If The Four-firm Concentration Ratio For Industry X Is 80

Holbox

Mar 27, 2025 · 6 min read

Table of Contents

- If The Four-firm Concentration Ratio For Industry X Is 80

- Table of Contents

- If the Four-Firm Concentration Ratio for Industry X is 80: Implications and Analysis

- Understanding the Significance of a High CR4 (80%)

- Potential Anti-Competitive Behaviors

- Impact on Consumers

- Causes of High Concentration (CR4 = 80%)

- High Barriers to Entry

- Mergers and Acquisitions

- Product Differentiation and Branding

- Policy Implications and Potential Interventions

- Antitrust Enforcement

- Deregulation

- Promoting Innovation and Competition

- Price Controls

- Conclusion: Navigating the Complexities of Industry X

- Latest Posts

- Latest Posts

- Related Post

If the Four-Firm Concentration Ratio for Industry X is 80: Implications and Analysis

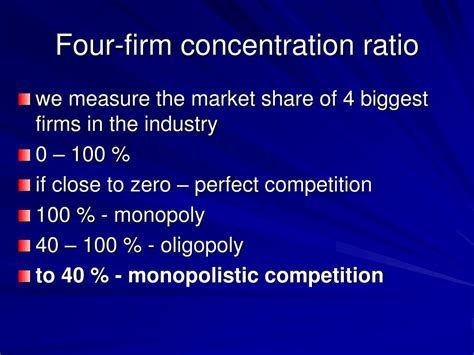

The four-firm concentration ratio (CR4) is a crucial metric in industrial organization economics, measuring the market share held by the four largest firms in a specific industry. A CR4 of 80% for Industry X signifies that the top four companies control a significant 80% of the total market. This high concentration level has profound implications for competition, pricing, innovation, and overall market dynamics. This article delves deep into the ramifications of such a high CR4, exploring its causes, consequences, and potential policy interventions.

Understanding the Significance of a High CR4 (80%)

A CR4 of 80% in Industry X indicates a highly concentrated market structure, often characterized by oligopoly. This implies that the four dominant firms possess substantial market power, influencing pricing, output, and innovation within the industry. Consumers might face limited choices, potentially higher prices, and less product differentiation compared to a more competitive market with a lower CR4. This level of concentration raises concerns about potential anti-competitive practices and reduced consumer welfare.

Potential Anti-Competitive Behaviors

The high concentration in Industry X raises red flags regarding potential anti-competitive behaviors. The dominant firms might engage in:

- Collusion: Secret agreements or tacit understandings between the four firms to fix prices, limit output, or allocate market shares. This can lead to artificially high prices and reduced output, harming consumers.

- Predatory Pricing: One or more dominant firms might temporarily lower prices below cost to drive out smaller competitors, creating a more concentrated market and ultimately raising prices once the competition is eliminated.

- Market Allocation: Firms might agree to divide the market geographically or by product segment, reducing competition within each area.

- Mergers and Acquisitions: Further consolidation of the market through mergers or acquisitions among the dominant firms could further increase concentration and market power.

Impact on Consumers

The implications for consumers in Industry X are significant. A high CR4 of 80% often translates into:

- Higher Prices: Reduced competition allows the dominant firms to charge higher prices than they would in a more competitive market. This reduces consumer surplus and decreases purchasing power.

- Less Choice: Consumers have limited choices due to the dominance of four firms. This can result in a lack of product differentiation and innovation.

- Lower Quality: Without significant competitive pressure, the dominant firms might be less incentivized to improve product quality or offer superior customer service.

- Reduced Innovation: A lack of competition can stifle innovation. The dominant firms might be less inclined to invest in research and development, leading to slower technological advancements.

Causes of High Concentration (CR4 = 80%)

Several factors could contribute to the high CR4 of 80% in Industry X. These factors often interplay to create a self-reinforcing cycle of concentration.

High Barriers to Entry

Substantial barriers to entry prevent new firms from entering Industry X, thus reinforcing the dominance of the existing four firms. These barriers could include:

- High Capital Requirements: Significant upfront investment is needed to establish a presence in the industry.

- Economies of Scale: Larger firms can achieve lower production costs per unit, making it difficult for smaller firms to compete.

- Network Effects: The value of a product or service increases as more people use it, giving existing dominant firms an advantage.

- Government Regulations: Permits, licenses, or other regulatory hurdles can restrict new entrants.

- Patents and Intellectual Property: Strong intellectual property protection can limit the ability of competitors to replicate the products or services of dominant firms.

- Brand Loyalty: Strong brand recognition and customer loyalty make it harder for new firms to gain market share.

Mergers and Acquisitions

Past mergers and acquisitions among firms in Industry X could significantly contribute to the current high level of concentration. These mergers might have been driven by several factors, including:

- Synergies: Merging firms can achieve cost savings and efficiencies, leading to greater market power.

- Elimination of Competition: Acquiring a competitor can reduce competition and increase market share.

- Vertical Integration: A merger can combine firms at different stages of the supply chain, strengthening market control.

Product Differentiation and Branding

While not always the cause of high concentration, significant product differentiation and strong brand loyalty can contribute to a stable oligopolistic market structure. If consumers strongly prefer the products of the four dominant firms, new entrants have difficulty competing.

Policy Implications and Potential Interventions

Given the high CR4 of 80% and the potential for anti-competitive behavior, various policy interventions might be considered to promote competition and protect consumer welfare in Industry X.

Antitrust Enforcement

Vigorous antitrust enforcement is crucial to prevent anti-competitive practices such as collusion, predatory pricing, and market allocation. Regulatory bodies must carefully monitor the activities of the four dominant firms and take action against any violations of antitrust laws. This might involve imposing fines, breaking up monopolies, or blocking mergers that would further concentrate the market.

Deregulation

In some cases, excessive government regulation can act as a barrier to entry, contributing to high market concentration. Careful deregulation in Industry X might promote competition and reduce concentration. However, this must be balanced against the potential negative externalities.

Promoting Innovation and Competition

Policies that promote innovation and competition can help to reduce the market power of the four dominant firms. This might involve:

- Investing in Research and Development: Government support for R&D can spur the development of new technologies and products, fostering competition.

- Supporting Small and Medium-Sized Enterprises (SMEs): Providing resources and assistance to SMEs can help them compete more effectively against larger firms.

- Reducing Barriers to Entry: Lowering capital requirements, simplifying regulations, and fostering entrepreneurship can make it easier for new firms to enter the market.

Price Controls

In extreme cases, price controls might be considered to prevent the dominant firms from exploiting their market power and charging excessively high prices. However, price controls can have unintended consequences, such as shortages and reduced investment in quality. They are typically a last resort.

Conclusion: Navigating the Complexities of Industry X

The 80% CR4 in Industry X signals a highly concentrated market with significant implications for competition, consumer welfare, and innovation. While high concentration isn't inherently negative, the potential for anti-competitive practices and reduced consumer choice necessitates careful monitoring and potential intervention. The optimal policy response will depend on a detailed analysis of the specific circumstances of Industry X, including the nature of the barriers to entry, the extent of product differentiation, and the potential for anti-competitive behavior. A balanced approach that combines antitrust enforcement, targeted deregulation where appropriate, and measures to promote innovation and competition is crucial for achieving a more dynamic and competitive market that benefits both consumers and the overall economy. Further research into the specific dynamics within Industry X—including analyzing market dynamics, supply chain complexities, and consumer behavior—would provide a more nuanced and effective strategy for achieving a more balanced market. This would include investigations into the nature of any technological advancements and their impact on the competitiveness of the industry. A comprehensive approach is needed to address the complex issues arising from such a high level of market concentration.

Latest Posts

Latest Posts

-

Ethics And College Student Life 3rd Edition

Mar 31, 2025

-

Match Each Term With Its Description

Mar 31, 2025

-

Income Smoothing Describes The Concept That

Mar 31, 2025

-

When Can A Notary Submit An Application For Reappointment

Mar 31, 2025

-

A Financial Advisor Schedules An Introductory Meeting

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about If The Four-firm Concentration Ratio For Industry X Is 80 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.