In Monopolistically Competitive Markets Free Entry And Exit Suggests That

Holbox

Mar 27, 2025 · 6 min read

Table of Contents

- In Monopolistically Competitive Markets Free Entry And Exit Suggests That

- Table of Contents

- In Monopolistically Competitive Markets, Free Entry and Exit Suggests… Zero Economic Profit in the Long Run

- Understanding Monopolistic Competition

- The Short Run: Potential for Economic Profit

- The Long Run: The Impact of Free Entry and Exit

- The Role of Free Exit

- Efficiency Implications of Monopolistic Competition

- The Dynamic Nature of Monopolistic Competition

- Comparing Monopolistic Competition to Other Market Structures

- Conclusion: The Significance of Free Entry and Exit

- Latest Posts

- Latest Posts

- Related Post

In Monopolistically Competitive Markets, Free Entry and Exit Suggests… Zero Economic Profit in the Long Run

Monopolistic competition, a market structure blending elements of both perfect competition and monopoly, presents a fascinating dynamic regarding firm profitability. Unlike perfectly competitive markets where firms earn zero economic profit in the long run, and monopolies where firms can potentially earn significant economic profits indefinitely, monopolistically competitive markets offer a unique equilibrium. The key to understanding this equilibrium lies in the interplay of free entry and exit of firms. This article will delve deep into this interplay, exploring its implications for pricing, output, and the overall efficiency of the market.

Understanding Monopolistic Competition

Before analyzing the impact of free entry and exit, let's establish a firm understanding of monopolistic competition itself. This market structure is characterized by:

- Many buyers and sellers: A large number of firms compete, preventing any single firm from dominating the market.

- Differentiated products: Firms offer products that are similar but not identical. This differentiation can be based on brand, quality, features, or location. This is the crucial difference between monopolistic competition and perfect competition.

- Relatively low barriers to entry and exit: Firms can enter or leave the market with relative ease, although not as freely as in perfect competition. This is a key factor influencing long-run profitability.

- Downward-sloping demand curve: Due to product differentiation, each firm faces a downward-sloping demand curve, unlike the perfectly elastic demand curve faced by firms in perfect competition. This allows firms to have some degree of price control.

The Short Run: Potential for Economic Profit

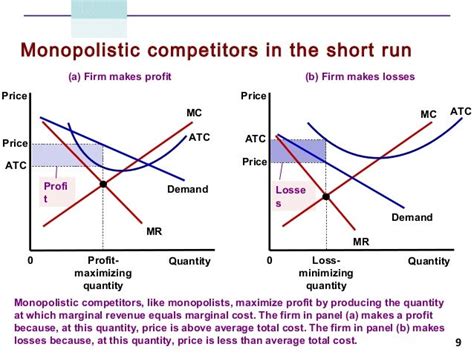

In the short run, a monopolistically competitive firm can earn economic profit. This happens when the firm's average revenue (AR) exceeds its average total cost (ATC) at the profit-maximizing output level (where marginal revenue (MR) equals marginal cost (MC)). The firm's ability to differentiate its product allows it to charge a price above its marginal cost, leading to potential profit. This profit, however, is not guaranteed and depends on the firm's success in differentiating its product and attracting customers. The firm's demand curve, although downward-sloping, is still relatively elastic due to the presence of many close substitutes.

The Long Run: The Impact of Free Entry and Exit

The long-run equilibrium in a monopolistically competitive market is drastically different. The presence of free entry is the driving force behind this change. If firms in the market are earning economic profits (positive economic profit which exceeds normal profit), this attracts new entrants. These new firms add to the supply, increasing competition and reducing the demand faced by each individual firm. This shifts each firm's demand curve to the left, causing a decrease in price and quantity demanded.

This process continues until economic profits are eliminated. The entry of new firms will continue until the point where the firm's demand curve is tangent to its average total cost curve. At this point, the price charged is equal to the average total cost, and the firm earns zero economic profit. Remember, zero economic profit does not mean the firm is making zero accounting profit. It signifies that the firm is earning a normal profit, just enough to cover all its costs, including the opportunity cost of the owner's time and capital.

The Role of Free Exit

The possibility of free exit plays an equally crucial role in maintaining the long-run equilibrium. If firms are experiencing economic losses (negative economic profit), they will exit the market. This reduces the supply, leading to an increase in the demand faced by the remaining firms. This allows the remaining firms to increase their prices and, potentially, their profits. This process of exit will continue until all remaining firms are at least breaking even (earning zero economic profit).

This exit and entry process ensures that the market continuously adjusts to maintain a state of zero economic profit in the long run. It’s a dynamic process, not a static one. Firms continuously enter and exit based on their profitability, creating a fluctuating but ultimately stable equilibrium.

Efficiency Implications of Monopolistic Competition

The long-run equilibrium in monopolistically competitive markets results in a level of inefficiency compared to perfect competition. This inefficiency arises from two main sources:

-

Excess Capacity: In the long-run equilibrium, monopolistically competitive firms produce at an output level below their efficient scale. This means that they are not producing at the minimum point of their average total cost curve. This is a direct consequence of the downward-sloping demand curve. To maximize profit, firms produce at a point where marginal revenue equals marginal cost, resulting in output less than the efficient scale. This is considered excess capacity.

-

Markup Pricing: Unlike perfect competition, where price equals marginal cost, monopolistically competitive firms charge a price above their marginal cost. This price markup is necessary to cover their average total cost and earn a normal profit. This markup leads to an allocative inefficiency, as the price doesn't accurately reflect the marginal cost of production. Consumers are willing to pay more than the marginal cost, but this extra money doesn't reflect the extra value received.

These inefficiencies are, however, weighed against the benefits of product differentiation and consumer choice. The variety offered by monopolistically competitive markets satisfies consumer preferences more effectively than the homogeneous products in perfect competition. Whether this trade-off between efficiency and diversity is beneficial depends on the specific market and consumer preferences.

The Dynamic Nature of Monopolistic Competition

It is crucial to understand that the long-run equilibrium of zero economic profit is not a static state. The market is constantly evolving. Firms are constantly innovating, trying to differentiate their products further and capturing a larger market share. This continuous process of innovation and competition can offset some of the inefficiency associated with monopolistic competition. Successful firms may temporarily earn economic profits until competitors adapt or innovate their own solutions.

Comparing Monopolistic Competition to Other Market Structures

Let's briefly compare monopolistic competition with other market structures:

-

Perfect Competition: In perfect competition, free entry and exit lead to zero economic profit in the long run, but without product differentiation. Firms are price takers, having no control over their price.

-

Monopoly: In a monopoly, barriers to entry prevent new firms from entering the market. Monopolies can earn sustained economic profits due to the absence of competition.

-

Oligopoly: Oligopolies have a small number of firms, often with significant barriers to entry. Profitability varies widely depending on the nature of competition and collusion between firms.

Conclusion: The Significance of Free Entry and Exit

The interplay of free entry and exit is central to understanding the long-run equilibrium in monopolistically competitive markets. It guarantees that, over time, economic profits are driven to zero. While this equilibrium results in certain inefficiencies compared to perfect competition, it also fosters innovation, product differentiation, and a wider range of consumer choices. The continuous adjustment and dynamic nature of this market structure makes it a significant and relevant model for a considerable portion of real-world markets. The trade-off between efficiency and diversity is a complex one, with the optimal balance varying depending on the specific goods and services involved. The study of monopolistic competition highlights the importance of considering market dynamics and the role of consumer preferences in evaluating market outcomes. This nuanced understanding is critical for informed policy decisions and strategic business planning in industries characterized by product differentiation and relatively easy market entry and exit.

Latest Posts

Latest Posts

-

What Is The Major Product Of This Reaction

Mar 31, 2025

-

Which Of The Following Describes The Yerkes Dodson Law

Mar 31, 2025

-

What Is The Importance Of Maintaining Payroll Registers

Mar 31, 2025

-

In C3 Plants The Conservation Of Water Promotes

Mar 31, 2025

-

The Current 1876 Constitution Recognizes That Political Power Stems From

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about In Monopolistically Competitive Markets Free Entry And Exit Suggests That . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.