If A Price Floor Is Not Binding Then

Holbox

Mar 14, 2025 · 5 min read

Table of Contents

If a Price Floor is Not Binding, Then What? Understanding Market Equilibrium and Price Controls

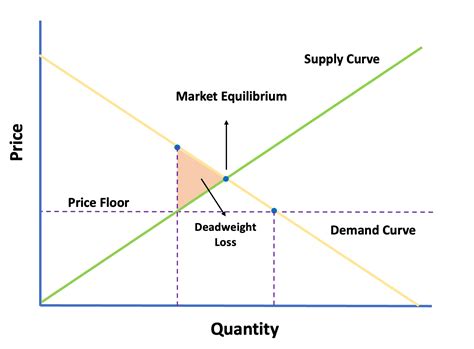

A price floor, a government-mandated minimum price for a good or service, only becomes truly impactful when it's set above the equilibrium price. If it's not binding, it essentially becomes irrelevant to the market's natural functioning. Understanding this nuance is crucial to grasping the dynamics of price controls and their influence on market equilibrium. This article will delve deep into the implications of a non-binding price floor, exploring its effects on producers, consumers, and the overall market efficiency.

What is a Binding Price Floor?

Before we dissect a non-binding price floor, let's establish a clear understanding of its counterpart. A binding price floor is set above the equilibrium price, the point where supply and demand intersect. This artificially high minimum price creates several consequences:

-

Surplus: At the mandated price, the quantity supplied exceeds the quantity demanded, resulting in a surplus of the good or service. This surplus can lead to waste, spoilage (particularly for perishable goods), and storage costs for producers.

-

Reduced Consumer Surplus: Consumers face higher prices and purchase less of the good or service, leading to a decrease in consumer surplus—the difference between what consumers are willing to pay and what they actually pay.

-

Increased Producer Surplus (Potentially): Producers who can still sell their goods at the higher price experience an increase in producer surplus. However, those who cannot sell their surplus goods due to reduced demand lose out.

-

Deadweight Loss: A binding price floor creates a deadweight loss – a loss of economic efficiency that represents the potential gains from trade that aren't realized due to the price intervention. This loss reflects the reduction in both consumer and producer surplus.

The Non-Binding Price Floor: An Insignificant Intervention

A non-binding price floor, conversely, is set at or below the equilibrium price. This means the government's mandated minimum price has no impact on the market because the market price naturally settles at a level that already meets or exceeds the floor. In essence, the price floor is simply ignored.

Think of it like this: Imagine a price floor for apples set at $0.50 per apple, but the equilibrium price is already $1.00. Producers would happily sell apples at $1.00, and consumers would willingly purchase them at that price. The price floor of $0.50 is meaningless because the market price comfortably surpasses it.

Implications of a Non-Binding Price Floor

The key takeaway is that a non-binding price floor has virtually no effect on market outcomes. The quantity traded remains at the equilibrium quantity, and the equilibrium price remains unchanged. This contrasts sharply with the significant consequences of a binding price floor.

Here's a breakdown of the key implications:

-

No Surplus: There's no excess supply because the market price naturally clears at the equilibrium point.

-

Unchanged Consumer Surplus: Consumers continue to enjoy the same level of consumer surplus as they would in a free market.

-

Unchanged Producer Surplus: Producers similarly retain the same level of producer surplus as they would in a free market.

-

No Deadweight Loss: There's no loss of economic efficiency since the price floor doesn't interfere with the market's ability to reach its equilibrium.

Why Implement a Non-Binding Price Floor?

Given that a non-binding price floor is effectively inert, you might wonder why a government would bother implementing one. Several possibilities exist:

-

Political Signaling: The government might implement a non-binding price floor as a symbolic gesture to show support for a particular industry or group of producers. It signals good intentions without actually affecting the market.

-

Future Considerations: The government might anticipate future shifts in market conditions that could make the price floor binding. This is a form of proactive policy-making, although its effectiveness depends on accurate market forecasting.

-

Lack of Information: The government may lack accurate information about the true equilibrium price, leading to an unintentionally non-binding price floor. This highlights the importance of thorough market analysis before implementing price controls.

-

Gradual Implementation: A non-binding price floor could be a stepping stone toward a more substantial, binding price floor. It allows the government to gauge the market's response and potentially adjust the policy accordingly.

Comparing Binding and Non-Binding Price Floors: A Table Summary

To further clarify the differences, let's summarize the key impacts in a table:

| Feature | Binding Price Floor | Non-Binding Price Floor |

|---|---|---|

| Price | Above equilibrium price | At or below equilibrium price |

| Quantity Traded | Below equilibrium quantity | At equilibrium quantity |

| Surplus | Exists | Does not exist |

| Consumer Surplus | Reduced | Unchanged |

| Producer Surplus | Potentially Increased (for some), Reduced (for others) | Unchanged |

| Deadweight Loss | Exists | Does not exist |

| Market Efficiency | Reduced | Unchanged |

The Importance of Market Equilibrium

The concept of a non-binding price floor underscores the importance of understanding market equilibrium. It's the point at which the forces of supply and demand balance, creating an efficient allocation of resources. Interventions like price floors, when not carefully calibrated, can disrupt this equilibrium, leading to negative consequences.

Beyond Price Floors: Other Price Controls

While this article focuses on price floors, it's important to note that similar principles apply to price ceilings, which set a maximum price for a good or service. A non-binding price ceiling, set above the equilibrium price, is equally ineffective, as the market naturally trades at a price below the ceiling. The impact of price controls hinges on their relationship to the market equilibrium.

Conclusion: The Significance of Context

Whether a price floor is binding or non-binding fundamentally depends on its level relative to the prevailing market equilibrium. A non-binding price floor essentially has no effect on market outcomes, acting more as a symbolic gesture than an effective policy tool. Understanding this distinction is vital for evaluating the true impact of government interventions in the marketplace and for promoting informed policy-making. Careful consideration of market dynamics and thorough analysis are crucial before implementing any price control mechanism to avoid unintended consequences and ensure market efficiency. The focus should always remain on fostering a market environment that maximizes both consumer and producer welfare.

Latest Posts

Latest Posts

-

Which Eoc Configuration Aligns With The On Scene Incident Organization

Mar 14, 2025

-

Suppose A New Technology Is Discovered Which Increases Productivity

Mar 14, 2025

-

Managers Must Recognize That Motivating Individuals Today Requires

Mar 14, 2025

-

Drag Each Label To The Appropriate Location On The Flowchart

Mar 14, 2025

-

The Manufacturing Overhead Account Is Debited When

Mar 14, 2025

Related Post

Thank you for visiting our website which covers about If A Price Floor Is Not Binding Then . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.