Howard Inc Had Prepaid Rent Of

Holbox

Mar 14, 2025 · 6 min read

Table of Contents

- Howard Inc Had Prepaid Rent Of

- Table of Contents

- Howard Inc. Had Prepaid Rent Of: A Comprehensive Guide to Understanding Prepaid Expenses and Their Impact on Financial Statements

- Understanding Prepaid Rent

- Howard Inc.'s Prepaid Rent Scenario: A Hypothetical Example

- Accounting Treatment of Prepaid Rent

- Accrual Accounting and Prepaid Rent

- Journal Entries for Howard Inc.

- Analyzing the Impact on Howard Inc.'s Financial Statements

- Impact on Profitability

- Impact on Liquidity

- Impact on Solvency

- Potential Errors and Misinterpretations

- Overstating or Understating Expenses

- Misrepresenting Asset Values

- Impact on Financial Ratios

- Best Practices for Accounting for Prepaid Rent

- Regular Reconciliation

- Clear Documentation

- Consistent Application of Accounting Principles

- Internal Controls

- Conclusion: The Importance of Accurate Prepaid Rent Accounting for Howard Inc.

- Latest Posts

- Related Post

Howard Inc. Had Prepaid Rent Of: A Comprehensive Guide to Understanding Prepaid Expenses and Their Impact on Financial Statements

Prepaid expenses represent a crucial aspect of accounting, impacting a company's financial health and influencing its reported financial performance. This in-depth analysis will explore the concept of prepaid rent, specifically focusing on a hypothetical scenario involving Howard Inc. We will delve into the accounting treatment of prepaid rent, its implications for financial statements, and its broader impact on financial analysis.

Understanding Prepaid Rent

Prepaid rent, a common type of prepaid expense, arises when a company pays rent in advance for a period extending beyond the current accounting period. This advance payment is considered an asset because it represents a future economic benefit – the right to occupy a property for a specified period. Rather than expensing the entire rent payment immediately, the company recognizes it as an asset on its balance sheet and gradually expenses it over the periods it benefits from the rental space.

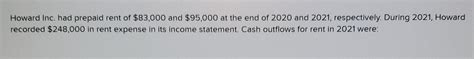

Howard Inc.'s Prepaid Rent Scenario: A Hypothetical Example

Let's assume Howard Inc. paid $12,000 on October 1st for rent covering the period from October 1st, 2024 to March 31st, 2025 (six months). This transaction initially appears as a debit to a prepaid rent account and a credit to cash. The key point here is that only a portion of this prepaid rent is considered an expense in the current accounting period (October 1st, 2024 - December 31st, 2024).

Accounting Treatment of Prepaid Rent

The accounting for prepaid rent follows the matching principle, which dictates that expenses should be recognized in the same period as the revenues they help generate. Since the rent benefits Howard Inc. over six months, the expense should be recognized gradually, not all at once.

Accrual Accounting and Prepaid Rent

Under accrual accounting, the company records the transaction at the time the expense is incurred, not when cash changes hands. This leads to the creation of the prepaid rent asset. The expense is then gradually recognized as the benefit from the rental space is consumed.

Journal Entries for Howard Inc.

October 1st, 2024:

- Debit: Prepaid Rent ($12,000)

- Credit: Cash ($12,000)

This entry reflects the initial payment of rent. Now, let’s look at the adjusting entry at the end of the year (December 31st, 2024):

December 31st, 2024 (Adjusting Entry):

To determine the rent expense for the three months (October, November, and December), we calculate: ($12,000 / 6 months) * 3 months = $6,000.

- Debit: Rent Expense ($6,000)

- Credit: Prepaid Rent ($6,000)

This adjusting entry reflects the portion of prepaid rent that has been used during the three-month period and is now expensed. This expense will be reflected in Howard Inc's income statement for the year ended December 31st, 2024.

Impact on the Balance Sheet and Income Statement

The balance sheet at December 31st, 2024, will show a prepaid rent balance of $6,000 ($12,000 initial payment - $6,000 expense recognized). This represents the remaining rent paid in advance that will be expensed in future periods. The income statement will show a rent expense of $6,000 for the year ended December 31st, 2024.

Analyzing the Impact on Howard Inc.'s Financial Statements

The correct accounting treatment of prepaid rent is critical for accurately reflecting Howard Inc.'s financial position and performance. Incorrect handling can lead to misstatements, affecting key financial ratios and potentially misleading investors and creditors.

Impact on Profitability

The proper recognition of prepaid rent ensures that Howard Inc.'s net income is accurately calculated. If the entire $12,000 was expensed in October, net income would be artificially deflated in the current year. Conversely, if the expense was not recognized until the end of the rental period, net income would be artificially inflated. The proper approach ensures a fair representation of profitability over time.

Impact on Liquidity

The balance sheet shows the prepaid rent as a current asset. This accurately reflects Howard Inc.'s liquidity position. It demonstrates the company's ability to utilize the prepaid rent for future periods, potentially improving the company's short-term liquidity. However, it’s essential to note that this is a non-cash asset; its value is not readily convertible into cash.

Impact on Solvency

The accurate recording of prepaid rent does not directly impact solvency ratios like the debt-to-equity ratio. However, the correct representation of assets and expenses influences the overall financial health of Howard Inc., ultimately impacting its ability to meet its long-term obligations. A healthy, accurate representation of financial statements is crucial for attracting investors and securing favorable loans.

Potential Errors and Misinterpretations

Inaccurate accounting of prepaid rent can lead to several misinterpretations and errors.

Overstating or Understating Expenses

If the expense is entirely recognized in the current period, it leads to an overstatement of expenses and an understatement of net income and profitability. Conversely, if the expense is not recognized at all, it leads to an understatement of expenses and an overstatement of net income and profitability. Both scenarios paint a misleading picture of Howard Inc.’s financial performance.

Misrepresenting Asset Values

Failure to correctly account for prepaid rent on the balance sheet leads to an inaccurate portrayal of assets. Overlooking the asset entirely misrepresents the company's resources and its ability to meet its future obligations.

Impact on Financial Ratios

Inaccurate accounting directly impacts various financial ratios. Profitability ratios (gross profit margin, net profit margin, return on assets) and liquidity ratios (current ratio, quick ratio) will be distorted, leading to flawed financial analysis and potentially incorrect business decisions.

Best Practices for Accounting for Prepaid Rent

To avoid inaccuracies, Howard Inc. should adhere to best accounting practices.

Regular Reconciliation

Regular reconciliation of the prepaid rent account is critical. This helps identify discrepancies and ensures that the amounts reported are accurate.

Clear Documentation

Maintaining clear and detailed documentation of all rent payments, including the rental period covered, is essential for accurate accounting. This documentation acts as a valuable audit trail and aids in the year-end adjustment process.

Consistent Application of Accounting Principles

Howard Inc. must consistently apply generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS) in accounting for prepaid rent. This ensures uniformity and comparability across different accounting periods and companies.

Internal Controls

Establishing strong internal controls over prepaid rent transactions minimizes the risk of errors and fraud. This includes segregation of duties, authorization procedures, and regular audits.

Conclusion: The Importance of Accurate Prepaid Rent Accounting for Howard Inc.

The accurate accounting treatment of prepaid rent is fundamental to the reliable financial reporting of Howard Inc. By following the matching principle, making appropriate adjusting entries, and adhering to best practices, Howard Inc. ensures its financial statements accurately reflect its financial position and performance. Understanding prepaid expenses and their impact on financial statements is critical for effective financial management, informed decision-making, and building trust with stakeholders. Failing to account for prepaid rent correctly can have significant consequences, potentially misleading investors, creditors, and other stakeholders, jeopardizing the company's credibility and financial stability. Therefore, meticulous accounting practices, robust internal controls, and a commitment to transparent financial reporting are essential for the long-term success of Howard Inc. and any business dealing with prepaid expenses.

Latest Posts

Related Post

Thank you for visiting our website which covers about Howard Inc Had Prepaid Rent Of . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.