Independent Auditing Can Best Be Described As

Holbox

Mar 28, 2025 · 7 min read

Table of Contents

- Independent Auditing Can Best Be Described As

- Table of Contents

- Independent Auditing: A Deep Dive into Objective Assurance

- What is Independent Auditing?

- Key Characteristics of Independent Auditing:

- The Auditing Process: A Step-by-Step Breakdown

- 1. Planning and Risk Assessment:

- 2. Internal Controls Testing:

- 3. Substantive Procedures:

- 4. Reporting:

- The Importance of Independent Auditing

- Types of Audits Beyond Financial Statement Audits

- Challenges Faced by Independent Auditors

- The Future of Independent Auditing

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

Independent Auditing: A Deep Dive into Objective Assurance

Independent auditing plays a crucial role in maintaining the integrity of financial markets and fostering public trust. It's a systematic process designed to objectively assess and verify the fairness and reliability of a company's financial statements. But what exactly is independent auditing, and why is it so important? This comprehensive guide will delve into the intricacies of independent auditing, exploring its core principles, methodologies, and significance in today's complex business landscape.

What is Independent Auditing?

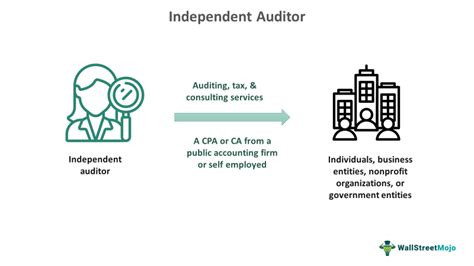

Independent auditing can best be described as an objective examination and evaluation of a company's financial records and internal controls by an independent, qualified professional. This process aims to provide assurance to stakeholders—including investors, creditors, regulators, and the public—that the financial statements present a true and fair view of the company's financial position, performance, and cash flows. Unlike internal audits conducted by a company's own employees, independent audits are performed by external auditors who have no vested interest in the company's outcomes. This independence is paramount to ensuring the credibility and impartiality of the audit.

The primary goal of independent auditing is to reduce information asymmetry. This means bridging the gap between the company's management, who have intimate knowledge of its operations, and external stakeholders who rely on the financial statements for decision-making. By providing an independent assessment, auditors enhance the reliability of the information and mitigate the risk of misleading or fraudulent reporting.

Key Characteristics of Independent Auditing:

- Independence: The auditor must be free from any influence or bias that could compromise their objectivity. This includes financial interests, personal relationships, or any other factors that could affect their judgment.

- Objectivity: Auditors must maintain a neutral and unbiased perspective, basing their conclusions solely on evidence and professional standards.

- Professional Competence: Auditors must possess the necessary skills, knowledge, and experience to conduct a thorough and effective audit. This typically requires professional qualifications and ongoing professional development.

- Due Professional Care: Auditors are expected to exercise diligence, skill, and care in performing their duties. This includes adhering to relevant auditing standards and conducting a systematic and rigorous examination.

- Confidentiality: Auditors are bound by ethical obligations to maintain the confidentiality of the information they receive during the audit process.

The Auditing Process: A Step-by-Step Breakdown

The independent audit process is a structured and methodical undertaking, typically involving several key stages:

1. Planning and Risk Assessment:

This initial phase involves understanding the client's business, industry, and internal controls. The auditor identifies potential risks of material misstatement, which are areas where the financial statements might be inaccurate or misleading. This risk assessment informs the scope and focus of the audit. Factors considered include the company's size, complexity, industry regulations, and recent changes in operations.

2. Internal Controls Testing:

Auditors evaluate the effectiveness of the client's internal controls—the processes and procedures designed to prevent and detect errors and fraud. Strong internal controls reduce the risk of material misstatement and allow the auditor to rely on the company's systems to a greater extent. Testing may involve examining documentation, observing procedures, and interviewing employees.

3. Substantive Procedures:

These are the core procedures designed to directly verify the accuracy and completeness of the financial statements. This involves testing individual transactions, balances, and disclosures. Common substantive procedures include:

- Inspection of documents: Examining supporting documentation for transactions, such as invoices, receipts, and bank statements.

- Confirmation: Obtaining direct confirmation from third parties, such as customers or banks, to verify the accuracy of information.

- Observation: Observing the client's processes and procedures to assess their effectiveness.

- Recalculation: Independently recalculating amounts and totals to ensure accuracy.

- Analytical procedures: Analyzing financial data to identify trends and anomalies that might indicate errors or fraud.

4. Reporting:

After completing the audit procedures, the auditor prepares an audit report that summarizes their findings and expresses an opinion on the fairness and reliability of the financial statements. The report typically includes:

- Auditor's opinion: This is the key element of the report, stating whether the financial statements present a true and fair view in accordance with applicable accounting standards. The opinion can be unqualified (clean), qualified (with exceptions), adverse (significantly misstated), or disclaimer of opinion (insufficient evidence).

- Basis for opinion: A description of the audit procedures performed and the scope of the audit.

- Key audit matters: For larger public companies, the report will highlight significant judgments and areas of focus during the audit.

The Importance of Independent Auditing

Independent auditing is crucial for several reasons:

- Protecting Investors and Creditors: Audits provide assurance that the financial information used by investors and creditors to make investment and lending decisions is reliable and trustworthy. This protects them from potential losses due to fraudulent or misleading financial reporting.

- Maintaining Market Integrity: Independent audits help maintain the integrity and efficiency of capital markets. Reliable financial reporting promotes investor confidence and ensures the smooth functioning of the financial system.

- Enhancing Corporate Governance: Independent audits contribute to stronger corporate governance by providing an independent assessment of management's stewardship of company resources. This helps prevent fraud and mismanagement.

- Compliance with Regulations: Many industries are subject to regulatory requirements that mandate independent audits. This ensures compliance with laws and regulations related to financial reporting and disclosure.

- Facilitating Better Decision-Making: Reliable financial information, verified through independent audits, enables more informed decision-making by stakeholders. This leads to better resource allocation and improved business outcomes.

Types of Audits Beyond Financial Statement Audits

While financial statement audits are the most common, independent auditors also conduct other types of audits, including:

- Compliance Audits: These audits assess whether an organization is adhering to specific laws, regulations, and internal policies.

- Operational Audits: These audits evaluate the efficiency and effectiveness of an organization's operations, identifying areas for improvement.

- Internal Control Audits: These audits focus specifically on assessing the design and effectiveness of an organization's internal control systems.

- Forensic Audits: These audits investigate suspected fraud or other financial irregularities.

Challenges Faced by Independent Auditors

Independent auditors operate in a dynamic and challenging environment, facing several key hurdles:

- Increasing Complexity of Business: Globalisation, technological advancements, and complex financial instruments make auditing increasingly challenging.

- Evolving Accounting Standards: Keeping abreast of the latest accounting standards and regulations requires ongoing professional development.

- Technological Advancements: Auditors must adapt to new technologies and data analytics techniques to perform efficient and effective audits.

- Fraud Detection: Detecting sophisticated fraud schemes requires specialized skills and expertise.

- Maintaining Independence: Maintaining objectivity and independence in the face of pressure from clients can be difficult.

The Future of Independent Auditing

The future of independent auditing will likely be shaped by several key factors:

- Data Analytics and Automation: The use of data analytics and automation will transform the audit process, making it more efficient and effective.

- Increased Use of Technology: Blockchain technology and other advancements will impact how auditors collect and verify data.

- Focus on Risk Management: Auditors will increasingly focus on identifying and assessing risks throughout the audit process.

- Emphasis on Transparency and Communication: Clear and transparent communication with stakeholders will be crucial.

Conclusion

Independent auditing is a cornerstone of a healthy and transparent financial system. It provides crucial assurance to stakeholders, fostering trust and confidence in the integrity of financial reporting. While the profession faces ongoing challenges, the continuous evolution of auditing practices, coupled with the increasing adoption of technology, ensures that independent auditors will continue to play a vital role in safeguarding the integrity of financial markets in the years to come. The core principles of independence, objectivity, and professional competence remain paramount, ensuring the credibility and reliability of the audits performed. The future of independent auditing promises a more efficient and effective process, powered by technology and focused on mitigating risks and fostering transparency in the business world.

Latest Posts

Latest Posts

-

In Equity Theory Employees Are Motivated To

Mar 31, 2025

-

A Gallup Poll Conducted Telephone Interviews

Mar 31, 2025

-

Increasing Inventory Turnover Rate Will Improve Profitability

Mar 31, 2025

-

Based On The Values In Cells A49

Mar 31, 2025

-

Which Structure Is Highlighted In Aqua In This Image

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Independent Auditing Can Best Be Described As . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.