Joe's Retirement Savings Contributions Credit Is____.

Holbox

Mar 14, 2025 · 5 min read

Table of Contents

Joe's Retirement Savings Contributions Credit Is… A Complex Issue

Joe, a diligent worker nearing retirement, is meticulously reviewing his financial landscape. A crucial component of his planning involves understanding the intricacies of retirement savings contributions and the potential tax credits associated with them. This article delves deep into the complexities of retirement savings contribution credits, exploring various factors influencing eligibility and the potential benefits for individuals like Joe. We'll unravel the complexities, offering a comprehensive guide to maximize retirement savings and minimize tax burdens.

Understanding Retirement Savings Contribution Credits

Retirement savings contribution credits are essentially government incentives designed to encourage individuals, particularly those with lower to moderate incomes, to save for retirement. These credits aren't a single, monolithic program; instead, they're often comprised of multiple programs with varying eligibility criteria and contribution limits. The exact nature and availability of these credits depend heavily on the country and specific tax laws in place. In the US, for example, the Saver's Credit is a key program, while other countries might offer similar schemes under different names.

The Saver's Credit (United States): A Deeper Dive

The Saver's Credit in the United States is a nonrefundable tax credit that helps offset the cost of contributing to eligible retirement accounts. It's designed to encourage individuals with modest incomes to participate in retirement savings plans. Let's break down the key aspects:

Eligibility:

- Adjusted Gross Income (AGI): AGI is a crucial determinant of eligibility. The maximum AGI limits are adjusted annually, so checking the current IRS guidelines is paramount. Individuals exceeding these limits are generally ineligible.

- Age: There's generally no age restriction for contributing to eligible retirement accounts, but eligibility for the Saver's Credit is tied to contributing to these accounts.

- Filing Status: Eligibility and the credit amount can vary based on your filing status (single, married filing jointly, etc.).

- Retirement Account Type: The contributions must be made to eligible retirement plans, such as traditional or Roth IRAs, 401(k)s, and other qualified retirement plans.

Contribution Limits & Credit Calculation:

- Maximum Contribution: There's a limit on the amount of contributions that qualify for the credit. This limit is adjusted annually for inflation.

- Matching Percentage: The credit isn't a fixed percentage; instead, it's a tiered system. The percentage of contributions eligible for the credit is higher for lower-income taxpayers. This generally ranges from 50% to 10%, decreasing as AGI increases.

- Maximum Credit Amount: There's an upper limit on the total amount of credit that can be claimed. This limit is also adjusted annually.

How Joe Can Maximize His Saver's Credit

For Joe to maximize his Saver's Credit, he needs to understand the eligibility requirements and contribution limits. This involves:

- Calculating his AGI: He must accurately calculate his AGI using the IRS guidelines. This will determine his eligibility and the percentage of the credit he can receive.

- Choosing the Right Retirement Account: Contributing to a traditional IRA or Roth IRA often simplifies claiming the credit, but contributions to employer-sponsored plans (401(k)s, 403(b)s) also qualify.

- Contributing the Maximum Eligible Amount: Joe should contribute the maximum amount allowed to qualify for the highest possible credit while still staying within his income limits.

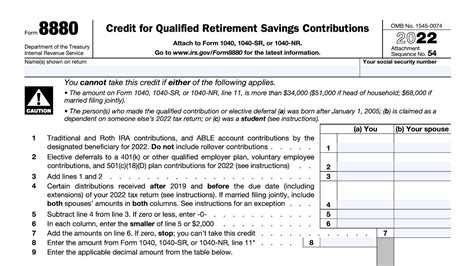

- Filing his Taxes Accurately: He must complete the appropriate tax forms (Form 8880) to claim the credit. Any errors could lead to delays or rejection of the claim.

Beyond the Saver's Credit: Other Retirement Savings Incentives

The Saver's Credit is just one example of a retirement savings incentive. Other potential benefits Joe might explore include:

- Employer Matching Contributions: Many employers offer matching contributions to employee retirement plans, effectively doubling or tripling Joe's contributions. This significantly boosts retirement savings.

- Tax-Deferred Growth: Contributions to tax-advantaged retirement plans like traditional IRAs and 401(k)s grow tax-deferred. This means that taxes are only paid upon withdrawal during retirement.

- Roth IRA Conversions: For those with higher incomes currently, converting a traditional IRA to a Roth IRA might make sense, offering tax-free growth in retirement (with potential tax implications in the year of conversion).

- State-Specific Incentives: Many states offer additional tax incentives for retirement savings, further boosting the value of Joe's contributions.

Potential Pitfalls and Considerations

While retirement savings incentives are beneficial, Joe needs to be aware of potential pitfalls:

- Income Limits: The strict income limitations of credits like the Saver's Credit can exclude higher-income earners.

- Complex Regulations: Navigating the intricate regulations and eligibility requirements can be challenging, potentially leading to errors in filing. Tax professionals can be invaluable.

- Future Tax Law Changes: Tax laws are subject to change, impacting the availability and value of these credits in the future.

- Withdrawal Penalties: Early withdrawals from many retirement accounts can result in significant tax penalties. Joe must carefully consider the long-term implications.

Planning for Retirement: A Holistic Approach

Joe's retirement planning should not solely focus on maximizing tax credits. A holistic approach is essential, encompassing:

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) helps manage risk.

- Risk Tolerance: Joe's investment strategy should align with his risk tolerance and time horizon. A longer time horizon allows for higher risk tolerance.

- Regular Review: Regularly reviewing and adjusting his portfolio is essential to adapt to changing circumstances and market conditions.

- Professional Advice: Seeking professional advice from a financial advisor or tax professional can provide valuable insights and guidance.

Conclusion: Navigating the Retirement Savings Landscape

Joe's journey to a comfortable retirement involves understanding the intricacies of retirement savings contributions and the associated tax credits. While the Saver's Credit (and its equivalents in other countries) offers significant benefits to lower and moderate-income individuals, it’s crucial to carefully consider all aspects of eligibility, contribution limits, and potential future changes. Joe, by diligently researching his options, utilizing available resources, and perhaps seeking professional financial and tax advice, can effectively navigate this complex landscape and build a secure financial future for his retirement years. Remember, planning early and consistently contributing is key to maximizing the benefits of retirement savings and enjoying a financially sound retirement. Don't underestimate the power of proactive planning and understanding the numerous resources and incentives available to help you reach your retirement goals. Understanding the intricacies of retirement savings and utilizing available credits is crucial to ensuring a secure and fulfilling retirement. The journey might seem complex, but with careful planning and informed decisions, the rewards are well worth the effort.

Latest Posts

Latest Posts

-

Which One Of The Following Statements Is Correct

Mar 14, 2025

-

Experiment 3 Radioactivity Effect Of Distance And Absorbers

Mar 14, 2025

-

Rn Targeted Medical Surgical Cardiovascular Online Practice 2023

Mar 14, 2025

-

Which Eoc Configuration Aligns With The On Scene Incident Organization

Mar 14, 2025

-

Suppose A New Technology Is Discovered Which Increases Productivity

Mar 14, 2025

Related Post

Thank you for visiting our website which covers about Joe's Retirement Savings Contributions Credit Is____. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.