Identify The Correct Definition Of An Asset

Holbox

Mar 14, 2025 · 6 min read

Table of Contents

- Identify The Correct Definition Of An Asset

- Table of Contents

- Identifying the Correct Definition of an Asset: A Comprehensive Guide

- What is an Asset? – The Fundamental Definition

- Different Perspectives on Asset Definition: Accounting vs. Investing

- Accounting Perspective:

- Investing Perspective:

- Classifications of Assets: A Detailed Breakdown

- 1. Current Assets:

- 2. Non-current Assets (Long-term Assets):

- Identifying Assets: Practical Examples and Considerations

- Common Pitfalls in Asset Identification

- The Importance of Accurate Asset Identification

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

Identifying the Correct Definition of an Asset: A Comprehensive Guide

Understanding the precise definition of an asset is crucial for anyone involved in finance, accounting, or business management. While the concept seems straightforward, nuances exist that can significantly impact financial reporting, investment strategies, and overall business decisions. This comprehensive guide delves into the multifaceted nature of assets, exploring various definitions, classifications, and practical examples to provide a clear and comprehensive understanding.

What is an Asset? – The Fundamental Definition

At its core, an asset is a resource controlled by an entity as a result of past events and from which future economic benefits are expected to flow to the entity. This definition, widely accepted in accounting principles, encapsulates three key elements:

-

Resource: This refers to something of value that the entity possesses. This value can be monetary, or it can represent future potential for generating revenue or reducing costs.

-

Control: The entity must have the power to obtain the benefits associated with the asset and to restrict access to others. This control doesn't necessarily mean absolute ownership; it can also involve leasing or other forms of beneficial use.

-

Future Economic Benefits: This is perhaps the most crucial element. An asset isn't merely something of value; it must be expected to generate some future economic benefit, be it through cash inflows, cost savings, or increased efficiency. This expectation must be based on verifiable evidence and reasonable estimations, not mere speculation.

Different Perspectives on Asset Definition: Accounting vs. Investing

While the above definition is largely consistent across accounting standards like Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), the perspective on assets can differ slightly depending on the context.

Accounting Perspective:

In accounting, the focus is primarily on quantifiable and verifiable economic benefits. Assets are recorded on balance sheets at historical cost (the original price paid) or fair value (current market price), depending on the type of asset and accounting standards. The emphasis is on accuracy, consistency, and adherence to established reporting frameworks. Assets here are categorized further into current assets (likely to be converted to cash within a year) and non-current assets (long-term assets).

Investing Perspective:

From an investing standpoint, the definition of an asset broadens slightly. While the expectation of future economic benefits remains central, the focus shifts towards potential for appreciation and return on investment. Investors may consider assets beyond those recognized in traditional accounting, such as intellectual property, brand reputation, or even human capital, depending on the investment strategy. The valuation of assets also takes a different approach, often emphasizing market value or discounted cash flow analysis.

Classifications of Assets: A Detailed Breakdown

Assets are broadly classified into several categories, each with unique characteristics and implications for accounting and financial analysis.

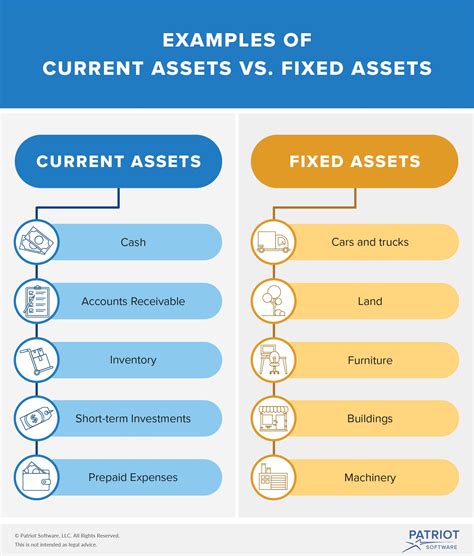

1. Current Assets:

These are assets expected to be converted into cash or used up within one year or the operating cycle, whichever is longer. Examples include:

- Cash and cash equivalents: Money readily available, such as bank balances, short-term investments, and marketable securities.

- Accounts receivable: Money owed to the entity by customers for goods or services sold on credit.

- Inventories: Goods held for sale in the ordinary course of business.

- Prepaid expenses: Expenses paid in advance, such as insurance premiums or rent.

2. Non-current Assets (Long-term Assets):

These are assets expected to provide economic benefits for more than one year. They are further subdivided into:

- Property, Plant, and Equipment (PP&E): Tangible assets used in the production of goods or services, such as land, buildings, machinery, and equipment. These are often depreciated over their useful life.

- Intangible Assets: Non-physical assets that provide future economic benefits, such as patents, copyrights, trademarks, and goodwill. These are often amortized over their useful life.

- Investments: Long-term holdings in other entities, such as stocks, bonds, and other securities.

- Deferred Tax Assets: The potential future tax benefit arising from deductible temporary differences.

Identifying Assets: Practical Examples and Considerations

Let's look at some examples to solidify our understanding of asset identification:

- A company's factory: This is a tangible, non-current asset (PP&E). It generates future economic benefits by facilitating production and potentially appreciating in value.

- A company's brand name: This is an intangible, non-current asset. It represents a valuable resource that attracts customers and enhances profitability.

- Cash in a company's bank account: This is a current asset, providing immediate liquidity.

- Accounts payable: This is a liability, not an asset. It represents money owed by the entity to its suppliers.

- A company's employee skills: While valuable, it's difficult to quantify and control, making it challenging to classify as a traditional asset in accounting. However, from an investment perspective, human capital is a key element influencing the company's value.

Common Pitfalls in Asset Identification

Several common errors can arise when attempting to identify assets:

- Confusing assets with liabilities: As seen with accounts payable, accurately distinguishing between assets and liabilities is crucial. Liabilities represent obligations to pay others, unlike assets which provide future benefits.

- Overlooking intangible assets: Many businesses undervalue their intangible assets, such as intellectual property or brand reputation. Failing to account for these can lead to an incomplete and misleading picture of a company's overall value.

- Incorrect valuation: Assets must be valued accurately, which can be challenging, especially for intangible assets or assets subject to fluctuating market prices. Inaccurate valuation impacts financial reporting and investment decisions.

- Ignoring future economic benefits: An item might have inherent value, but if it does not provide future economic benefits to the entity holding it, it cannot be considered an asset. This could include personal collectibles or unused inventory without market demand.

The Importance of Accurate Asset Identification

Accurate asset identification is not simply a matter of accounting compliance; it's crucial for:

- Financial Reporting: Accurate asset identification ensures that a company's financial statements accurately reflect its financial position and performance.

- Investment Decisions: Understanding the nature and value of a company's assets is critical for making sound investment decisions.

- Strategic Planning: A clear understanding of assets allows businesses to make informed decisions about resource allocation, expansion, and divestment.

- Tax Planning: The classification and valuation of assets have significant implications for tax liabilities.

Conclusion

The definition of an asset, while seemingly simple, involves several critical considerations. Understanding the three key components – resource, control, and future economic benefits – is paramount. Further, appreciating the different perspectives of accounting and investing, the various classifications of assets, and the common pitfalls in asset identification is essential for both financial professionals and anyone interested in understanding business finance. By paying close attention to these details, businesses can ensure accurate financial reporting, effective investment strategies, and well-informed decision-making processes. The consistent and careful identification of assets remains a cornerstone of sound financial management and successful business operations.

Latest Posts

Latest Posts

-

What Is 180 Mm In Inches

May 21, 2025

-

What Is 17 Stone In Kilos

May 21, 2025

-

13 Kilometers Is How Many Miles

May 21, 2025

-

What Is 48 Kilos In Pounds

May 21, 2025

-

What Is 108 Cm In Inches

May 21, 2025

Related Post

Thank you for visiting our website which covers about Identify The Correct Definition Of An Asset . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.