Joe Adjusted Gross Income On His Form 1040 Is _______.

Holbox

Mar 16, 2025 · 6 min read

Table of Contents

- Joe Adjusted Gross Income On His Form 1040 Is _______.

- Table of Contents

- Joe's Adjusted Gross Income (AGI) on Form 1040: A Comprehensive Guide

- Understanding Adjusted Gross Income (AGI)

- Calculating Joe's AGI: A Step-by-Step Approach

- Common Above-the-Line Deductions:

- The Importance of Accurate Record Keeping

- Seeking Professional Tax Advice

- Frequently Asked Questions (FAQs)

- Latest Posts

- Latest Posts

- Related Post

Joe's Adjusted Gross Income (AGI) on Form 1040: A Comprehensive Guide

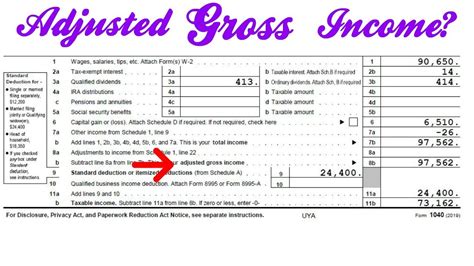

Determining Joe's Adjusted Gross Income (AGI) on his Form 1040 requires a thorough understanding of several factors. AGI isn't simply Joe's gross income; it's a crucial figure calculated by subtracting certain deductions from his gross income. This number significantly impacts his tax liability, eligibility for various tax benefits and credits, and even the amount he can deduct for certain expenses. This guide will delve into the intricacies of calculating AGI, exploring common adjustments and offering illustrative examples relevant to Joe's situation.

Understanding Adjusted Gross Income (AGI)

Adjusted Gross Income (AGI) is a critical element in the US tax system. It's the taxpayer's gross income less certain deductions above the line. These "above the line" deductions are subtracted before arriving at taxable income, unlike itemized deductions which are considered below the line. The significance of AGI lies in its influence on:

- Tax Liability: Your AGI determines your tax bracket and, consequently, the amount of tax you owe. A lower AGI generally leads to a lower tax liability.

- Eligibility for Tax Benefits: Many tax credits and deductions are based on your AGI. Falling within specific AGI thresholds can unlock valuable tax savings. Examples include the Earned Income Tax Credit (EITC), the Saver's Credit, and certain education credits.

- Deduction Limits: Some deductions are limited based on your AGI, including the medical expense deduction and the deduction for IRA contributions.

- Standard Deduction: While the standard deduction itself isn't based on AGI, the amount you can deduct is influenced by your filing status (single, married filing jointly, etc.), and AGI plays a role in determining eligibility for specific additional standard deductions.

Therefore, accurately calculating Joe's AGI is paramount to ensuring he accurately reports his income and claims all applicable tax benefits.

Calculating Joe's AGI: A Step-by-Step Approach

To determine Joe's AGI, we need to begin with his gross income. This encompasses all sources of income, including:

- Wages and Salaries: Income received from employment, including bonuses and commissions.

- Self-Employment Income: Profits from a business or freelance work.

- Interest Income: Earnings from savings accounts, bonds, and other interest-bearing investments.

- Dividend Income: Distributions from stocks and other investments.

- Capital Gains and Losses: Profits or losses from the sale of assets like stocks or real estate.

- Rental Income: Income received from renting out property.

- Pension and Annuity Income: Payments from retirement plans.

- Social Security Benefits: A portion of Social Security benefits may be taxable, depending on Joe's total income.

- Unemployment Compensation: Payments received while unemployed.

- Alimony Received (for divorces finalized before 2019): Alimony received before 2019 is considered gross income. (Note: Alimony received after 2018 is not taxable to the recipient).

Once Joe has compiled all his income sources, he can begin calculating his AGI by subtracting the following "above-the-line" deductions:

Common Above-the-Line Deductions:

- IRA Deductions: Contributions made to traditional Individual Retirement Accounts (IRAs) can be deducted, subject to limitations based on Joe's income and whether he or his spouse is covered by a retirement plan at work.

- Self-Employment Tax Deduction: Self-employed individuals can deduct one-half of the self-employment taxes they paid.

- Health Savings Account (HSA) Deduction: Contributions to an HSA can be deducted, provided Joe meets certain eligibility requirements.

- Student Loan Interest Deduction: Joe can deduct the amount he paid in student loan interest, up to a certain limit.

- Tuition and Fees Deduction (Expired): While this deduction expired after 2017, it is crucial to consider its impact if Joe's tax year includes it.

- Alimony Payments (for divorces finalized before 2019): Alimony paid before 2019 is deductible. (Note: Alimony paid after 2018 is not deductible by the payer).

- Penalty for Early Withdrawal of Savings: Penalties paid for withdrawing savings early.

- One-Half of Self-Employment Tax: This deduction is crucial for individuals who are self-employed.

- Deduction for Certain Business Expenses: Depending on Joe's business structure, there might be other deductions applicable.

Example Scenario for Joe:

Let's assume Joe's gross income is $75,000. He contributed $6,000 to his traditional IRA, paid $2,000 in student loan interest, and is self-employed with self-employment taxes totaling $4,000.

- Gross Income: $75,000

- IRA Deduction: $6,000

- Student Loan Interest Deduction: $2,000

- One-Half Self-Employment Tax Deduction: $2,000 ($4,000/2)

- Total Above-the-Line Deductions: $10,000

Joe's Adjusted Gross Income (AGI): $75,000 (Gross Income) - $10,000 (Deductions) = $65,000

The Importance of Accurate Record Keeping

Accurate record-keeping is absolutely crucial for determining Joe's AGI correctly. Joe should meticulously maintain records of all his income sources and any eligible deductions. This includes:

- W-2 Forms: From employers, detailing wages and withholdings.

- 1099 Forms: Reporting various types of income, such as interest, dividends, and freelance work.

- Receipts and Bank Statements: Supporting documentation for all expenses and income.

- Tax Returns from Previous Years: Useful for comparing income and deductions.

By keeping detailed and organized records, Joe minimizes the risk of errors and ensures he can accurately complete his tax return.

Seeking Professional Tax Advice

While this guide provides a comprehensive overview of AGI calculation, tax laws are complex and subject to change. If Joe has a complex financial situation or is unsure about any aspect of calculating his AGI, seeking advice from a qualified tax professional is highly recommended. They can provide personalized guidance and ensure Joe maximizes his tax benefits and complies with all applicable laws.

Frequently Asked Questions (FAQs)

Q1: What happens if Joe's above-the-line deductions exceed his gross income?

A1: This is not possible. Above-the-line deductions cannot reduce your AGI below zero.

Q2: How does my AGI affect my standard deduction?

A2: While the standard deduction itself isn't directly based on AGI, your AGI might impact your eligibility for certain additional standard deductions. For example, there might be additional standard deduction amounts applicable to those with certain AGI thresholds.

Q3: What if Joe forgets to claim a deduction?

A3: If Joe forgets to claim a deduction, he can file an amended tax return (Form 1040-X) to correct the error.

Q4: Does AGI affect the amount of Social Security benefits that are taxable?

A4: Yes, a portion of your Social Security benefits may be included in gross income and ultimately factored into your AGI. The amount of taxable benefits depends on your combined income (which includes your AGI) and filing status.

Q5: Are there any penalties for incorrectly calculating AGI?

A5: Yes, there can be penalties for inaccuracies on your tax return, including underpayment penalties if you owe additional taxes due to an inaccurate AGI calculation.

This comprehensive guide offers a detailed understanding of how Joe can calculate his Adjusted Gross Income (AGI) on Form 1040. Remember, accurate calculations are critical for ensuring compliance and maximizing tax benefits. Always consult with a tax professional if you have any questions or uncertainties. Accurate record-keeping and professional guidance are key to navigating the complexities of the tax system successfully.

Latest Posts

Latest Posts

-

Mistral Vs Opus Vs Sora Vs Devin

Mar 17, 2025

-

During The Breathing Task For Infants You Should

Mar 17, 2025

-

Find The Frequency F In Terahertz Of Visible Light

Mar 17, 2025

-

A School Nutritionist Was Interested In How Students

Mar 17, 2025

-

A Customer Wants To Increase His Storage Capacity By 25gb

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Joe Adjusted Gross Income On His Form 1040 Is _______. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.