Is Direct Labor A Period Cost

Holbox

Mar 27, 2025 · 6 min read

Table of Contents

- Is Direct Labor A Period Cost

- Table of Contents

- Is Direct Labor a Period Cost? A Comprehensive Guide

- What is Direct Labor?

- Product Costs vs. Period Costs: A Fundamental Distinction

- Is Direct Labor a Period Cost? The Definitive Answer: No

- Implications of Classifying Direct Labor as a Product Cost

- Direct Labor and Different Business Models

- Analyzing Direct Labor Costs: Key Metrics and Techniques

- Common Mistakes in Classifying Direct Labor

- Conclusion: Accurate Classification is Crucial

- Latest Posts

- Latest Posts

- Related Post

Is Direct Labor a Period Cost? A Comprehensive Guide

Understanding the classification of costs is crucial for accurate financial reporting and effective business management. One common area of confusion lies in differentiating between product costs and period costs, particularly when it comes to direct labor. This article will delve deep into the nature of direct labor, exploring whether it's a period cost or a product cost, and the implications of this classification for your business.

What is Direct Labor?

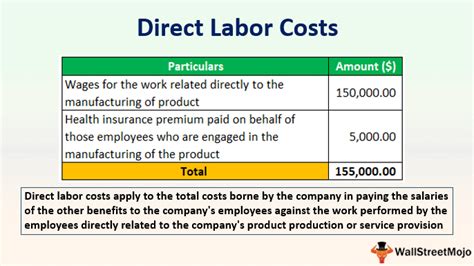

Direct labor refers to the wages and benefits paid to employees who directly work on manufacturing or producing a product or service. This is in contrast to indirect labor, which encompasses the wages of employees who support the production process but don't directly work on the product itself (e.g., factory supervisors, maintenance personnel).

Key characteristics of direct labor:

- Directly traceable: The time spent by direct labor employees can be easily and directly traced to specific products or services.

- Manufacturing-focused (for manufacturers): In manufacturing companies, direct labor is a significant component of the cost of goods sold (COGS).

- Service-based (for service industries): In service-based businesses, direct labor represents the time spent by employees directly providing the service to the client. For example, the time a consultant spends with a client is considered direct labor.

Examples of direct labor include:

- Assembly line workers in a car manufacturing plant

- Welders in a construction company

- Software developers working on a specific software project

- Hair stylists providing services to clients in a salon

- Surgeons performing operations in a hospital

Product Costs vs. Period Costs: A Fundamental Distinction

Before we address whether direct labor is a period cost, let's clearly define the two main cost categories:

Product Costs: These are costs directly associated with the production of goods or services. They're also known as inventoriable costs because they are included in the cost of inventory until the goods are sold. Product costs are expensed only when the goods are sold. They comprise:

- Direct Materials: Raw materials directly used in the production process.

- Direct Labor: The labor cost of employees directly involved in production.

- Manufacturing Overhead: All other manufacturing costs that are not easily traceable to a specific product but are necessary for production (e.g., factory rent, utilities, depreciation of factory equipment).

Period Costs: These costs are not directly tied to the production process. They are expensed in the period they are incurred, regardless of whether goods are sold or not. Examples include:

- Selling Expenses: Costs associated with marketing and selling products (e.g., advertising, sales salaries, sales commissions).

- General and Administrative Expenses: Costs associated with the overall management and administration of the business (e.g., rent for office space, salaries of administrative staff, insurance).

- Research and Development Expenses: Costs incurred in developing new products or improving existing ones.

Is Direct Labor a Period Cost? The Definitive Answer: No

Direct labor is not a period cost. It's a product cost. This is because direct labor is directly involved in the creation of a product or service. The cost of direct labor is included in the inventory valuation until the product is sold. Once the product is sold, the direct labor cost becomes part of the cost of goods sold (COGS).

Implications of Classifying Direct Labor as a Product Cost

The correct classification of direct labor as a product cost has several important implications for financial reporting and decision-making:

- Inventory Valuation: Direct labor costs are included in the value of inventory on the balance sheet. This impacts the company's assets and ultimately its profitability.

- Cost of Goods Sold (COGS): When a product is sold, the direct labor cost associated with that product is transferred from inventory to COGS on the income statement. This affects the calculation of gross profit and net income.

- Pricing Decisions: Accurate product costing, including direct labor, is critical for setting profitable prices. Underestimating direct labor costs can lead to underpricing and reduced profitability.

- Budgeting and Forecasting: Understanding the direct labor costs involved in production is vital for accurate budgeting and forecasting of future expenses.

- Performance Evaluation: Monitoring direct labor costs helps in evaluating the efficiency and productivity of the production process. Analyzing variances between actual and budgeted direct labor costs can highlight areas for improvement.

- Financial Statement Accuracy: Correct classification of costs is crucial for the accurate presentation of a company's financial position and performance in its financial statements. Misclassifying direct labor can lead to inaccurate reporting and potentially mislead stakeholders.

Direct Labor and Different Business Models

While the fundamental principle remains the same – direct labor is a product cost – its application might vary slightly across different business models:

Manufacturing: In manufacturing companies, direct labor is a prominent cost component directly attributable to the production of goods. It's intricately linked to the cost of goods manufactured and subsequently the cost of goods sold.

Service Industries: In service industries, the concept of direct labor might be slightly different. The "product" is the service rendered, and direct labor represents the time directly spent providing that service. For instance, a lawyer’s billable hours constitute direct labor, directly contributing to the cost of the service provided.

Hybrid Models: Many businesses operate on hybrid models, combining elements of manufacturing and service provision. In such cases, careful segregation of direct labor costs related to manufacturing and service delivery is crucial for accurate accounting and financial analysis.

Analyzing Direct Labor Costs: Key Metrics and Techniques

Effectively managing direct labor necessitates a thorough understanding of key metrics and analytical techniques:

- Direct Labor Rate: The cost of labor per hour or unit of output. Analyzing fluctuations in direct labor rates can reveal issues with labor efficiency or wage increases.

- Direct Labor Efficiency: A measure of how effectively labor is utilized in production. Calculating efficiency ratios helps identify areas for improvement in production processes.

- Labor Variance Analysis: Comparing budgeted direct labor costs with actual costs to identify and explain any discrepancies. This involves analyzing both price and efficiency variances.

- Activity-Based Costing (ABC): A more sophisticated costing method that assigns overhead costs (including portions indirectly related to direct labor) more accurately based on the activities consuming those resources. ABC helps gain a more precise understanding of the true cost of products or services.

Common Mistakes in Classifying Direct Labor

Incorrect classification of direct labor can have serious financial consequences. Here are some common pitfalls to avoid:

- Confusing Direct and Indirect Labor: Failing to distinguish between employees directly involved in production and those providing support services can lead to inaccurate cost allocation.

- Arbitrary Cost Allocation: Using arbitrary methods to allocate direct labor costs, instead of basing it on actual time spent on production, can distort financial reporting.

- Ignoring Fringe Benefits: Excluding employee benefits (health insurance, retirement contributions) from direct labor costs leads to an incomplete picture of true labor expenses.

Conclusion: Accurate Classification is Crucial

Understanding whether direct labor is a period cost or a product cost is fundamental to accurate financial reporting and effective business management. Direct labor is unequivocally a product cost, influencing inventory valuation, cost of goods sold, pricing decisions, and overall profitability. Careful tracking, analysis, and accurate classification of direct labor costs are crucial for optimizing business operations, making informed decisions, and ensuring the accurate presentation of financial information to stakeholders. By avoiding common mistakes and employing appropriate cost accounting techniques, businesses can leverage their understanding of direct labor costs to enhance profitability and competitiveness.

Latest Posts

Latest Posts

-

Organizations Reorganized To Empower Frontline Workers So That They

Mar 30, 2025

-

The Enzyme That Combines Co2 And Rubp Is Known As

Mar 30, 2025

-

Within The Relevant Range Variable Costs Can Be Expected To

Mar 30, 2025

-

Identify The Best Support For A Separatory Funnel

Mar 30, 2025

-

Look At The Figure Below Which Of The Following Statements

Mar 30, 2025

Related Post

Thank you for visiting our website which covers about Is Direct Labor A Period Cost . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.