M Completes An Application For Life Insurance

Holbox

Mar 24, 2025 · 6 min read

Table of Contents

- M Completes An Application For Life Insurance

- Table of Contents

- M Completes an Application for Life Insurance: A Comprehensive Guide

- Understanding Your Needs: The First Step for M

- 1. What are your financial obligations?

- 2. What type of coverage is suitable for M?

- 3. How much coverage does M need?

- Completing the Application: A Step-by-Step Guide for M

- 1. Providing Personal Information:

- 2. Health Information:

- 3. Lifestyle Information:

- 4. Beneficiary Designation:

- 5. Reviewing and Signing the Application:

- The Underwriting Process: What Happens After M Submits the Application?

- 1. Medical Examination:

- 2. Medical Records Review:

- 3. Risk Assessment:

- 4. Policy Issuance:

- Factors Affecting M's Life Insurance Premiums

- Choosing the Right Life Insurance Provider for M

- Beyond the Application: Maintaining Your Policy

- Latest Posts

- Latest Posts

- Related Post

M Completes an Application for Life Insurance: A Comprehensive Guide

Applying for life insurance can feel daunting, but understanding the process can significantly ease the anxieties. This comprehensive guide walks you through the application process, focusing on the key steps and considerations involved for someone like "M" – a stand-in for any individual considering life insurance. We'll explore everything from choosing the right policy to understanding the underwriting process and beyond.

Understanding Your Needs: The First Step for M

Before M even begins the application, a crucial first step is self-assessment. This involves honestly evaluating your financial situation, dependents, and long-term goals. Several key questions need answering:

1. What are your financial obligations?

- Mortgage: Does M have a mortgage? If so, how much remains outstanding? Life insurance can help protect loved ones from this financial burden.

- Debts: Are there any outstanding loans, credit card debts, or other financial obligations? Life insurance can provide funds to settle these debts.

- Dependents: Does M have children, a spouse, or other dependents reliant on their income? Life insurance helps ensure their financial security.

- Future Plans: Does M have any significant future plans, such as children's education or retirement? Life insurance can help fund these goals.

2. What type of coverage is suitable for M?

Several types of life insurance policies cater to different needs and budgets:

- Term Life Insurance: Provides coverage for a specific period (term), typically 10, 20, or 30 years. It's generally more affordable than permanent life insurance but offers no cash value accumulation. Ideal for M if they need coverage for a specific period, such as while raising children or paying off a mortgage.

- Whole Life Insurance: Provides lifelong coverage and builds cash value that grows tax-deferred. More expensive than term life insurance, but offers long-term security and a savings component. Suitable for M if they want permanent coverage and a savings vehicle.

- Universal Life Insurance: Offers flexible premiums and death benefits, allowing M to adjust the coverage amount and premium payments as needed. Also builds cash value. A good option for M if they anticipate their financial needs changing over time.

- Variable Life Insurance: Similar to universal life insurance, but the cash value grows based on the performance of underlying investments. Involves more risk but offers the potential for higher returns. Suitable for M if they are comfortable with investment risk.

3. How much coverage does M need?

Determining the appropriate coverage amount requires careful consideration of M's financial obligations, income, and desired level of protection for dependents. Several methods can help estimate coverage needs:

- Multiple of Income Method: A common approach involves calculating coverage based on a multiple (e.g., 5-10 times) of M's annual income.

- Needs Analysis Method: A more detailed approach that assesses all financial obligations and future needs, providing a more accurate estimate of coverage required.

Completing the Application: A Step-by-Step Guide for M

Once M has determined their insurance needs and chosen a policy type, it's time to complete the application. The process usually involves several steps:

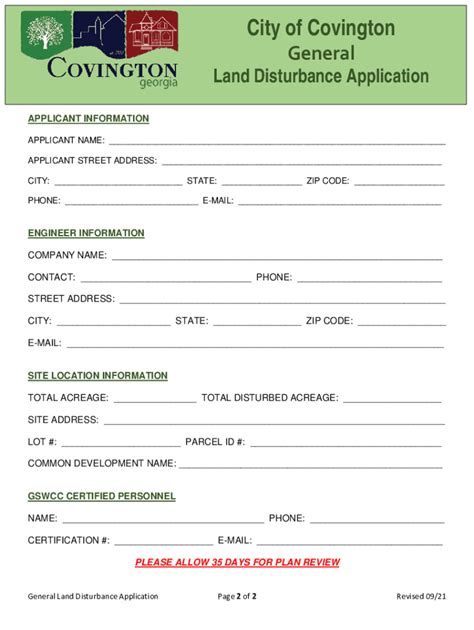

1. Providing Personal Information:

This includes basic details like M's name, address, date of birth, contact information, and Social Security number. Accuracy is crucial here, as any discrepancies can delay the process.

2. Health Information:

This section requires detailed information about M's health history, including past illnesses, surgeries, hospitalizations, and current medications. Complete and honest disclosure is essential; providing inaccurate information can lead to policy denial or even fraud charges.

3. Lifestyle Information:

Insurance companies assess risk based on lifestyle factors. M will need to provide information about their occupation, hobbies, travel habits, and tobacco use. These factors can impact the premium rates.

4. Beneficiary Designation:

M needs to specify who will receive the death benefit upon their passing. This can be a spouse, children, other family members, or a trust. Careful consideration should be given to the choice of beneficiaries.

5. Reviewing and Signing the Application:

Before submitting the application, M should thoroughly review all information for accuracy and completeness. Any errors should be corrected before signing.

The Underwriting Process: What Happens After M Submits the Application?

After M submits the application, the insurance company's underwriting department reviews the information to assess the risk. This process typically involves:

1. Medical Examination:

In many cases, M will be required to undergo a medical examination, which may include blood tests, urine tests, and a physical examination. This helps the underwriter assess M's overall health and determine the risk level.

2. Medical Records Review:

The underwriter will request M's medical records from their doctors and hospitals. This provides a comprehensive picture of M's health history.

3. Risk Assessment:

Based on the information gathered, the underwriter assesses M's risk level. This determines the premium rates and whether the application will be approved.

4. Policy Issuance:

If the application is approved, the insurance company will issue the policy to M. This marks the completion of the process.

Factors Affecting M's Life Insurance Premiums

Several factors influence the cost of M's life insurance premiums:

- Age: Younger applicants typically receive lower premiums than older applicants.

- Health: Individuals with good health generally receive lower premiums.

- Lifestyle: Health habits, such as smoking and excessive alcohol consumption, can lead to higher premiums.

- Occupation: Hazardous occupations can result in higher premiums.

- Policy Type: Different policy types have different premium structures.

- Coverage Amount: Higher coverage amounts result in higher premiums.

Choosing the Right Life Insurance Provider for M

Choosing the right life insurance provider is crucial. M should consider factors such as:

- Financial Stability: Choose a financially stable company with a strong track record.

- Customer Service: Select a company known for providing excellent customer service.

- Policy Features: Compare policy features and benefits offered by different providers.

- Reviews and Ratings: Research the company's reputation and read customer reviews.

Beyond the Application: Maintaining Your Policy

Once M has secured their life insurance policy, maintaining it is equally important:

- Regular Reviews: Review the policy periodically to ensure it still meets M's needs. Life circumstances change, and the policy may require adjustments.

- Premium Payments: Ensure timely payment of premiums to avoid policy lapse.

- Communication: Maintain open communication with the insurance provider. Notify them of any significant changes in health or lifestyle.

This comprehensive guide provides a detailed overview of the life insurance application process for M and anyone considering securing their financial future. Remember, seeking professional advice from a financial advisor is highly recommended before making any decisions. Thorough planning and understanding will ensure M secures the appropriate coverage to safeguard their loved ones.

Latest Posts

Latest Posts

-

Mass Of Sulfur In Copper Sulfide

Mar 26, 2025

-

Productivity Is The Amount Of Goods And Services

Mar 26, 2025

-

The Graph Below Shows The Monopolistically Competitive Market For Smartphones

Mar 26, 2025

-

The Norton Introduction To Literature Shorter 14th Edition

Mar 26, 2025

-

A Food Worker Prepares A Raw Fish Fillet For Cooking

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about M Completes An Application For Life Insurance . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.