Larry Recorded The Following Donations This Year

Holbox

Mar 28, 2025 · 6 min read

Table of Contents

- Larry Recorded The Following Donations This Year

- Table of Contents

- Larry Recorded the Following Donations This Year: A Comprehensive Guide to Charitable Giving and Tax Deductions

- Understanding Different Types of Charitable Donations

- 1. Cash Donations:

- 2. Non-Cash Donations:

- Best Practices for Record-Keeping:

- 1. Dedicated Donation File:

- 2. Detailed Records:

- 3. Digital Organization:

- 4. Regular Updates:

- Tax Implications for Charitable Donations:

- 1. Itemized Deductions:

- 2. Deduction Limits:

- 3. Substantiation Requirements:

- 4. Car Donations:

- 5. Non-Cash Donations of Property Held for More Than One Year:

- Avoiding Common Mistakes:

- Conclusion:

- Latest Posts

- Latest Posts

- Related Post

Larry Recorded the Following Donations This Year: A Comprehensive Guide to Charitable Giving and Tax Deductions

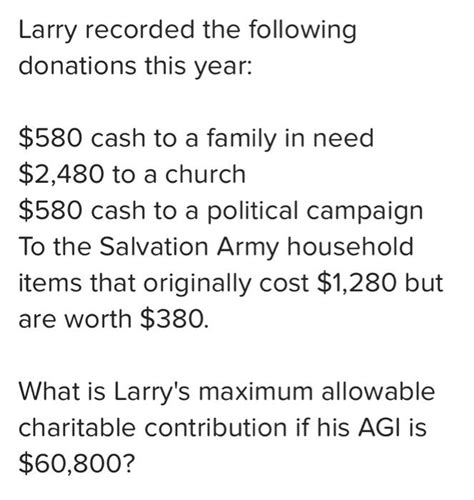

Larry, like many generous individuals, diligently recorded his donations this year. Tracking charitable contributions is crucial not only for personal record-keeping but also for maximizing potential tax benefits. This comprehensive guide delves into the intricacies of documenting charitable donations, exploring various donation types, record-keeping best practices, and the tax implications for Larry and other taxpayers. We will cover everything from cash donations to non-cash contributions, ensuring you understand how to properly document and claim deductions.

Understanding Different Types of Charitable Donations

Before diving into record-keeping, let's clarify the different types of donations Larry might have made:

1. Cash Donations:

This is the most straightforward type of donation, encompassing contributions made by:

- Check: Always obtain a cancelled check or bank statement showing the payment.

- Credit/Debit Card: Keep a copy of the credit card or debit card statement showing the transaction.

- Electronic Transfers: Print or save a confirmation of the electronic transfer from your bank or online platform.

- Cash: While possible, cash donations are less recommended due to the difficulty of proving the donation occurred. Only consider this if you received a written acknowledgment from the charity.

Important Note: For cash donations exceeding $250, you'll need a written acknowledgement from the organization, including the amount of the contribution, the date of the contribution, and a statement that no goods or services were received in return.

2. Non-Cash Donations:

Non-cash donations encompass a broader range of contributions, each with its specific documentation requirements:

-

Clothing and Household Goods: Keep a detailed list describing each item donated, its estimated fair market value (FMV), and the date of the donation. For items valued at over $500, you'll need a written appraisal from a qualified appraiser.

-

Vehicles: Similar to clothing, maintain a detailed description and FMV. You will likely need a receipt from the charity, indicating they received the vehicle and its condition. If the vehicle is sold, you'll only be able to deduct the proceeds from the sale.

-

Stocks and Securities: Obtain a brokerage statement showing the sale of securities and the contribution to charity. The deduction is typically the fair market value of the security at the time of the donation. If held for more than one year, you may also be able to deduct any capital gains taxes avoided on the appreciation in value.

-

Real Estate: This requires a professional appraisal to determine the FMV. Keep a copy of the appraisal and the deed transferring ownership to the charity.

-

Art and Collectibles: Professional appraisal is essential here. Keep detailed records, including images, provenance, and the appraisal itself.

Best Practices for Record-Keeping:

Meticulous record-keeping is crucial for Larry (and any taxpayer) to successfully claim deductions. Here’s a suggested system:

1. Dedicated Donation File:

Create a separate file (physical or digital) exclusively for charitable donation records. This ensures easy access during tax season.

2. Detailed Records:

For each donation, record:

- Date of Donation: Crucial for tracking and matching with tax documents.

- Name of Charity: Ensure the charity is a qualified 501(c)(3) organization.

- Amount of Donation: Be precise and include cents.

- Type of Donation: Cash, check, stock, goods, etc.

- Description of Non-Cash Donations: Include specific details, such as the make, model, and year of a vehicle or the description of clothing items.

- Fair Market Value (FMV): Especially important for non-cash donations; obtain appraisals when necessary.

- Acknowledgement from Charity: Keep copies of any written acknowledgements received from the charity.

3. Digital Organization:

Scan physical documents and store them digitally. Cloud storage provides an added layer of security and accessibility.

4. Regular Updates:

Maintain your records throughout the year. Don't wait until tax season to start organizing your donations.

Tax Implications for Charitable Donations:

The tax implications of Larry's charitable donations depend on several factors, primarily the type of donation and his overall income level.

1. Itemized Deductions:

Larry can only deduct charitable contributions if he itemizes his deductions instead of using the standard deduction. Itemizing is typically advantageous for taxpayers with significant itemized deductions exceeding the standard deduction amount.

2. Deduction Limits:

There are limits to the amount of charitable contributions Larry can deduct. These limits differ based on donation type and whether the contributions are to a public charity or a private foundation. For cash contributions, the deduction is limited to 60% of Larry's adjusted gross income (AGI). For non-cash contributions, the limits vary and are often dependent on factors like the appraisal value.

3. Substantiation Requirements:

As previously mentioned, specific documentation is required for different types of donations. Failing to provide proper documentation may result in the IRS rejecting the deduction claim.

4. Car Donations:

If Larry donated a car, he can deduct the lower of the car's fair market value (FMV) or the amount the charity sold the car for. If the charity sells the car for less than its FMV, Larry can deduct that amount. If the charity sells it for more than its FMV, he can only deduct the FMV. It is also important to receive a confirmation letter from the organization noting the disposition of the vehicle.

5. Non-Cash Donations of Property Held for More Than One Year:

Larry may be able to deduct the fair market value of the item at the time of contribution, even if it exceeds his cost basis. This means he may be able to deduct the full appreciated value without paying capital gains tax. However, there are certain limitations and restrictions depending on the type of asset donated.

Avoiding Common Mistakes:

Several common mistakes can jeopardize Larry's ability to claim deductions:

- Poor Record Keeping: The most frequent issue. Lack of detailed records is the leading cause of denied deductions.

- Ignoring Substantiation Requirements: Failure to obtain necessary documentation from charities can be costly.

- Overstating the Value of Non-Cash Donations: This can lead to penalties from the IRS. Always get a professional appraisal for high-value items.

- Not Itemizing: If Larry doesn't itemize, he forfeits the ability to deduct charitable contributions.

Conclusion:

Careful planning and record-keeping are essential for Larry and all taxpayers making charitable contributions. By understanding the various types of donations, adhering to best practices for record-keeping, and understanding the tax implications, Larry can ensure accurate reporting and maximize his potential tax benefits. Always consult with a tax professional if you have any questions or concerns about your specific circumstances. The information provided here is for general guidance only and is not a substitute for professional tax advice. Remember to keep accurate records, and keep a copy for your own files for at least 3 years. Proactive organization will significantly simplify the process and help you avoid potential pitfalls during tax season. Remember to always check the current IRS guidelines and regulations for the most up-to-date information on charitable deductions.

Latest Posts

Latest Posts

-

Which Of The Following Transactions Would Be Included In Gdp

Apr 01, 2025

-

A Ten Loop Coil Of Area 0 23

Apr 01, 2025

-

Chemical Reactions Occur As A Result Of

Apr 01, 2025

-

Stage Theories Hold That The Sequence Of Development Is

Apr 01, 2025

-

Which Occupation Would Most Likely Be Involved In Genome Mapping

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Larry Recorded The Following Donations This Year . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.