Incremental Is Incremental Revenues Minus Incremental Costs.

Holbox

Mar 24, 2025 · 5 min read

Table of Contents

- Incremental Is Incremental Revenues Minus Incremental Costs.

- Table of Contents

- Incremental is Incremental Revenues Minus Incremental Costs: A Deep Dive into Profitability Analysis

- Defining Incremental Revenue and Incremental Cost

- Calculating Incremental Profit: The Core Concept

- Example: Launching a New Product

- Applications of Incremental Analysis in Business Decision-Making

- 1. Pricing Decisions

- 2. Make-or-Buy Decisions

- 3. Accepting or Rejecting Special Orders

- 4. Product Line Decisions

- 5. Investment Appraisal

- 6. Marketing and Advertising Decisions

- Pitfalls to Avoid in Incremental Analysis

- 1. Ignoring Sunk Costs

- 2. Improper Allocation of Fixed Costs

- 3. Unrealistic Projections

- 4. Neglecting Qualitative Factors

- 5. Ignoring Opportunity Costs

- Conclusion: Incremental Analysis as a Strategic Tool

- Latest Posts

- Latest Posts

- Related Post

Incremental is Incremental Revenues Minus Incremental Costs: A Deep Dive into Profitability Analysis

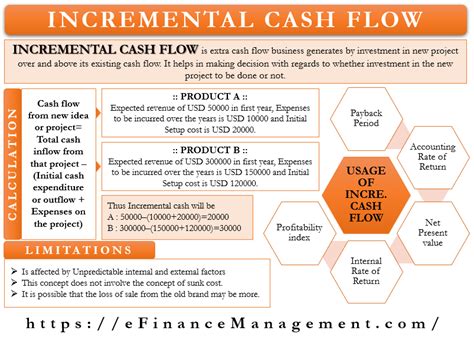

Understanding incremental revenue and incremental cost is crucial for businesses aiming to optimize profitability and make informed strategic decisions. While seemingly simple, a thorough grasp of this concept unlocks powerful insights into the true impact of various business initiatives. This article provides a comprehensive exploration of incremental analysis, its practical applications, and potential pitfalls to avoid.

Defining Incremental Revenue and Incremental Cost

Before delving deeper, let's establish clear definitions:

Incremental Revenue: This refers to the additional revenue generated from a specific business decision or action. This could be anything from launching a new product line, increasing advertising spend, or expanding into a new market. It's the difference between the total revenue after the decision and the total revenue before the decision. It's crucial to isolate the impact of the specific change; other external factors must be considered and factored out as much as possible.

Incremental Cost: Similarly, incremental cost represents the additional costs incurred as a direct result of the same decision or action. These could include manufacturing costs for new products, marketing expenses for a new campaign, or operational costs associated with market expansion. Again, it’s the difference in total cost before and after the implementation of the change. It's essential to accurately track and attribute all associated costs to avoid an inaccurate assessment.

Calculating Incremental Profit: The Core Concept

The core of incremental analysis lies in calculating incremental profit, which is simply the difference between incremental revenue and incremental cost:

Incremental Profit = Incremental Revenue - Incremental Cost

A positive incremental profit indicates that the decision was financially sound, adding value to the business. A negative incremental profit signals that the decision reduced overall profitability. This seemingly basic calculation holds immense strategic importance.

Example: Launching a New Product

Let's illustrate with a concrete example. Imagine a company currently selling 10,000 units of its existing product at $50 per unit, generating $500,000 in revenue. Their total costs are $300,000, resulting in a profit of $200,000. They decide to launch a new product.

- Scenario 1: Successful Launch

After launching the new product, they sell 2,000 units at $40 each, adding $80,000 to their revenue. The new product incurred additional costs (manufacturing, marketing, etc.) of $25,000.

- Incremental Revenue: $80,000

- Incremental Cost: $25,000

- Incremental Profit: $80,000 - $25,000 = $55,000

In this scenario, the new product significantly contributed to increased profitability.

- Scenario 2: Unsuccessful Launch

Let’s say the new product only sells 500 units at $40 each, generating $20,000 in additional revenue. The same $25,000 in costs were incurred.

- Incremental Revenue: $20,000

- Incremental Cost: $25,000

- Incremental Profit: $20,000 - $25,000 = -$5,000

Here, the new product resulted in a loss, reducing overall profitability. This demonstrates the crucial role of incremental analysis in evaluating new ventures.

Applications of Incremental Analysis in Business Decision-Making

Incremental analysis is a versatile tool applicable to numerous business scenarios. Here are some key applications:

1. Pricing Decisions

Determining optimal pricing strategies frequently utilizes incremental analysis. A company might assess the impact of a price increase or decrease on both revenue and cost to predict the effect on profit. This involves carefully considering the price elasticity of demand – how much the quantity demanded changes in response to price fluctuations.

2. Make-or-Buy Decisions

Businesses often face the choice of manufacturing a product in-house (making) or outsourcing its production (buying). Incremental analysis helps determine the more cost-effective option by comparing incremental costs of each scenario.

3. Accepting or Rejecting Special Orders

When a company receives a one-time order with different pricing terms than usual, incremental analysis helps evaluate whether accepting the order will contribute positively to profit. This involves focusing solely on the incremental revenue and costs associated with this specific order.

4. Product Line Decisions

Companies frequently analyze whether to discontinue or add product lines. Incremental analysis provides a structured way to assess the potential impact on overall profitability. This requires carefully identifying all incremental revenues and costs, both positive and negative.

5. Investment Appraisal

Before making capital investments, like purchasing new equipment or expanding facilities, businesses use incremental analysis to predict the impact of the investment on future profits. This often involves projecting future incremental revenues and costs over the investment's lifetime.

6. Marketing and Advertising Decisions

Deciding on the optimal level of marketing and advertising spend also benefits from incremental analysis. By comparing the incremental costs of different marketing strategies to their resulting incremental revenues, companies can make data-driven choices.

Pitfalls to Avoid in Incremental Analysis

While powerful, incremental analysis has potential pitfalls:

1. Ignoring Sunk Costs

Sunk costs are past expenditures that cannot be recovered. They should be completely excluded from incremental analysis. Focusing on sunk costs leads to biased and inaccurate decisions.

2. Improper Allocation of Fixed Costs

Carefully allocating fixed costs is crucial. While some fixed costs might be unaffected by a decision, others might be influenced indirectly. Accurate allocation ensures the analysis reflects the true impact.

3. Unrealistic Projections

Relying on overly optimistic or pessimistic projections will result in flawed conclusions. Using realistic and data-driven forecasts is vital for meaningful results.

4. Neglecting Qualitative Factors

Incremental analysis primarily focuses on quantitative aspects. However, strategic decisions often involve qualitative factors like brand image, customer satisfaction, and long-term market position. These must be considered alongside the numerical analysis.

5. Ignoring Opportunity Costs

Opportunity costs represent the potential benefits foregone by choosing one option over another. Ignoring these costs can lead to an incomplete and potentially misleading analysis.

Conclusion: Incremental Analysis as a Strategic Tool

Incremental analysis is a powerful tool for data-driven decision-making across various business functions. By systematically comparing incremental revenues and incremental costs, companies can gain valuable insights into the true profitability of strategic decisions. However, careful consideration of potential pitfalls, including the correct treatment of sunk costs and accurate allocation of fixed costs, is essential for deriving meaningful and reliable conclusions. Remember that while numerical data is key, a holistic approach incorporating qualitative factors ensures a well-rounded and informed strategic approach. By mastering incremental analysis, businesses can enhance their profitability and build a robust foundation for sustainable growth. Consistent application and refinement of this technique will yield significant long-term benefits.

Latest Posts

Latest Posts

-

Identify And Select Flash Memory Cards

Mar 29, 2025

-

Juniper Company Uses A Perpetual Inventory System

Mar 29, 2025

-

The Purification Of Hydrogen Gas Is Possible By Diffusion

Mar 29, 2025

-

8 4 Absolute Dating Of Rocks And Fossils

Mar 29, 2025

-

Why Is The Psychodynamic Model Difficult To Research

Mar 29, 2025

Related Post

Thank you for visiting our website which covers about Incremental Is Incremental Revenues Minus Incremental Costs. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.