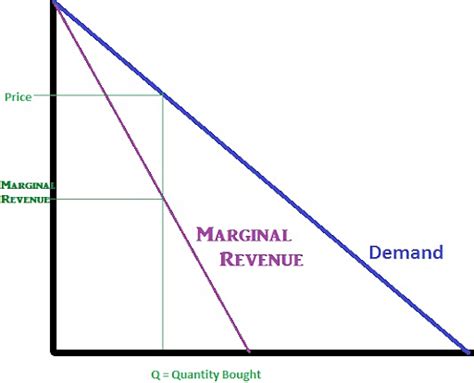

The Demand Curve for a Price-Taking Firm

Because a price-taking firm is a tiny player in a large market, its individual demand curve is perfectly elastic (horizontal). This means it can sell any quantity of its product at the prevailing market price, but it cannot sell any quantity above that price. If it attempts to charge a higher price, it will lose all its customers to competitors offering the same product at the market price.

This perfectly elastic demand curve is also the firm's average revenue (AR) curve. Average revenue is simply the total revenue divided by the quantity sold. Since the firm sells each unit at the same market price, the average revenue is always equal to the market price.

Deriving the Marginal Revenue Curve

The marginal revenue (MR) is the additional revenue a firm earns from selling one more unit of its output. For a price-taking firm, the marginal revenue is always equal to the market price. This is because each additional unit sold contributes revenue equal to the market price, without affecting the price of other units.

Therefore, the marginal revenue curve for a price-taking firm is identical to its demand curve and its average revenue curve. All three curves are horizontal lines at the prevailing market price.

Graphically:

Imagine a graph with quantity on the x-axis and price/revenue on the y-axis. The demand curve, average revenue curve, and marginal revenue curve will all be represented by a single horizontal line at the market price.

The Relationship Between Marginal Revenue, Average Revenue, and Total Revenue

Let's clarify the relationship between these three key concepts using a numerical example. Suppose the market price for a widget is $10.

| Quantity (Q) | Price (P) | Total Revenue (TR) | Average Revenue (AR) | Marginal Revenue (MR) |

|---|---|---|---|---|

| 0 | $10 | $0 | - | - |

| 1 | $10 | $10 | $10 | $10 |

| 2 | $10 | $20 | $10 | $10 |

| 3 | $10 | $30 | $10 | $10 |

| 4 | $10 | $40 | $10 | $10 |

As you can see, the average revenue remains constant at $10 (the market price), and the marginal revenue is also consistently $10. Total revenue increases linearly with the quantity sold. This is a defining characteristic of perfect competition.

Profit Maximization for a Price-Taking Firm

The marginal revenue curve plays a crucial role in determining the profit-maximizing output level for a price-taking firm. A firm maximizes its profit where its marginal revenue (MR) equals its marginal cost (MC).

- Marginal Cost (MC): This represents the additional cost of producing one more unit of output. It typically follows a U-shaped curve, reflecting initially decreasing and then increasing costs as production expands.

To find the profit-maximizing output:

- Determine the market price: This sets the horizontal MR curve.

- Find the firm's MC curve: This usually requires cost data.

- Find the intersection of MR and MC: The quantity at this intersection point represents the profit-maximizing output level.

Graphical Representation:

On the same graph showing the MR curve, plot the firm's MC curve. The point where the horizontal MR curve intersects the upward-sloping portion of the MC curve represents the profit-maximizing output. At this point, the additional revenue from selling one more unit (MR) equals the additional cost of producing it (MC).

Short-Run and Long-Run Equilibrium

The marginal revenue curve helps us understand both the short-run and long-run equilibrium of a price-taking firm:

Short-Run: In the short run, firms may earn economic profits or incur economic losses. Economic profit is the difference between total revenue and total economic cost (including opportunity cost). If the market price exceeds the average total cost (ATC) at the profit-maximizing output, the firm earns a positive economic profit. If the price is below the ATC, the firm incurs a loss, but it may still continue operating in the short run as long as the price is above the average variable cost (AVC).

Long-Run: In the long run, free entry and exit ensure that economic profits are driven to zero. If firms are earning profits, new firms will enter the market, increasing supply and lowering the market price. This process continues until the price falls to the minimum point on the ATC curve, eliminating economic profits. Conversely, if firms are incurring losses, some will exit the market, reducing supply and raising the market price. This process continues until the price rises to the minimum point on the ATC curve, eliminating losses.

Implications and Applications

Understanding the marginal revenue curve for a price-taking firm has several important implications:

- Price-taking behavior is a fundamental assumption of perfect competition models. These models provide valuable insights into market efficiency and resource allocation.

- The concept helps explain how firms react to changes in market conditions. For instance, a rise in market price leads to increased output, while a fall in price results in reduced output.

- It's an essential tool for evaluating firm performance and making informed business decisions. By analyzing cost and revenue data, firms can identify their profit-maximizing output and adjust their operations accordingly.

- The model forms a foundation for understanding more complex market structures. While not perfectly realistic, the price-taking model helps establish a benchmark against which to analyze imperfect competition.

Limitations of the Model

While the price-taking model is valuable, it's crucial to acknowledge its limitations:

- Perfect competition is a theoretical construct: Real-world markets rarely exhibit all the characteristics of perfect competition. Products may be differentiated, entry and exit might be restricted, and information may be imperfect.

- The model assumes homogenous products: In reality, many products are differentiated in terms of quality, branding, or features.

- The assumption of free entry and exit is often not fully realistic: Government regulations, high start-up costs, or other barriers can restrict entry or exit.

These limitations imply that the price-taking model offers a simplified representation of reality, particularly useful for theoretical understanding and as a baseline for comparisons with more complex market structures.

Conclusion

The marginal revenue curve for a price-taking firm, being identical to its demand and average revenue curves, is a crucial concept for understanding firm behavior under perfect competition. Its horizontal nature reflects the lack of market power of individual firms, forcing them to accept the prevailing market price. The intersection of the marginal revenue curve with the marginal cost curve determines the profit-maximizing output. While the model's assumptions are not perfectly representative of real-world markets, it provides a powerful framework for analyzing firm decisions, market dynamics, and resource allocation under competitive conditions. Understanding this concept is essential for anyone studying economics, business, or related fields. By grasping the intricacies of the marginal revenue curve in a perfectly competitive setting, one gains a solid foundation for analyzing more complex market structures and business scenarios.

Latest Posts

Latest Posts

-

Hey Mom I Finished That Book About Jennifer

Mar 10, 2025

-

Documents Are Marked With A Number And Then A Name

Mar 10, 2025

-

Relationship Management Principles Are Fundamental To

Mar 10, 2025

-

Today You Need To Complete Any Financial

Mar 10, 2025

-

How To Get Tinder Gold Free

Mar 10, 2025

Related Post

Thank you for visiting our website which covers about Marginal Revenue Curve For A Price Taking Business . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.