How Does The Yield Curve Indirectly Affect Trade

Holbox

Mar 29, 2025 · 5 min read

Table of Contents

- How Does The Yield Curve Indirectly Affect Trade

- Table of Contents

- How the Yield Curve Indirectly Affects Trade: A Comprehensive Analysis

- Understanding the Yield Curve and its Shapes

- The Yield Curve as a Leading Economic Indicator

- The Indirect Impact of the Yield Curve on Trade

- 1. Impact on Investor Sentiment and Capital Flows

- 2. Influence on Exchange Rates

- 3. Impact on Business Investment and Trade Financing

- 4. Influence on Commodity Prices and Trade

- 5. Impact on Consumer Spending and Imports

- Yield Curve and Global Trade Imbalances

- Conclusion: The Indirect Yet Significant Role of the Yield Curve

- Latest Posts

- Latest Posts

- Related Post

How the Yield Curve Indirectly Affects Trade: A Comprehensive Analysis

The yield curve, a graphical representation of the relationship between interest rates and the time to maturity of debt securities, might seem like a purely domestic financial phenomenon. However, its subtle shifts and pronounced inversions have far-reaching consequences, indirectly influencing international trade in significant ways. While not a direct causal factor like tariffs or exchange rates, the yield curve acts as a powerful macroeconomic indicator, shaping investor sentiment, influencing capital flows, and ultimately affecting the global trade landscape. This article delves into the intricate mechanisms through which the yield curve exerts its indirect influence on trade.

Understanding the Yield Curve and its Shapes

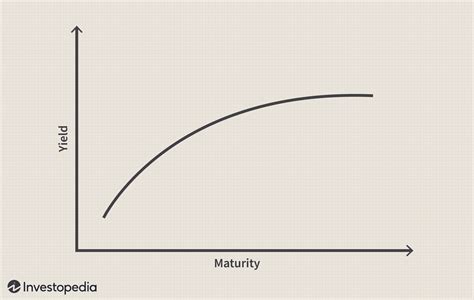

Before exploring the indirect impact on trade, it's crucial to understand the yield curve itself. A normal yield curve slopes upward, reflecting the market's expectation of higher returns for longer-term investments due to increased risk and inflation. A flat yield curve exhibits minimal difference between short-term and long-term rates. However, an inverted yield curve, where short-term rates exceed long-term rates, is often viewed as a harbinger of economic recession. This inversion signals that investors anticipate future interest rate cuts by central banks in response to slowing economic activity.

The Yield Curve as a Leading Economic Indicator

The shape of the yield curve is closely watched by economists and investors as a leading economic indicator. Its predictive power stems from its ability to anticipate changes in monetary policy and overall economic health. A steepening yield curve generally suggests economic expansion, with robust growth spurring higher long-term rates. Conversely, a flattening or inverting yield curve signals weakening economic activity, increased uncertainty, and potential recession. This information is crucial for businesses involved in international trade.

The Indirect Impact of the Yield Curve on Trade

The yield curve's influence on trade is primarily indirect, operating through several key channels:

1. Impact on Investor Sentiment and Capital Flows

Changes in the yield curve significantly affect investor sentiment and subsequently influence international capital flows. A steep yield curve generally attracts foreign investment, boosting a nation's currency and encouraging imports. Investors are drawn to higher returns on long-term investments, leading to capital inflows. This strengthens the domestic currency, making imports cheaper and potentially impacting a nation’s trade balance.

Conversely, a flat or inverted yield curve often signals reduced investment opportunities and increased risk aversion. This can trigger capital outflows, weakening the domestic currency and making exports more competitive. The decreased attractiveness of investments in the country with the inverted curve can lead to a reduction in imports as well, due to reduced spending power.

2. Influence on Exchange Rates

The yield curve's effect on capital flows directly influences exchange rates. When a country experiences a steep yield curve, attracting foreign investment, its currency tends to appreciate. This appreciation can make exports more expensive and imports cheaper, impacting the country's trade balance. A weaker currency, on the other hand, often accompanies a flat or inverted yield curve, boosting the competitiveness of exports.

Example: Imagine Country A experiences a steep yield curve, attracting significant foreign investment. This leads to the appreciation of Country A's currency. Consequently, exports from Country A become more expensive for its trading partners, potentially leading to a decrease in demand for its exports. Simultaneously, imports into Country A become cheaper, potentially increasing the volume of imports.

3. Impact on Business Investment and Trade Financing

The yield curve plays a crucial role in shaping the cost of borrowing for businesses engaged in international trade. A steep yield curve typically reflects lower borrowing costs for businesses, encouraging investment in expanding production capacity, improving infrastructure, and increasing trade activities. This translates to increased exports and potentially greater import demand, particularly for capital goods.

However, a flat or inverted yield curve signals tighter credit conditions and higher borrowing costs. This can stifle business investment, reducing export capacity and potentially impacting import levels. Businesses may postpone expansion plans, impacting trade volume negatively.

4. Influence on Commodity Prices and Trade

The yield curve also influences commodity prices, which in turn can indirectly affect trade. An inverted yield curve, often indicating an impending recession, typically leads to lower commodity prices due to reduced demand. This can benefit importing countries reliant on commodities while harming exporting countries dependent on commodity revenues. The reduced price of commodities like oil can significantly impact international trade due to reduced fuel costs for transportation and production.

5. Impact on Consumer Spending and Imports

Consumer spending is significantly influenced by interest rates and economic outlook reflected in the yield curve. A steep yield curve may suggest economic growth, leading to higher consumer confidence and increased spending. This increase in spending may result in higher imports, especially of consumer goods. A flat or inverted yield curve, signaling economic slowdown, may lead to decreased consumer confidence and reduced spending, negatively affecting import demand.

Yield Curve and Global Trade Imbalances

The yield curve can have significant ramifications for global trade imbalances. Countries with steep yield curves might experience higher imports due to currency appreciation and increased consumer spending, contributing to a widening current account deficit. Conversely, countries with flat or inverted yield curves might see improved trade balances due to currency depreciation and increased export competitiveness. These imbalances can have far-reaching geopolitical and economic consequences.

Conclusion: The Indirect Yet Significant Role of the Yield Curve

The yield curve, while not directly involved in setting tariffs or managing exchange rates, profoundly influences international trade through its impact on investor sentiment, capital flows, exchange rates, business investment, and commodity prices. Understanding the shape and implications of the yield curve is crucial for businesses, policymakers, and investors involved in international trade. Its predictive power in signaling future economic trends allows proactive adjustments to business strategies, investment decisions, and policy formulations to navigate the complexities of the global marketplace. Furthermore, constant monitoring of the yield curve can provide valuable insights into potential shifts in global trade flows and economic landscapes, enhancing preparedness for various economic scenarios. In conclusion, while seemingly a niche financial metric, the yield curve's indirect yet pervasive impact on international trade deserves considerable attention and analysis.

Latest Posts

Latest Posts

-

A Ten Loop Coil Of Area 0 23

Apr 01, 2025

-

Chemical Reactions Occur As A Result Of

Apr 01, 2025

-

Stage Theories Hold That The Sequence Of Development Is

Apr 01, 2025

-

Which Occupation Would Most Likely Be Involved In Genome Mapping

Apr 01, 2025

-

A Critical Analysis Based On Heuristics Will Lead To

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about How Does The Yield Curve Indirectly Affect Trade . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.